Northrop Grumman (NOC): Reassessing Valuation After Recent Pullback in a Strong Year for the Stock

Northrop Grumman (NOC) has quietly outperformed the broader defense sector this year. With the stock now giving back some gains over the past month, investors are rechecking whether the current pullback offers value.

See our latest analysis for Northrop Grumman.

The recent pullback sits against an 18.7 percent year to date share price return and a 17.3 percent one year total shareholder return. This suggests momentum is cooling slightly as investors digest ongoing defense spending themes and shifting risk appetites.

If Northrop Grumman has you rethinking your exposure to defense, this could be a good moment to scan aerospace and defense stocks for other names benefiting from similar tailwinds.

With shares up strongly over one and five years, but trading about 19 percent below consensus targets and near estimated fair value, investors face a familiar dilemma: is Northrop Grumman now a genuine buying opportunity, or is the market already pricing in its future growth?

Most Popular Narrative Narrative: 16.8% Undervalued

With Northrop Grumman last closing at $555.36 against a narrative fair value near $667, the current gap focuses attention on long term cash flows.

The ramp up of advanced autonomous and integrated systems such as Beacon and IBCS, combined with ongoing investments in solid rocket motor capacity (targeting a near doubling by 2029), positions the company to capitalize on high growth, higher margin market segments, thereby enhancing future operating margins and underlying cash flow.

Curious how steady mid single digit growth, stable margins and a richer future earnings multiple can still point to upside from here? The narrative breaks down the cash flow math, the production ramp and the valuation bridge step by step, but keeps one crucial profitability assumption hidden in plain sight.

Result: Fair Value of $667.21 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the company’s sustained reliance on large U.S. programs, along with potential execution setbacks on complex platforms, could quickly undermine the current growth and valuation narrative.

Find out about the key risks to this Northrop Grumman narrative.

Another View: Market Ratio Signals

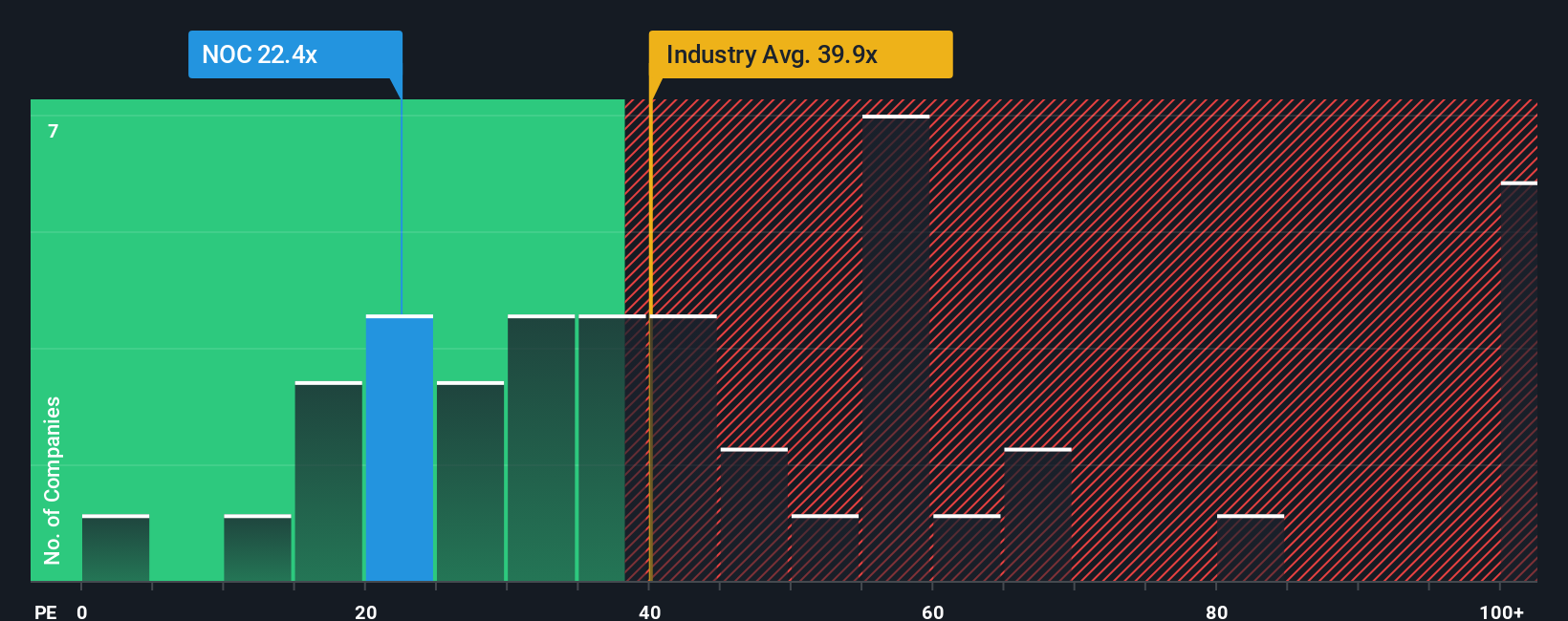

By contrast, Northrop Grumman's current price to earnings ratio of around 19.7 times sits well below both peers at 35.1 times and a fair ratio of 27 times. That gap hints at potential upside, but also raises a tougher question: what if the discount is telling us something about future risk?

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Northrop Grumman for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 904 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Northrop Grumman Narrative

If you see things differently, or simply want to test your own assumptions against the numbers, you can build a fresh, data driven view in minutes: Do it your way.

A great starting point for your Northrop Grumman research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

Ready for more investment ideas?

Before you move on, put your research momentum to work by scanning fresh opportunities in minutes, so you are not left watching others capture the upside.

- Target reliable cash generators by reviewing these 12 dividend stocks with yields > 3% with sustainable payouts that can support your portfolio through different market cycles.

- Capitalize on market mispricing by checking these 904 undervalued stocks based on cash flows where strong cash flows are not yet fully reflected in share prices.

- Catch the next wave of innovation early by assessing these 25 AI penny stocks positioned at the forefront of transformative AI breakthroughs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com