Centrus Energy (LEU) Valuation Check After Needham’s New Buy Rating on U.S. Nuclear Fuel Security Story

Needham just kicked off coverage on Centrus Energy (LEU) with a Buy call, and the timing is not random. It lines up with Washington pushing hard for domestic nuclear fuel security as Russian supplies wind down.

See our latest analysis for Centrus Energy.

Despite a choppy past month with an 8.8% drop in the 30 day share price return, Centrus still trades at $264.69 and boasts a powerful 257% year to date share price return, backed by a roughly 252% one year total shareholder return that signals strong, still building momentum behind its nuclear fuel story.

If this kind of policy driven energy upside interests you, it is worth exploring aerospace and defense stocks as another place where government spending and long term contracts can drive under appreciated opportunities.

With Centrus up more than 250% over the past year and trading near Needham’s bullish new target, is this just the start of a multi year rerating, or has the market already priced in the next leg of growth?

Most Popular Narrative: 3.6% Undervalued

With Centrus closing at $264.69 against a narrative fair value near $274.58, the story leans modestly positive and hinges on policy driven growth.

The analysts have a consensus price target of $229.3 for Centrus Energy based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $310.0, and the most bearish reporting a price target of just $108.0.

Want to see what kind of revenue runway and shifting margins could justify such a wide valuation spread? The narrative leans on punchy growth, contracting profitability, and a surprisingly rich future earnings multiple. Curious how those moving parts still point to upside from here?

Result: Fair Value of $274.58 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, faster renewable adoption, or delays and cost overruns in scaling enrichment capacity, could blunt Centrus' revenue runway and pressure the bullish valuation thesis.

Find out about the key risks to this Centrus Energy narrative.

Another View: Rich On Earnings Multiples

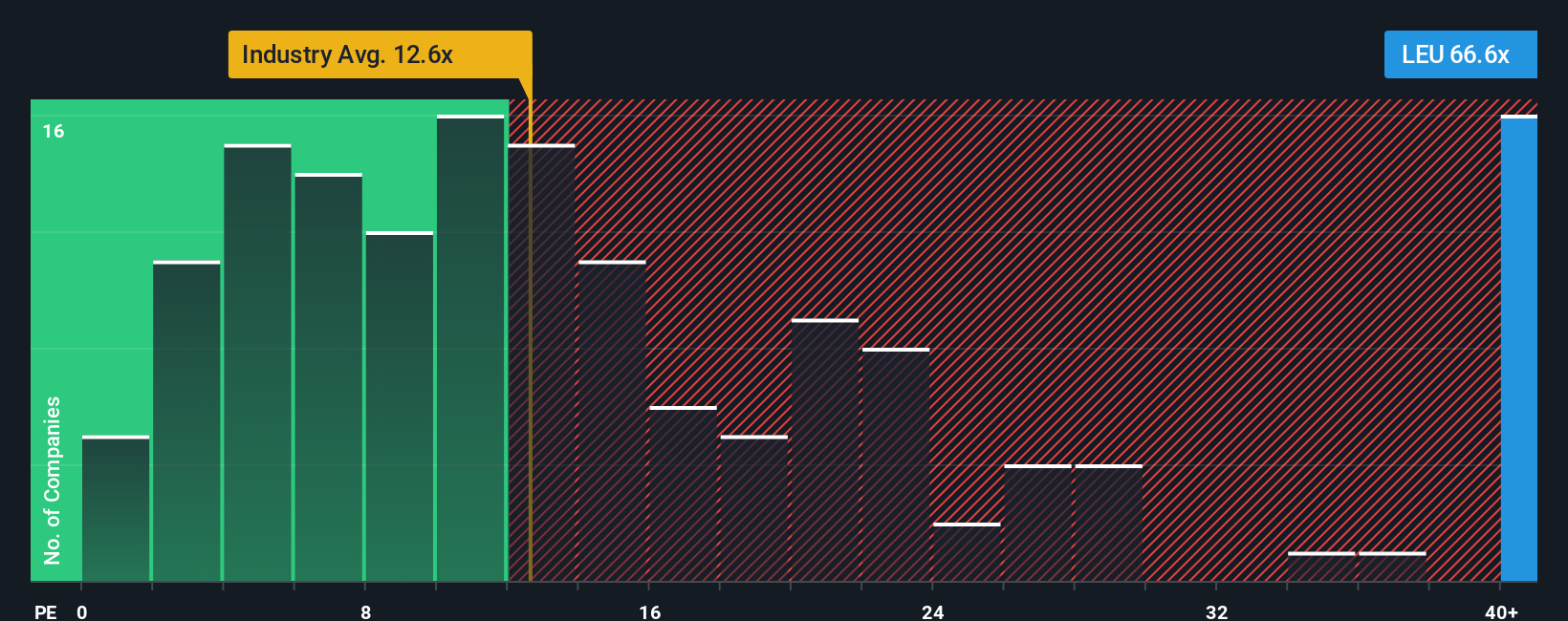

That fair value narrative paints Centrus as modestly undervalued, but the earnings multiple tells a very different story. At a P/E of 42.4x versus 13.5x for the US Oil and Gas industry, 16.8x for peers, and a fair ratio of 11.3x, the stock looks aggressively priced, leaving little room for execution missteps or policy delays. Are investors paying today for growth that may take years, or never fully arrive?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Centrus Energy Narrative

If you want to challenge this view or dig into the numbers yourself, you can quickly build a personalised thesis in under three minutes: Do it your way.

A great starting point for your Centrus Energy research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready for your next investing edge?

Before you move on, lock in a few high conviction ideas tailored to different strategies so you are not relying on a single Centrus style story.

- Capture potential bargains early by scanning these 895 undervalued stocks based on cash flows that the market may be mispricing despite strong underlying cash flows.

- Capitalize on breakthrough innovation by targeting these 27 AI penny stocks positioned to benefit from accelerating demand for intelligent automation and data driven tools.

- Strengthen your income stream by focusing on these 15 dividend stocks with yields > 3% that can help support reliable cash returns through changing market cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com