Southwest Airlines (LUV) Valuation After 2025 Profit Cut Linked to Extended U.S. Government Shutdown

Southwest Airlines (LUV) just cut its 2025 profit outlook after the extended U.S. government shutdown dented travel demand and pushed fuel expenses higher, even as management says bookings have already bounced back to pre shutdown expectations.

See our latest analysis for Southwest Airlines.

The market seems to be looking past the shutdown hit, with Southwest’s 30 day share price return of 16.8 percent and year to date share price return of 14.3 percent hinting at improving sentiment, despite a more modest 1 year total shareholder return of 16.2 percent.

If this rebound in airline risk appetite has you thinking about broader opportunities in travel and defense, it might be a good moment to explore aerospace and defense stocks.

Yet with the stock now trading above the average analyst target, and with long term growth initiatives from new partnerships and capacity upgrades gathering pace, investors have to ask if LUV is still a bargain or if future upside is already priced in.

Most Popular Narrative Narrative: 11.4% Overvalued

With the narrative fair value sitting modestly below Southwest Airlines’ last close of $38.15, investors are being asked to weigh a richer price against improving fundamentals.

The analysts have a consensus price target of $32.06 for Southwest Airlines based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $46.0, and the most bearish reporting a price target of just $19.0.

Want to see what kind of revenue climb and margin rebuild could justify this richer price tag, and how profit projections reshape Southwest’s future earnings power? Dive in to uncover the full playbook behind that fair value call.

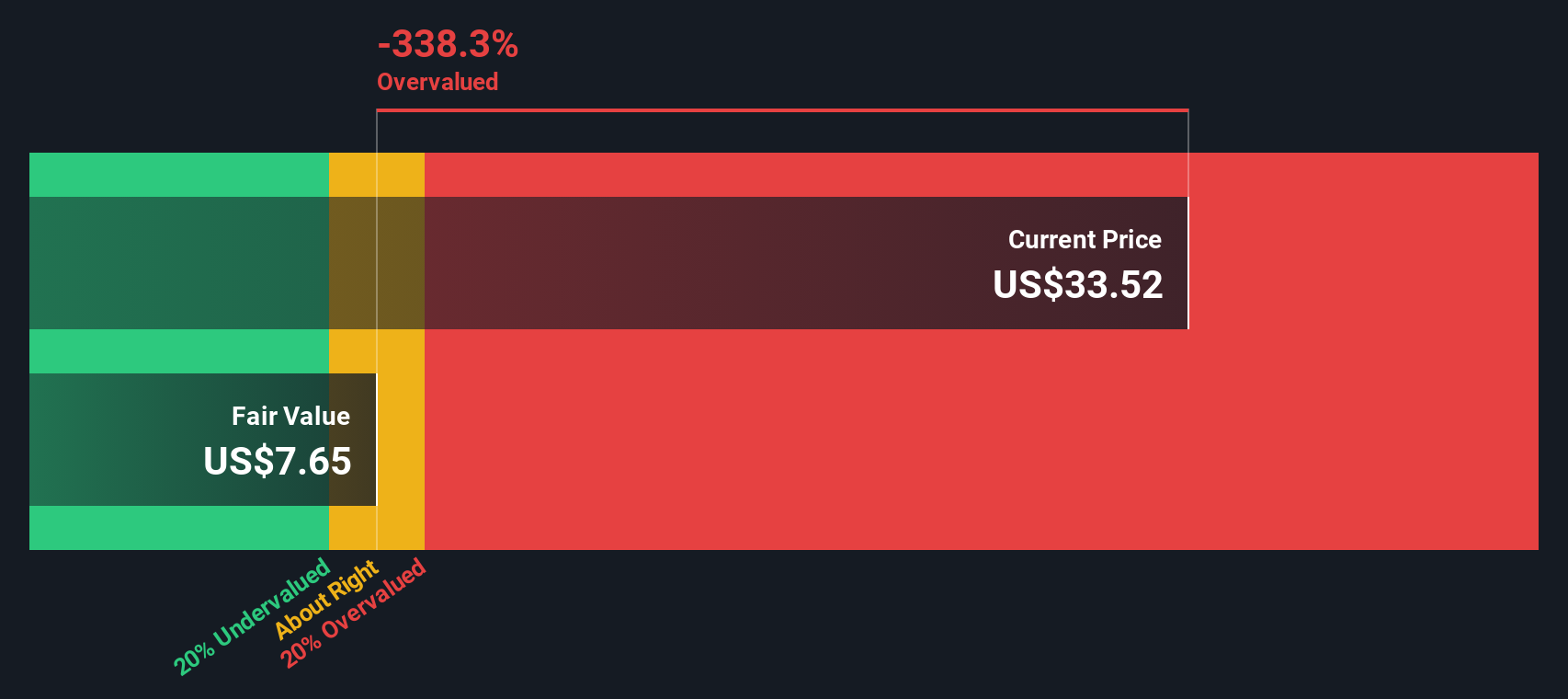

Result: Fair Value of $34.23 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, lingering macro uncertainty and potential Boeing delivery setbacks could quickly derail margin recovery expectations and challenge today’s more optimistic fair value narrative.

Find out about the key risks to this Southwest Airlines narrative.

Another Angle on Valuation

While the narrative fair value suggests Southwest is modestly overvalued, our SWS DCF model paints a very different picture, indicating the stock trades about 80.8 percent below its fair value of $198.25. Is the market underestimating Southwest’s long term cash generation, or is the model too optimistic?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Southwest Airlines for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 900 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Southwest Airlines Narrative

If you are not fully aligned with this view, or would rather dig into the numbers yourself, you can craft a personalized narrative in just a few minutes, Do it your way.

A great starting point for your Southwest Airlines research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Ready for your next investing move?

Before you move on, explore your next potential opportunity by scanning targeted stock ideas on Simply Wall Street that match how you like to invest.

- Capture potential mispriced opportunities early by scanning these 900 undervalued stocks based on cash flows that may be trading at a steep discount to their cash flow strength.

- Explore powerful technology trends by focusing on these 27 AI penny stocks that may benefit as artificial intelligence reshapes entire industries.

- Increase your income potential by focusing on these 15 dividend stocks with yields > 3% that can add additional cash flow on top of any capital gains.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com