Should Wendy's Aggressive Store Closures and Unit Volume Pressures Require Action From Wendy's (WEN) Investors?

- Earlier this month, JPMorgan downgraded Wendy's from Overweight to Neutral after the company outlined plans to close about 300 underperforming U.S. restaurants in 2025, following 240 closures in 2024 as part of its ongoing turnaround efforts.

- The downgrade highlights investors' concerns that Wendy's must lift average unit volumes to keep franchisees profitable and reignite U.S. expansion.

- We’ll now examine how these planned U.S. closures and the questions around unit volume growth could reshape Wendy’s broader investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

Wendy's Investment Narrative Recap

To own Wendy’s, you need to believe its digital investments, menu innovation, and international growth can offset pressure on its U.S. franchise base and margins. The planned closure of roughly 540 underperforming U.S. units across 2024 and 2025 directly affects the key near term catalyst of stabilizing same restaurant sales and the biggest current risk, which is franchisee profitability, so this JPMorgan downgrade is material to the story.

The most relevant recent update here is management reaffirming 2025 guidance for global systemwide sales to decline between 3% and 5%, alongside higher impairment charges in Q3. That guidance, paired with accelerated closures, underlines how dependent any eventual rebound looks on Wendy’s ability to lift average unit volumes through digital growth, breakfast, and new menu platforms rather than simply adding more stores.

But beneath the headline closures, a more structural risk to Wendy’s U.S. royalty stream is something investors should be aware of as...

Read the full narrative on Wendy's (it's free!)

Wendy's narrative projects $2.3 billion revenue and $210.4 million earnings by 2028. This implies an earnings increase from $192.1 million today.

Uncover how Wendy's forecasts yield a $10.25 fair value, a 21% upside to its current price.

Exploring Other Perspectives

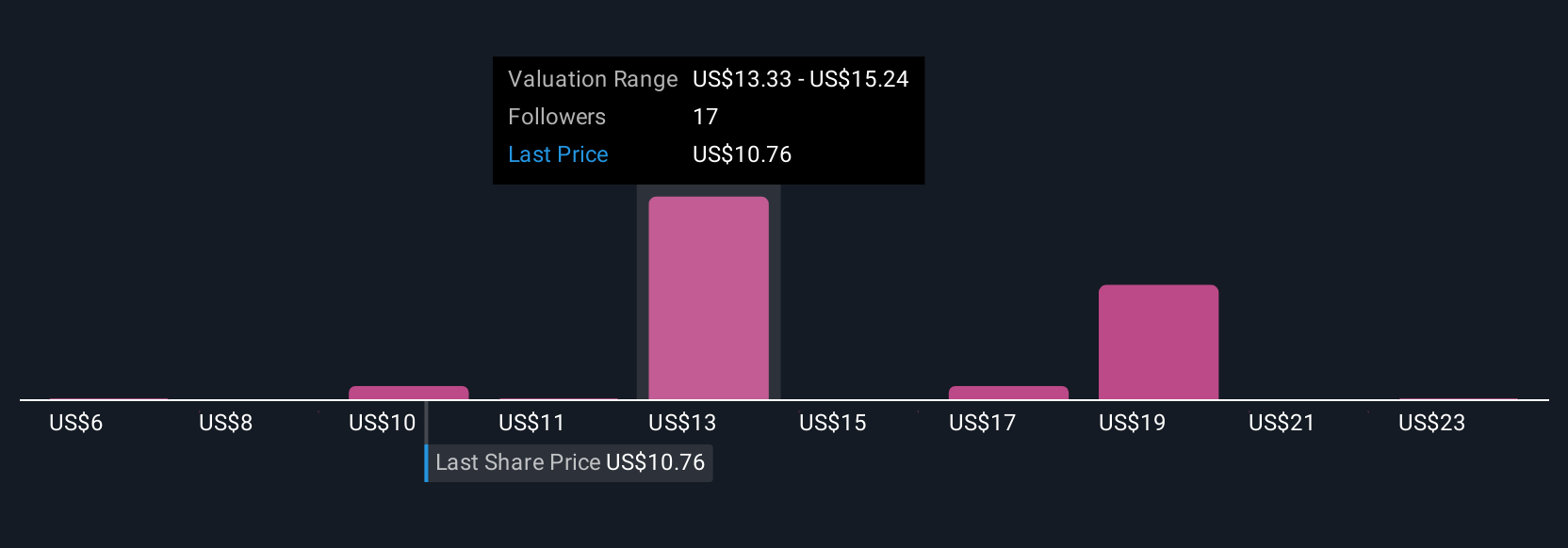

Eleven members of the Simply Wall St Community currently see Wendy’s fair value anywhere from US$10.00 up to US$25.41, showing how far apart individual views can be. When you set those expectations against the recent guidance for declining global systemwide sales, it underlines why exploring several alternative viewpoints on Wendy’s profit and franchise health trajectory is so important.

Explore 11 other fair value estimates on Wendy's - why the stock might be worth just $10.00!

Build Your Own Wendy's Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Wendy's research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Wendy's research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Wendy's overall financial health at a glance.

No Opportunity In Wendy's?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com