Boston Beer (SAM) Valuation Check After Twisted Tea “Twistmas Stocking” Holiday Launch

Boston Beer Company (SAM) is leaning into the holidays with a limited edition Twisted Tea Twistmas Stocking, a nine pack dispenser designed to support seasonal sales and refresh sentiment around the stock.

See our latest analysis for Boston Beer Company.

The holiday themed Twisted Tea launch lands at a tricky time for investors, with the share price down sharply on a year to date basis and the 1 year total shareholder return also deeply negative. This suggests sentiment is still rebuilding despite modest recent share price gains.

If this kind of seasonal catalyst has you thinking about what else could surprise to the upside, it might be worth exploring fast growing stocks with high insider ownership for more ideas where management has meaningful skin in the game.

With shares still down heavily over one and five years but trading at a discount to analyst targets and some intrinsic value estimates, should investors treat Boston Beer as a mispriced recovery story or assume the market already sees its future growth potential?

Most Popular Narrative Narrative: 16.7% Undervalued

With Boston Beer shares at $199.47 versus a narrative fair value near $239, the valuation gap hinges on margin expansion more than headline growth.

Ongoing productivity initiatives (brewery efficiency, procurement and waste reduction) are structurally raising gross margins, which should continue to benefit earnings as volume normalizes and new, margin-accretive products (e.g., Sun Cruiser) scale.

Want to see how modest top line expectations still support a richer price tag? The narrative quietly leans on fatter margins, rising earnings power, and a cooler future multiple than most investors might assume. Curious which specific shifts in profitability and share count drive that valuation math? Read on before the market closes the gap.

Result: Fair Value of $239.36 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the narrative could unravel if Beyond Beer innovations stall or if intensifying RTD competition forces deeper discounting and heavier marketing spend.

Find out about the key risks to this Boston Beer Company narrative.

Another View Using Market Ratios

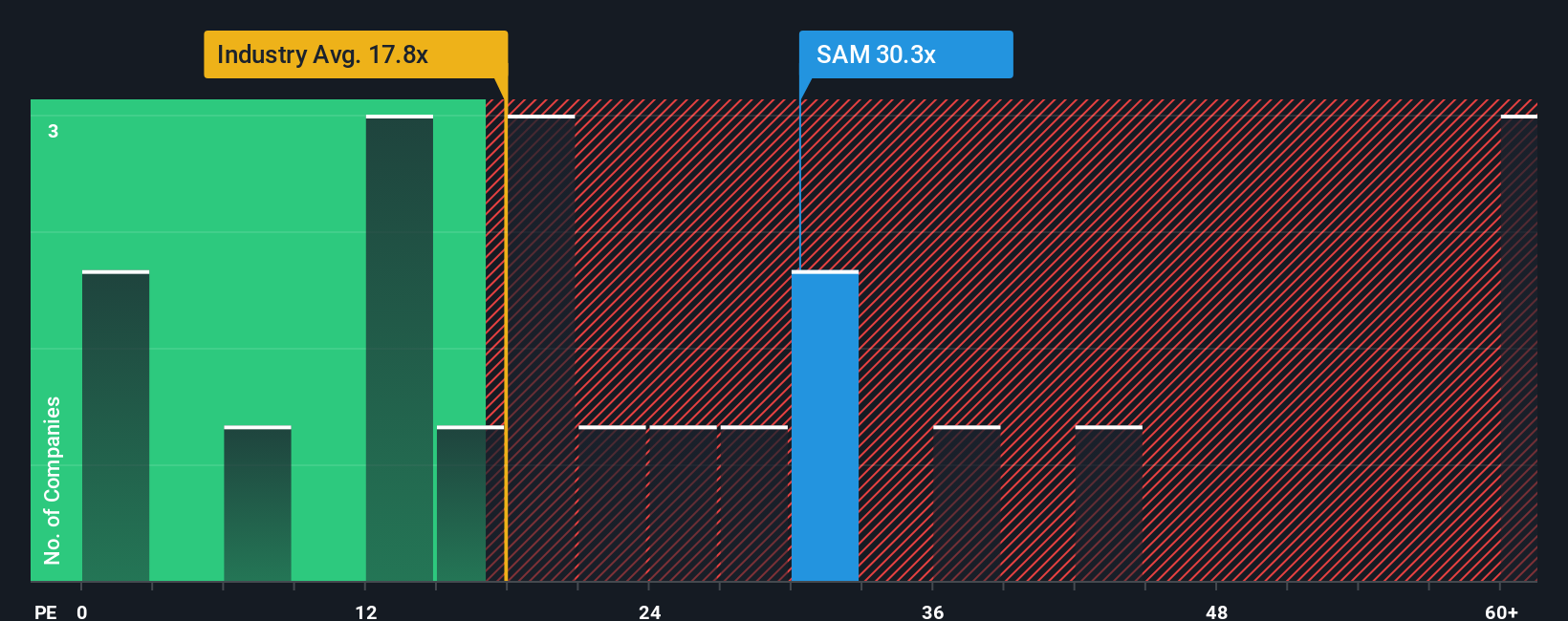

Our narrative fair value points to upside, but the earnings multiple paints a cooler picture. SAM trades on a P/E of 22.6x, richer than the global beverage industry at 17.6x and the fair ratio of 16.6x, even though it is cheaper than peers at 26.9x. Is the stock a value opportunity or a value trap if sentiment turns again?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Boston Beer Company Narrative

If this view does not quite match your own or you prefer to dig into the numbers yourself, you can build a custom narrative in just a few minutes: Do it your way.

A great starting point for your Boston Beer Company research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Do not stop with just one stock, use the Simply Wall Street Screener to spot fresh opportunities that match your strategy before other investors act.

- Capture powerful potential in neglected names by targeting these 904 undervalued stocks based on cash flows that the market has not fully priced in yet.

- Position yourself at the forefront of innovation by focusing on these 25 AI penny stocks that are shaping tomorrow's intelligent technologies.

- Strengthen your income stream by zeroing in on these 12 dividend stocks with yields > 3% that can keep cash flowing into your portfolio.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com