Assessing NPK International (NPKI) Valuation After Earnings Momentum And Rising Analyst Optimism

Why NPK International Is Back on Investor Screens

NPK International (NPKI) has attracted fresh attention after strong quarterly earnings growth and positive analyst estimate revisions coincided with the share price pushing toward a key technical resistance level.

See our latest analysis for NPK International.

That renewed interest sits on top of a share price that has climbed 15.99% over the past 90 days and contributed to a 75.41% total shareholder return over the last year. This suggests momentum has been building rather than fading.

If NPK International’s recent move has you thinking about what else is gaining traction, you can broaden your watchlist with fast growing stocks with high insider ownership.

With earnings growing, analyst targets sitting above the current US$12.91 share price, and a strong recent run already on the board, you have to ask: Is NPK International still undervalued, or is the market already pricing in future growth?

Most Popular Narrative: 23% Undervalued

With NPK International last closing at US$12.91 against a narrative fair value of US$16.75, the gap between price and projected potential is clear and worth unpacking.

Strong and flexible balance sheet with ample liquidity allows continued investment in fleet expansion, operational efficiency, and share repurchases, while also enabling potential strategic acquisitions. This supports both revenue growth and shareholder returns (EPS uplift from buybacks) and underpins the company's undervaluation relative to forward growth prospects.

Want to see what sits behind that confidence in future earnings power? The narrative leans heavily on robust revenue growth, shifting margins and a richer future P/E multiple. Curious which specific assumptions have to line up for that valuation to hold? The full story connects those moving parts into one pricing roadmap.

Result: Fair Value of $16.75 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, those fair value hopes rely on large infrastructure projects staying on track, and on less predictable product sales not softening from previously strong levels.

Find out about the key risks to this NPK International narrative.

Another View: Multiples Point To A Richer Price

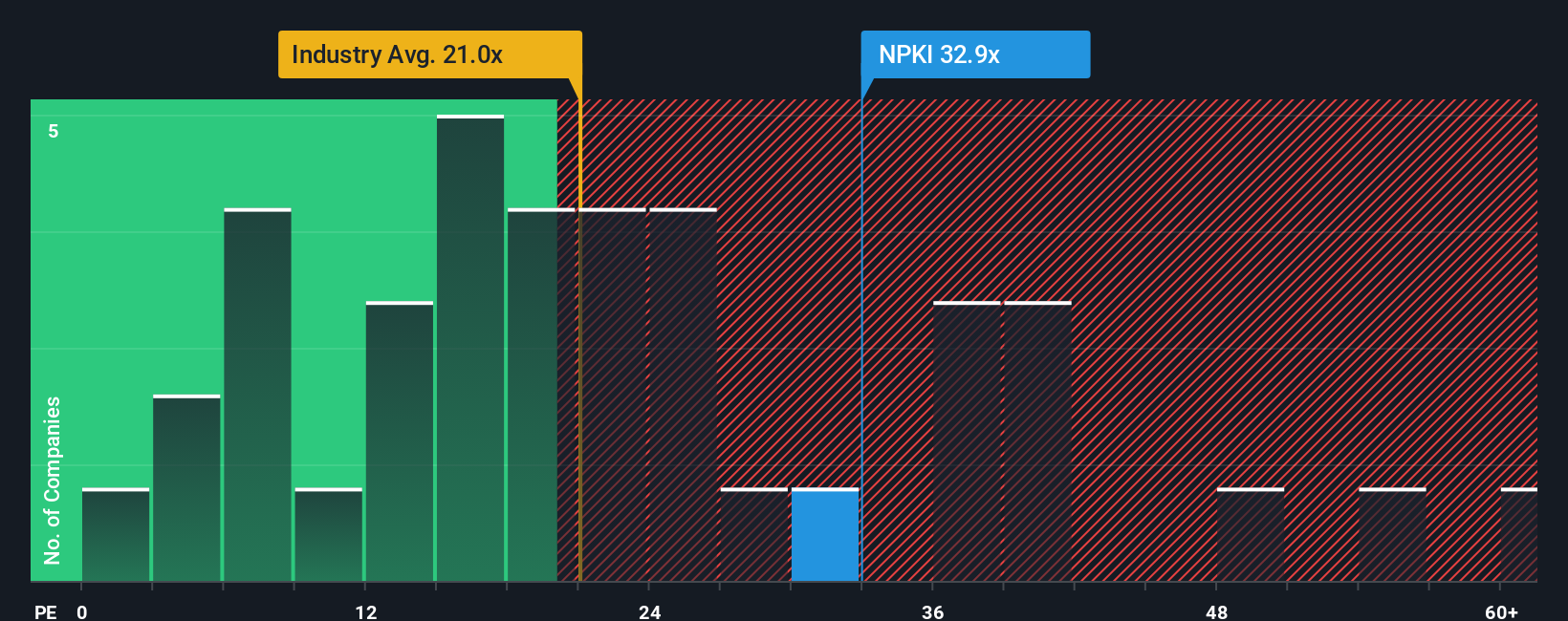

The narrative fair value paints NPK International as 23% undervalued, but the P/E numbers tell a different story. At 32.8x earnings versus a fair ratio of 26.7x, the shares are priced higher than both the modelled ratio and the US Trade Distributors industry at 21.9x, as well as peers at 22.4x.

That kind of gap can be read as investors already paying up for much of the expected growth. This raises the question: is there enough evidence in the earnings outlook to keep justifying this premium, or is the valuation leaning ahead of itself?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own NPK International Narrative

If you see the numbers differently or simply want to stress test your own view, you can build a personalised narrative in just a few minutes with Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding NPK International.

Looking for more investment ideas?

If NPK International has caught your eye, do not stop there. Use the Screener to quickly spot other opportunities that could fit your style and goals.

- Target potential value plays by checking out these 883 undervalued stocks based on cash flows that line up with your expectations on cash flow and price.

- Ride the growth of machine learning and automation by focusing on these 25 AI penny stocks shaping the next wave of technology.

- Tap into income opportunities by scanning these 12 dividend stocks with yields > 3% that may offer stronger yield profiles than your current holdings.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com