Is Alaska Air a Value Opportunity After the Recent 22.2% Share Price Surge?

- If you have been wondering whether Alaska Air Group at around $51.75 is a bargain or a value trap, you are not alone, and the answer is more nuanced than a quick glance at the share price suggests.

- The stock has jumped 14.1% over the last week and 22.2% over the past month, even though it is still down roughly 19.5% year to date and 19.3% over the last year.

- Those sharp short term gains have arrived as investors have become more optimistic about the broader airline space, with sentiment improving around travel demand resilience and operational execution across the industry. At the same time, ongoing debates about fuel costs, capacity discipline, and competitive dynamics are keeping risk perceptions elevated for carriers like Alaska Air.

- Right now, Alaska Air Group only scores 2/6 on our valuation checks, which suggests there may be selective pockets of undervaluation but also areas where the market looks appropriately cautious. In the sections ahead, we will unpack the main valuation methods behind that score before finishing with a more holistic way to think about the stock's true worth.

Alaska Air Group scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Alaska Air Group Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a company is worth today by projecting its future cash flows and then discounting those back to the present using a required return. For Alaska Air Group, the 2 Stage Free Cash Flow to Equity model starts from a challenging base, with last twelve month free cash flow at around $452 million negative, reflecting recent industry and company specific pressures.

Analysts expect this to recover meaningfully, with free cash flow projected to reach about $365 million by 2026 and $446 million by 2027, after which Simply Wall St extrapolates further growth out to 2035. Over the next decade, those projections rise gradually toward the mid $700 million range, indicating a steady normalization and expansion in cash generation as operations improve.

When all those future cash flows are discounted back to today, the model produces an intrinsic value of about $62.41 per share. This suggests the stock is roughly 17.1% undervalued compared with the recent price near $51.75. On this cash flow view, Alaska Air appears attractively priced for long term investors who are comfortable with volatility.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Alaska Air Group is undervalued by 17.1%. Track this in your watchlist or portfolio, or discover 908 more undervalued stocks based on cash flows.

Approach 2: Alaska Air Group Price vs Earnings

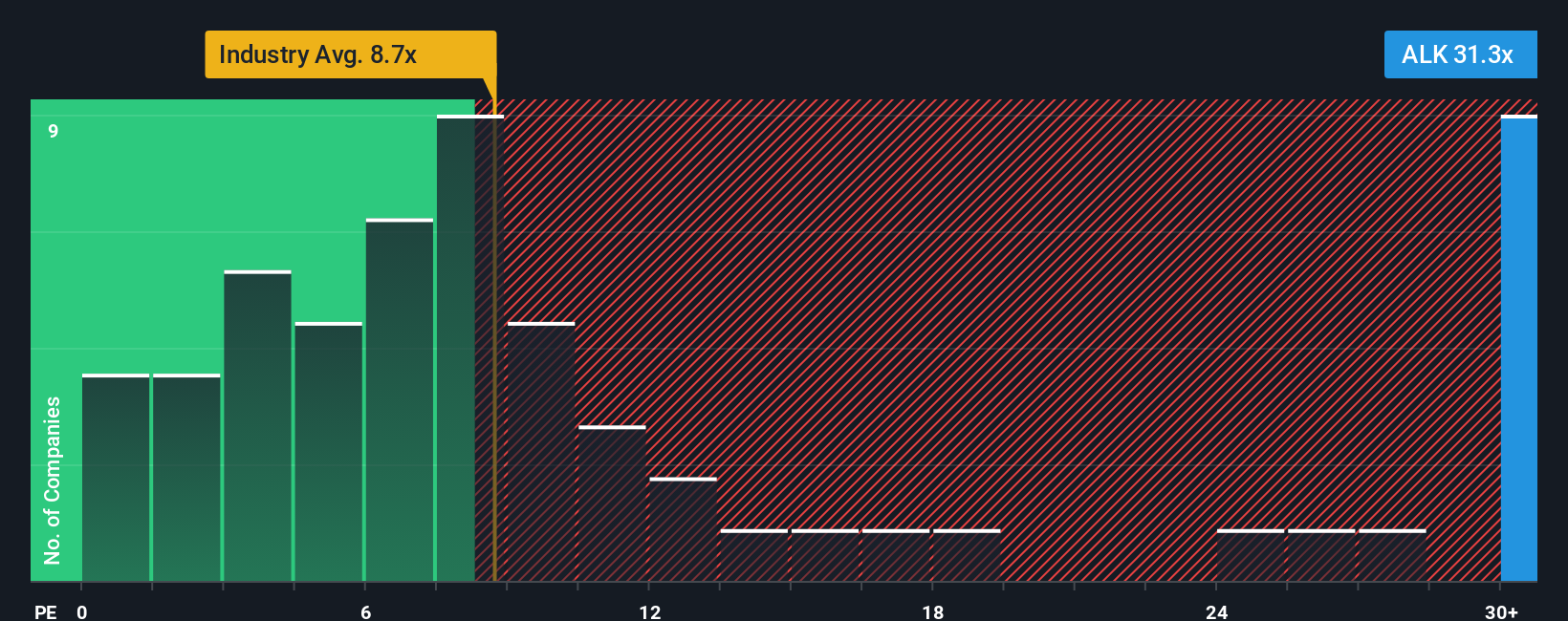

For profitable companies like Alaska Air Group, the Price to Earnings, or P E, ratio is a useful way to gauge how much investors are willing to pay today for each dollar of current earnings. In general, faster growth and lower perceived risk justify a higher P E ratio, while slower growth and higher risk usually mean a lower, more conservative multiple is appropriate.

Alaska Air currently trades on a P E of about 40.0x, which is well above both the airlines industry average of roughly 9.3x and the broader peer group average of around 10.9x. At first glance, that premium suggests the market is pricing in strong earnings growth or a much lower risk profile compared with typical airline operators.

Simply Wall St’s Fair Ratio framework estimates that, given Alaska Air’s growth outlook, profitability, risk profile, industry positioning, and market capitalization, a more appropriate P E would be closer to 57.6x. Because this Fair Ratio is significantly higher than the current 40.0x, it implies the market is not fully reflecting the company’s earnings potential and relative quality on this metric.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1446 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Alaska Air Group Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple way to attach your own story about Alaska Air Group to the numbers such as your fair value, and your expectations for future revenue, earnings, and margins. This means the company’s story flows naturally into a financial forecast and then into a fair value you can compare with today’s share price.

On Simply Wall St’s Community page, Narratives are easy to create and explore. The platform, used by millions of investors, continuously refreshes them as new information like earnings, news, or guidance arrives, helping you decide whether Alaska Air looks like a buy, hold, or sell as fair value moves relative to the current price.

For example, one Alaska Air Narrative might lean bullish, focusing on premium seat expansion, loyalty growth, and the Hawaiian Airlines integration to justify a fair value closer to the optimistic 80 dollar target. A more cautious Narrative could emphasize cost pressures, integration risks, and fuel volatility to support a fair value nearer the 56 dollar bear case. Your job as an investor is to decide which story, and which set of numbers, you believe is more probable.

Do you think there's more to the story for Alaska Air Group? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com