Tecnoglass (TGLS) Valuation Check After Soft EBITDA Guidance And Industry Weakness Concerns

Tecnoglass (TGLS) shares fell 5.5% after the company issued full-year EBITDA guidance that investors viewed as weak. At the same time, competitor Apogee Enterprises cut its outlook, reinforcing concerns about demand and cost pressures.

See our latest analysis for Tecnoglass.

At a share price of $51.23, Tecnoglass has a 1-day share price return of 6.86%, but a 90-day share price return decline of 17.46% and a 1-year total shareholder return loss of 30.55%, suggesting momentum has been fading despite a strong 5-year total shareholder return that is several times higher than its level five years ago.

If this kind of volatility has you rethinking concentration in a single name, it could be a good moment to broaden your watchlist with fast growing stocks with high insider ownership.

With Tecnoglass still growing revenue and earnings, yet trading below the average analyst price target, the key question is whether recent weakness leaves the stock undervalued or if the market is already fully reflecting that growth.

Most Popular Narrative: 30.8% Undervalued

With Tecnoglass closing at US$51.23 against a narrative fair value of US$74, the current price sits well below what this framework considers reasonable.

Ongoing urbanization and population migration trends in the Americas, combined with Tecnoglass's aggressive geographic expansion (notably into Western U.S. states and new commercial markets), are supporting strong visible volume growth and a record project backlog, which is likely to drive sustained top-line revenue growth for 2025 and beyond.

Curious how this backlog story turns into that higher fair value? Revenue compounding, margin shifts and a richer earnings multiple all play crucial roles. The full narrative connects those dots.

Result: Fair Value of $74 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that upside story can unravel if rising input costs or shifts in construction demand hit margins and make the current backlog and earnings assumptions look too optimistic.

Find out about the key risks to this Tecnoglass narrative.

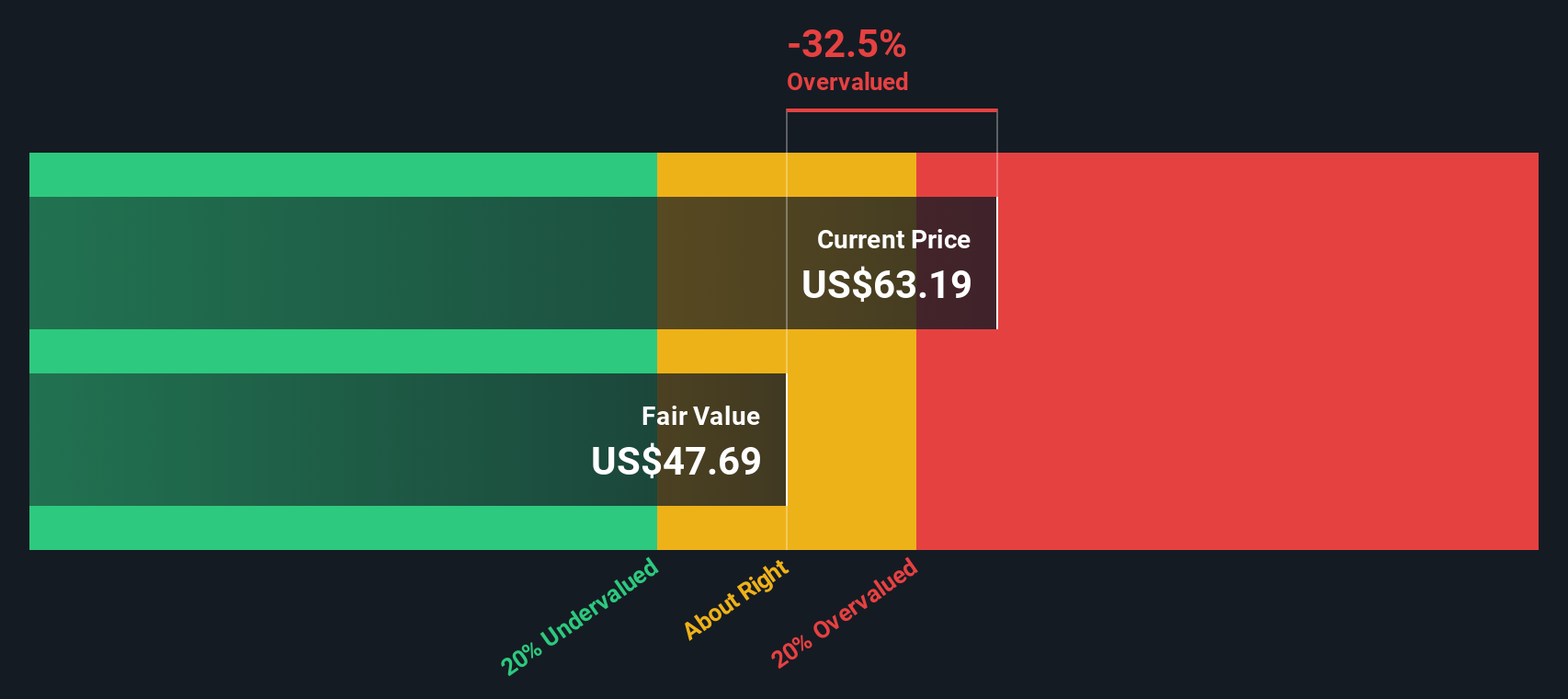

Another View: DCF Sees Limited Upside

While the narrative fair value sits at US$74, our DCF model paints a very different picture. On that framework, Tecnoglass at US$51.23 is trading above an estimated fair value of US$29.33, which would suggest the shares screen as overvalued. Which story do you think fits your own assumptions better?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Tecnoglass for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 876 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Tecnoglass Narrative

If you are not on board with these assumptions or simply want to stress test your own view using the same data, you can build a custom Tecnoglass storyline in just a few minutes: Do it your way.

A good starting point is our analysis highlighting 5 key rewards investors are optimistic about regarding Tecnoglass.

Looking for more investment ideas?

If Tecnoglass has sharpened your thinking, do not stop here. Use this moment to widen your opportunity set with fresh screens built around clear, data driven rules.

- Spot potential recovery plays by checking out these 3544 penny stocks with strong financials that already have stronger financials backing their stories.

- Ride powerful tech trends by scanning these 28 AI penny stocks where artificial intelligence sits at the core of the business model.

- Focus on price versus fundamentals with these 876 undervalued stocks based on cash flows that may offer more attractive cash flow based valuations.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com