Polaris (PII) Extends Call of Duty Partnership: A Fresh Look at Whether the Stock’s Valuation Reflects Its Rebound Story

Polaris (PII) is leaning into its gaming crossover by extending its Call of Duty partnership. The company is dropping Black Ops 7 themed RZR Pro R 4 and Sportsman XP 1000 vehicles into Warzone and Black Ops 7, plus offering a real world giveaway.

See our latest analysis for Polaris.

Investors seem to be warming back up to Polaris, with the share price at $67.45 after a roughly 19.6 percent year to date share price return. However, a weak three year total shareholder return of about negative 30 percent shows the longer term turnaround story is still in progress.

If this kind of brand driven catalyst has your attention, it could be a good moment to scan auto manufacturers for other names where new products and partnerships are starting to shift sentiment.

Yet despite double digit gains this year, Polaris still trades below its intrinsic value estimate and near a flat analyst target. This raises a key question: is this a stealth value play, or has the market already baked in the rebound?

Most Popular Narrative: 2.5% Overvalued

With Polaris closing at $67.45 against a narrative fair value of about $65.83, the valuation gap is narrow but still tilts above intrinsic estimates.

Polaris is focused on a strategic approach to mitigate the impact of tariffs through supply chain adjustments and cost control initiatives, which could potentially preserve net margins and improve earnings over time. Dealer feedback indicates a strong partnership and alignment with Polaris strategic initiatives, which suggests effective inventory management and could stabilize and eventually increase market share, supporting long-term revenue growth.

Want to see what happens when modest revenue growth, rising margins and a re rated earnings multiple collide in one model? The full narrative lays out the step by step financial blueprint, including how future profitability and valuation multiples are stitched together to justify today’s fair value.

Result: Fair Value of $65.83 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, lingering tariff uncertainty and potential demand softness in powersports and marine could easily derail the margin rebuild that underpins today’s valuation case.

Find out about the key risks to this Polaris narrative.

Another Angle on Valuation

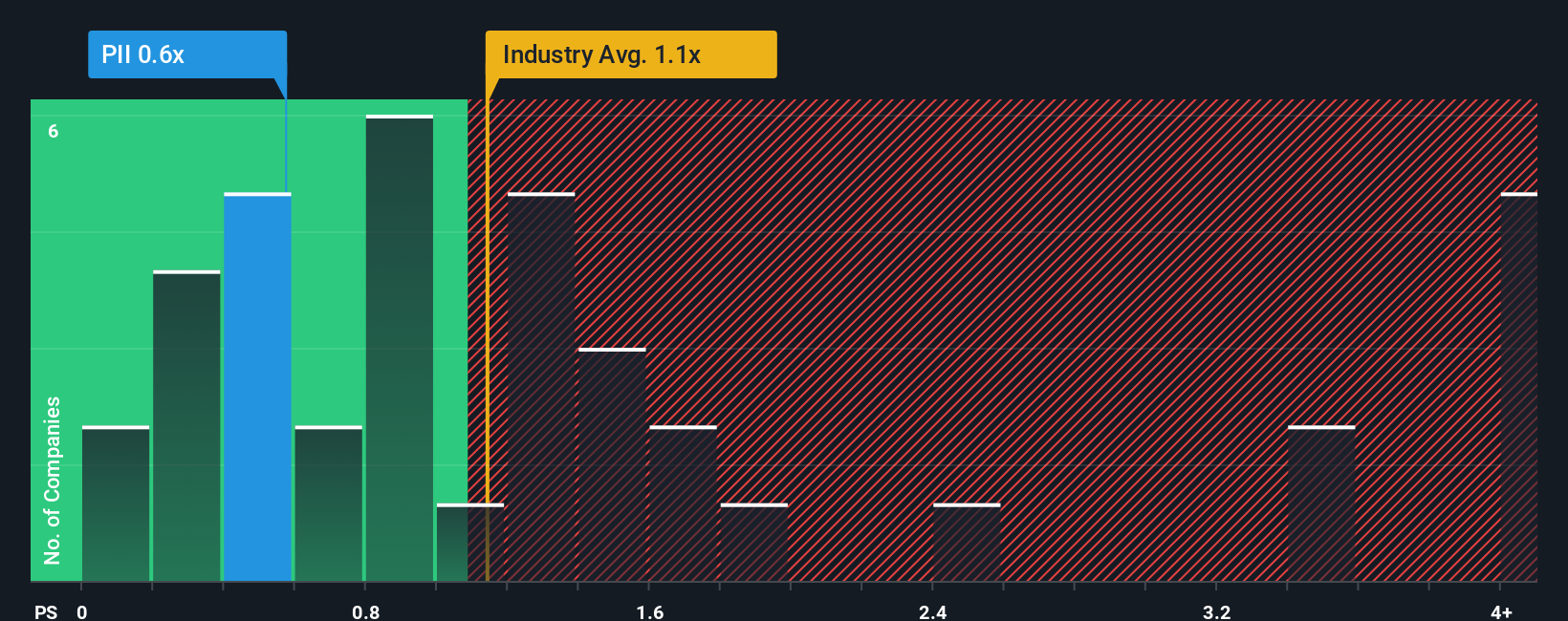

On simple sales based metrics, Polaris looks inexpensive, trading at 0.5 times revenue against both a 0.9 times industry average and a 1.4 times peer average, and even below a 0.6 times fair ratio. Is the market overlooking a recovery story, or correctly pricing in risk?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Polaris Narrative

If you see the setup differently or want to pressure test the numbers yourself, you can build a custom narrative in minutes: Do it your way.

A great starting point for your Polaris research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready for your next investing move?

Do not stop at a single stock when the market is full of mispriced stories. Use the Simply Wall St Screener to hunt for your next edge.

- Capitalize on overlooked potential by targeting these 903 undervalued stocks based on cash flows that the market has not fully appreciated yet.

- Ride innovation trends by zeroing in on these 26 AI penny stocks at the forefront of intelligent automation and data-driven disruption.

- Strengthen your income stream by focusing on these 15 dividend stocks with yields > 3% that may support long-term returns through cash payouts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com