Burlington Stores (BURL) Is Up 12.1% After Strong Q3, Raised Outlook and Buybacks - What's Changed

- In the past week, Burlington Stores reported higher third-quarter revenue of US$2,710.44 million and net income of US$104.75 million, raised full-year sales guidance, continued share repurchases totaling US$429.21 million across two programs, and reaffirmed plans to open 104 net new stores by fiscal year-end 2025.

- This combination of stronger earnings, ongoing buybacks, and an aggressive store-opening plan underscores management’s confidence in Burlington’s off-price model and its capacity-led growth strategy.

- We’ll now examine how these stronger third-quarter results and upgraded full-year sales outlook may influence Burlington’s existing multi-year margin expansion and store growth narrative.

These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Burlington Stores Investment Narrative Recap

To own Burlington Stores, you need to believe its off price model can keep converting steady traffic into higher margins while a large new store pipeline scales efficiently. The latest third quarter beat and raised full year sales guidance support that near term earnings momentum is intact, while the most immediate risk remains that a softer value focused consumer or over aggressive expansion could magnify fixed costs and pressure profitability; the new data does not remove that risk.

The most relevant update here is Burlington’s plan to open 104 net new stores by fiscal year end 2025, which ties directly into its capacity led growth story. This expansion program is central to the current catalyst of capturing more value seeking shoppers, but it also amplifies the risk that a slower economy or weaker in store traffic could leave the company with higher operating leverage and more volatile earnings.

But investors should also be aware that if store growth outpaces sustainable demand, then...

Read the full narrative on Burlington Stores (it's free!)

Burlington Stores' narrative projects $14.3 billion revenue and $993.7 million earnings by 2028.

Uncover how Burlington Stores' forecasts yield a $336.20 fair value, a 24% upside to its current price.

Exploring Other Perspectives

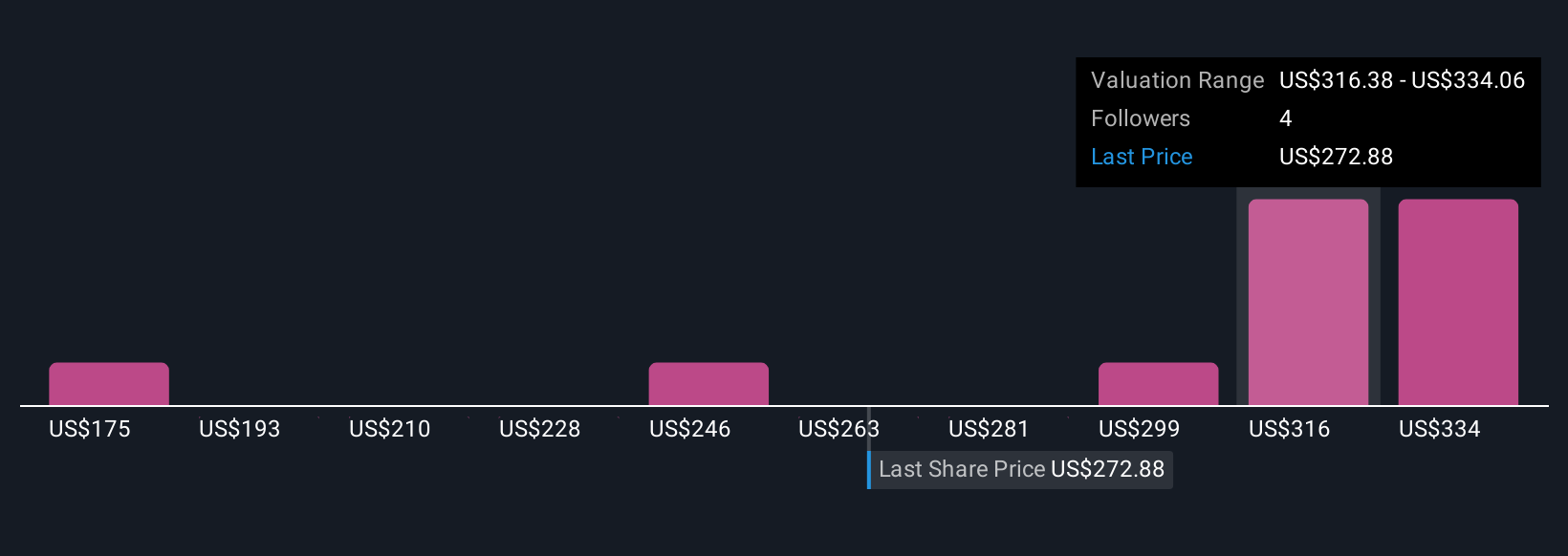

Five Simply Wall St Community fair value estimates for Burlington range from US$174.88 to US$377.53, showing how differently individual investors view its prospects. When you set these against Burlington’s large planned store rollout, it becomes clear that opinions on how expansion will affect future performance can vary widely, so it is worth exploring several viewpoints before making up your mind.

Explore 5 other fair value estimates on Burlington Stores - why the stock might be worth 36% less than the current price!

Build Your Own Burlington Stores Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Burlington Stores research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Burlington Stores research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Burlington Stores' overall financial health at a glance.

Contemplating Other Strategies?

Our top stock finds are flying under the radar-for now. Get in early:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 37 companies in the world exploring or producing it. Find the list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com