Is United Airlines (UAL) Still Undervalued After Its Recent Share Price Climb?

United Airlines Holdings (UAL) has been quietly grinding higher, with the stock up about 13% this year and roughly 12% over the past month, helped by steady revenue and earnings growth.

See our latest analysis for United Airlines Holdings.

The latest move to a 107.74 dollar share price caps a solid run, with a strong year to date share price return and a standout three year total shareholder return of 168.68 percent. This suggests momentum is still broadly intact as investors warm to its earnings trajectory and risk profile.

If United’s steady climb has you thinking about the broader travel and defense ecosystem, this could be a good moment to explore aerospace and defense stocks for other potential ideas.

With analysts still seeing double digit upside and valuation metrics hinting at a sizable intrinsic discount, the big question now is whether United remains undervalued or if the market has already priced in its next leg of growth.

Most Popular Narrative: 12.3% Undervalued

With the narrative fair value sitting meaningfully above United’s 107.74 dollar last close, the gap hinges on sustained growth and margin expansion playing out.

Execution of the United Next fleet modernization and capacity expansion strategy, particularly upgauging to larger, more fuel efficient aircraft with more premium seats, will unlock further operational leverage, reduce per seat operating costs, and drive operating margin improvement over the next several years.

Curious how much earnings power this strategy assumes, and what kind of future valuation multiple it bakes in? The narrative leans on confident growth, disciplined margins, and a surprisingly punchy long term profit profile. Want to see the exact projections behind that fair value call?

Result: Fair Value of $122.90 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this upbeat view could unravel if debt funded fleet upgrades coincide with weaker premium demand, which would pressure margins and amplify sensitivity to economic shocks.

Find out about the key risks to this United Airlines Holdings narrative.

Another View: Market Ratios Tell a Different Story

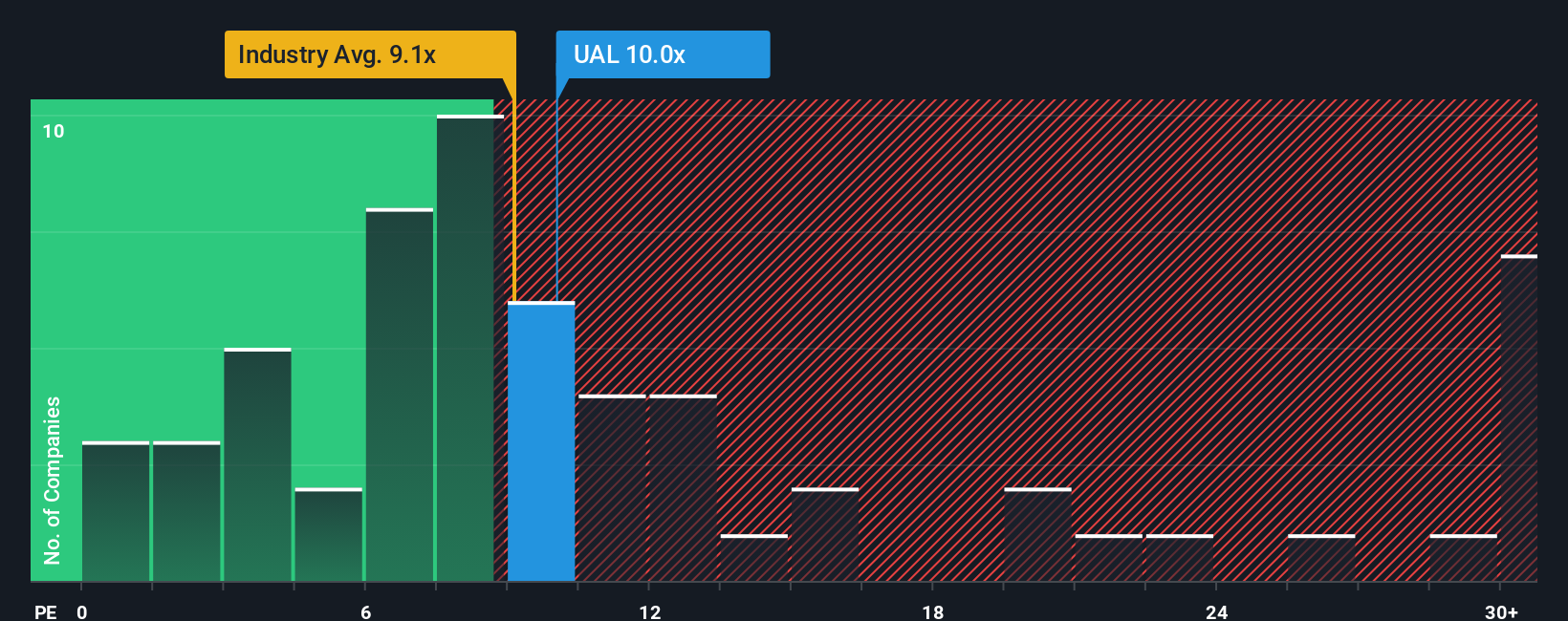

While the narrative fair value points to upside, market ratios are more cautious. United trades on 10.6 times earnings, above the global airlines average of 9.2 times, but below its 15.1 times fair ratio. That mix of slight expensiveness and latent upside leaves investors weighing execution risk against reward.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own United Airlines Holdings Narrative

If you see the story differently or simply want to explore the numbers yourself, you can build a custom view in under three minutes using Do it your way.

A great starting point for your United Airlines Holdings research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

United is just one opportunity. If you want to stay ahead of the crowd, use the Simply Wall St Screener to uncover your next smart move today.

- Capitalize on market mispricing by targeting these 906 undervalued stocks based on cash flows that may offer compelling upside based on strong cash flows and solid fundamentals.

- Position yourself at the frontier of innovation with these 26 AI penny stocks that could benefit from rapid advances in artificial intelligence and automation.

- Strengthen your income strategy by focusing on these 12 dividend stocks with yields > 3% that combine attractive yields with sustainable payout potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com