American Airlines (AAL) Valuation After 2026 Recovery Optimism and Fresh Buy Rating From Wall Street

American Airlines Group (AAL) heads into its December 3 presentation at the Goldman Sachs Industrials and Materials Conference with sentiment quietly improving as big money starts positioning for a potential airline recovery in 2026.

See our latest analysis for American Airlines Group.

That cautious optimism is starting to show up in the tape, with American’s 90 day share price return of 16.46 percent and 30 day share price return of 8.86 percent contrasting with a still negative year to date share price return and a one year total shareholder return of minus 13.40 percent. This suggests early momentum is building from a low base rather than a full rerating already being priced in.

If you think this airline story is just the start for the sector, it could be a good moment to scan other aerospace and defense stocks that might benefit from the same macro tailwinds.

With American trading at a hefty intrinsic discount but only a small gap to Wall Street’s price target, the real debate now is simple: is this a genuine buying opportunity, or is the market already pricing in a 2026 rebound?

Most Popular Narrative Narrative: 40.1% Overvalued

Compared with American Airlines Group's last close of $14.86, the narrative pegs fair value far lower, setting up a sharp valuation gap to explore.

There is a single reason why American is the least attractive of US legacy carriers (in terms of investing, anyway): its balance sheet. If most airlines and certainly those in the US are loaded up to the hilt with debt, American goes so far as to boast negative equity. Any startup would go belly up with a balance sheet such as this one.

Want to see how a modest growth outlook, slim profitability targets, and a future earnings multiple combine to slash this fair value estimate? The narrative lays out the full math.

Result: Fair Value of $10.61 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, if refinancing remains benign and premium economy upgrades lift yields faster than expected, American’s balance sheet overhang could ease far sooner.

Find out about the key risks to this American Airlines Group narrative.

Another View: Market Ratios Point the Other Way

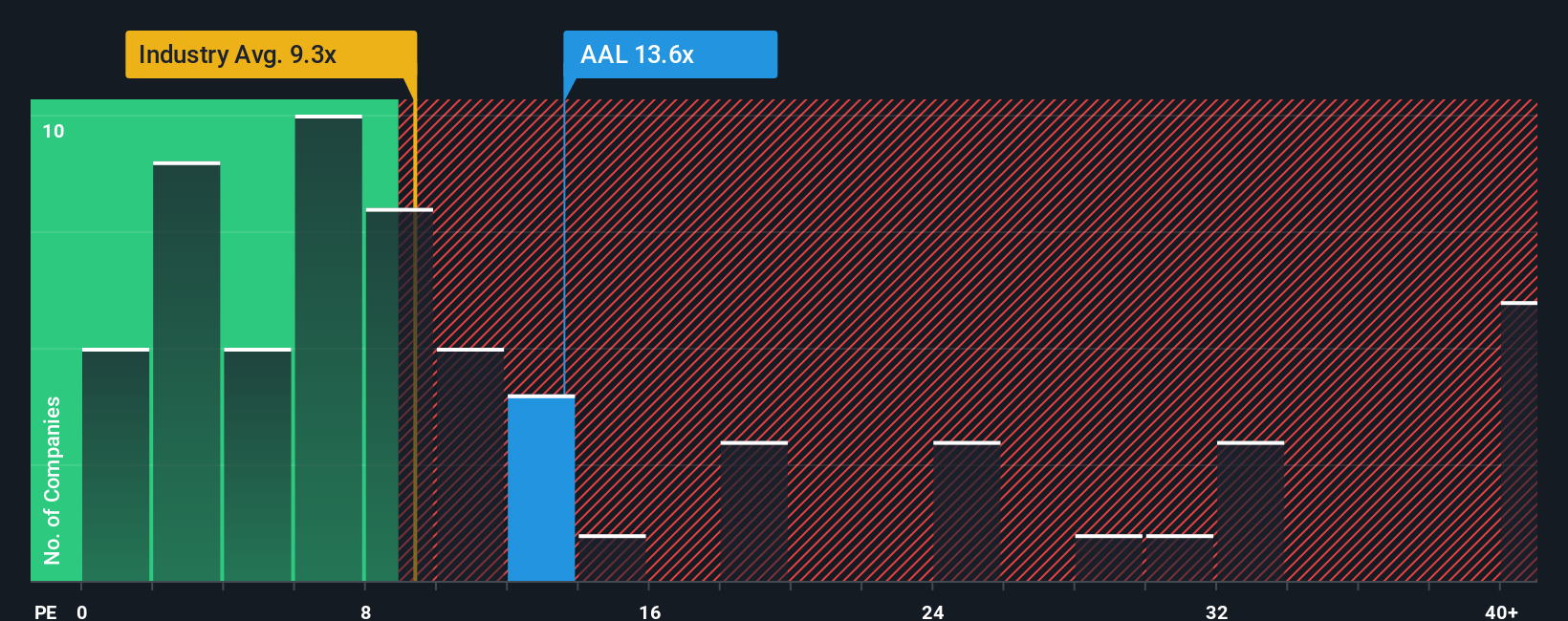

Our valuation checks using a single earnings ratio tell a different story. At 16.3 times earnings versus a global airlines average of 9.3 times, but below a fair ratio of 23.5 times, American screens neither obviously cheap nor clearly expensive, raising real questions about upside.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own American Airlines Group Narrative

If you see the story differently or would rather dig into the numbers yourself, you can build a complete narrative in just minutes with Do it your way.

A great starting point for your American Airlines Group research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before the market wakes up to the next wave of opportunities, put your watchlist to work with targeted ideas built from proven fundamentals and real momentum.

- Secure potential bargains early by tracking these 904 undervalued stocks based on cash flows that the market has not fully appreciated yet.

- Tap into cutting edge innovation with these 27 AI penny stocks pushing the boundaries of automation, data, and intelligent software.

- Strengthen your income stream by reviewing these 15 dividend stocks with yields > 3% that can help support long term, compounding returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com