Is U.S. Physical Therapy’s (USPH) Recent Rebound Enough to Justify Its Valuation Reset?

U.S. Physical Therapy (USPH) has quietly moved higher over the past week, and that modest rebound stands out against a tougher past 3 months, inviting a closer look at what the market is pricing in.

See our latest analysis for U.S. Physical Therapy.

That recent 7 day share price return of 2.6% only slightly dents a much weaker year to date. With the 1 year total shareholder return down nearly 20%, momentum still looks more like a reset than a full recovery.

If this kind of healthcare name is on your radar, it can be worth comparing it with other specialists by exploring healthcare stocks for fresh ideas.

With steady double digit profit growth, a sizeable discount to analyst targets, and shares still lagging over one and five years, the real question is whether U.S. Physical Therapy is now undervalued or whether markets already price in future growth.

Most Popular Narrative Narrative: 29.5% Undervalued

Compared with the last close at $75.34, the most followed narrative sees U.S. Physical Therapy worth notably more today, based on detailed long range assumptions.

Strategic cost efficiency initiatives such as AI driven clinical documentation, semi virtualized front desk operations, and recruitment retention technology are beginning to materially lower operating and labor costs per visit, directly improving net margins and earnings potential.

Curious how modest revenue growth, expanding margins, and a premium future earnings multiple can still point to upside from here? The narrative joins those dots. It blends rising visit volumes, a richer service mix, and disciplined cost control into one long term value case. The full breakdown reveals how all of that rolls up into its fair value today.

Result: Fair Value of $106.83 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent reimbursement pressure and tighter clinician supply could quickly erode margin gains, challenging the idea that today's discount fully reflects execution risk.

Find out about the key risks to this U.S. Physical Therapy narrative.

Another View on Valuation

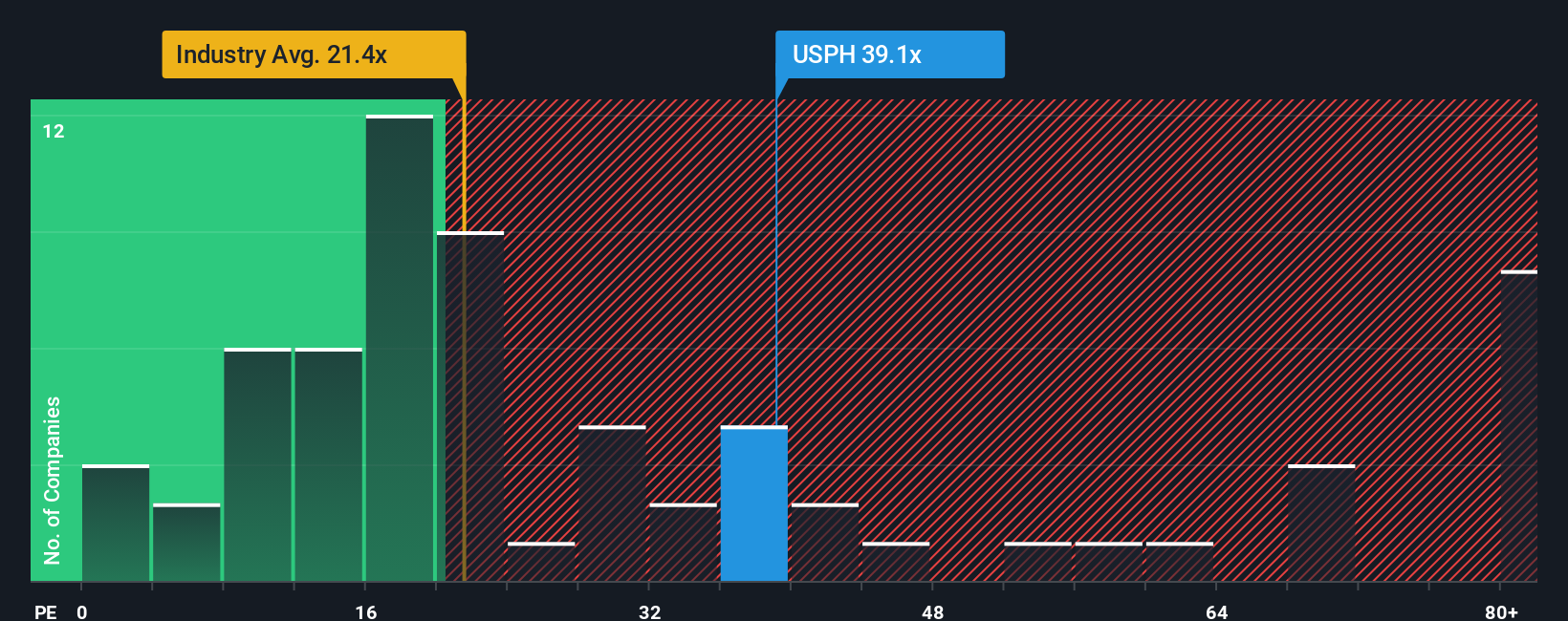

Step away from fair value models and the current price tells a different story. At a price to earnings ratio of 31.8 times, versus 22.2 times for the US Healthcare industry and a fair ratio of 18.5 times, U.S. Physical Therapy screens as richly valued, raising the risk that sentiment, not fundamentals, is doing more of the work here.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own U.S. Physical Therapy Narrative

If you are not fully convinced by this perspective or prefer to dig into the numbers first hand, you can shape a personalized view in just a few minutes, Do it your way.

A great starting point for your U.S. Physical Therapy research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Ready for your next investing move?

Before you log off, scan fresh opportunities on Simply Wall St, where focused screeners surface quality ideas you might otherwise miss.

- Explore potential bargains by running through these 909 undervalued stocks based on cash flows that appear mispriced relative to their projected cash flows and underlying fundamentals.

- Review these 27 AI penny stocks that are involved in advances in artificial intelligence and may be reshaping various industries.

- Assess these 15 dividend stocks with yields > 3% with dividend yields that may contribute to long term total returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com