Walmart (WMT) Valuation Check as Nasdaq Listing and Strong Earnings Reinforce Tech-Focused Growth Story

Walmart (WMT) just turned a page by shifting its listing to Nasdaq, as it delivered stronger earnings, faster e commerce growth, and fresh upgrades to its holiday delivery network and full year outlook.

See our latest analysis for Walmart.

Against that backdrop, Walmart’s momentum has been hard to ignore, with a roughly 13% 1 month share price return and a near 30% year to date share price gain, while its 3 year total shareholder return above 150% shows investors have been steadily rewarding its tech focused shift and holiday execution.

If Walmart’s Nasdaq pivot has you rethinking what “retail plus tech” can look like, it is a good moment to explore fast growing stocks with high insider ownership as potential next wave opportunities.

With the stock near record highs, trading just below consensus targets and roughly in line with estimates of intrinsic value, the real question now is whether Walmart remains an attractive opportunity for its next phase of growth or if markets have already priced in that potential.

Most Popular Narrative Narrative: 1.4% Undervalued

With Walmart closing at $116.70 against a narrative fair value near $118, the valuation edge is slim, but it rests on some ambitious growth assumptions.

Expansion of high margin business streams Walmart Connect (advertising, up 31 46% globally), marketplace, and Walmart+ memberships (global advertising up 46%, membership income up 15%) is diversifying Walmart's income base beyond retail, gradually transforming the company's profit mix and resulting in structurally higher net margins and earnings over time.

Curious how steady mid single digit growth and rising margins can still support a premium multiple usually reserved for high growth platforms? The narrative details a carefully staged path for revenue, earnings, and profit mix that challenges the idea of Walmart as a slow moving retailer.

Result: Fair Value of $118.38 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent wage and logistics cost inflation, alongside intensifying grocery competition, could squeeze margins and challenge the optimistic case around Walmart’s premium valuation.

Find out about the key risks to this Walmart narrative.

Another Lens on Valuation

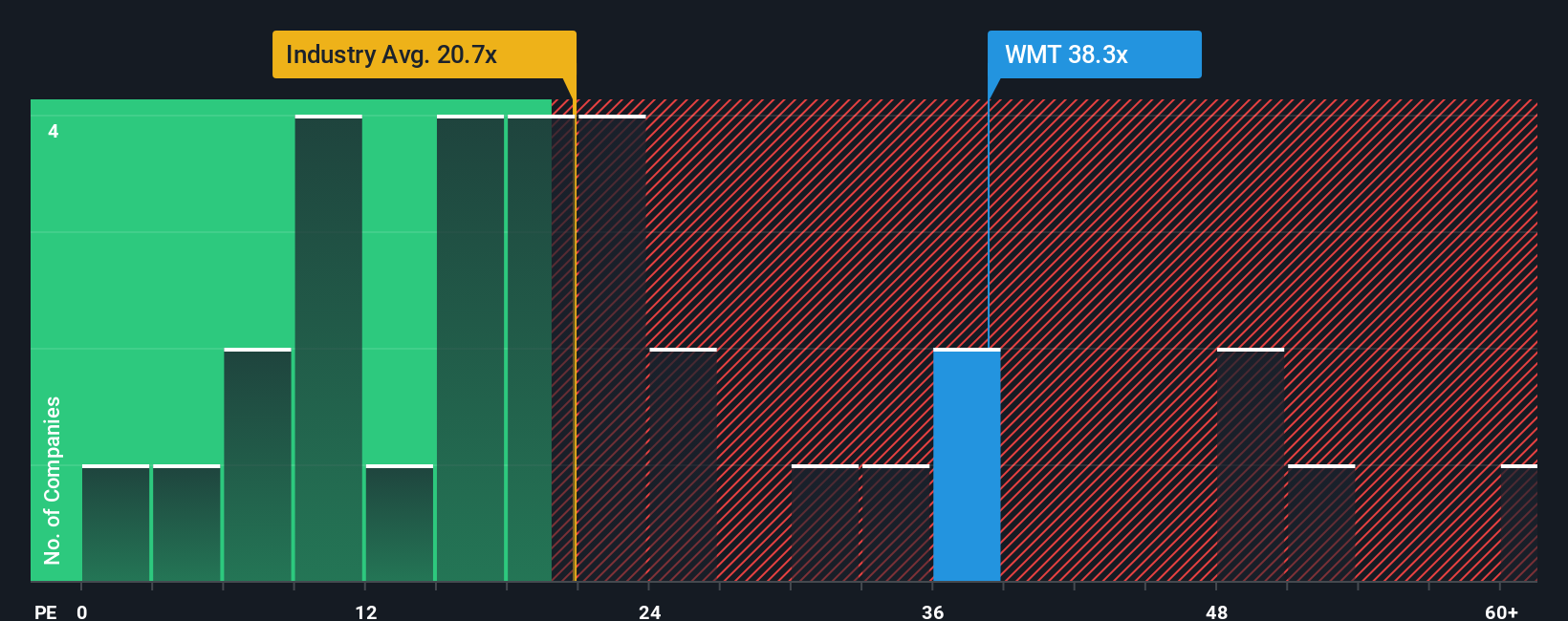

Set against that slight 1.4% narrative undervaluation, Walmart’s current price to earnings ratio of 40.6 times looks stretched next to the Consumer Retailing industry at 22.9 times and an estimated fair ratio of 36.9 times. This hints at valuation risk if growth or sentiment cools.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Walmart Narrative

If this view does not fully align with your own or you prefer to dig into the numbers yourself, you can build a custom narrative in under three minutes, Do it your way.

A great starting point for your Walmart research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Do not stop at a single opportunity when you can confidently scan the market for hidden winners, under the radar themes, and resilient income plays in minutes.

- Capture potential mispricings by screening for quality companies trading below their estimated worth through these 907 undervalued stocks based on cash flows and position yourself ahead of a sentiment shift.

- Ride powerful technology shifts by targeting businesses harnessing next gen innovation with these 26 AI penny stocks, before their growth stories become crowded trades.

- Strengthen your income stream by focusing on companies offering attractive yields using these 13 dividend stocks with yields > 3%, so your capital works harder while you stay selective.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com