A Look At ACV Auctions (ACVA) Valuation After Earnings Miss And Analyst Downgrades

Recent earnings miss and rising questions on profitability

ACV Auctions (ACVA) recently reported third quarter results that missed earnings and revenue forecasts, prompting analyst downgrades and new questions about its cost structure and path to sustainable profitability.

Investors are weighing these weaker results against concerns over high servicing costs, low gross margins, and limited free cash flow. These factors are increasing pressure on the company to justify continued spending for growth.

See our latest analysis for ACV Auctions.

At a share price of $8.98, ACV Auctions has seen a 12.25% 1-month share price return and an 8.32% year-to-date share price return. However, its 1-year total shareholder return of a 58% decline signals momentum that has weakened despite short-term gains, especially as recent earnings and cost concerns have kept sentiment cautious.

If ACV Auctions’ recent swings have you reassessing your options, this could be a useful moment to broaden your research and check out auto manufacturers as a different corner of the market.

With ACV Auctions trading at $8.98 and sitting at a sizeable intrinsic discount by some estimates, you have to ask if the recent weakness is creating a mispriced entry point or if the market already doubts future growth.

Most Popular Narrative: 14.2% Undervalued

With ACV Auctions closing at $8.98 against a narrative fair value of $10.46, the spread reflects a story built on future profitability and scaling economics.

The company's successful commercialization of value-added adjacent services such as ACV Transport and ACV Capital is increasing share of wallet among dealer partners and leveraging network effects, directly supporting both revenue acceleration and net margin improvement as operating scale increases.

Curious what revenue growth, margin lift, and future earnings power need to look like to support that higher value? The full narrative spells out the math behind it.

Result: Fair Value of $10.46 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that upside story still leans heavily on execution, with softer dealer volumes and unproven new initiatives serving as potential triggers for a reset in expectations.

Find out about the key risks to this ACV Auctions narrative.

Another View: Rich on Sales Despite DCF Support

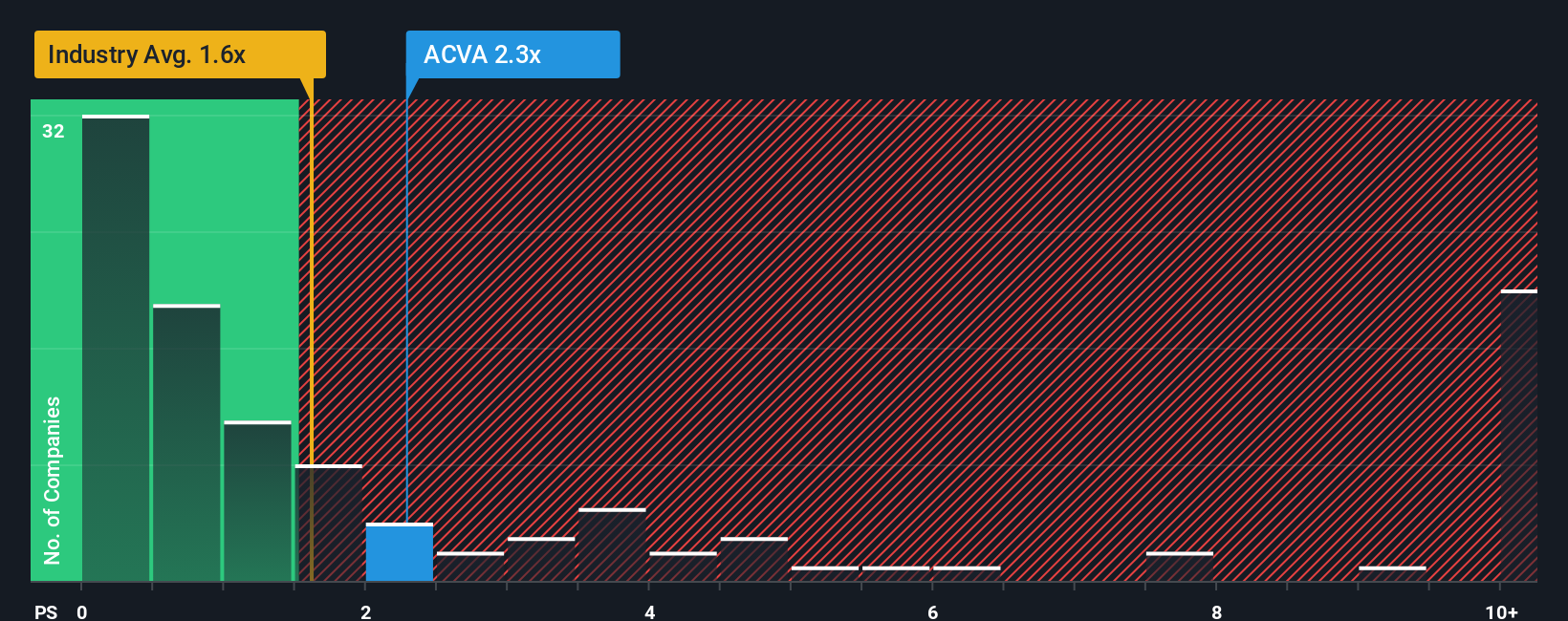

Our DCF model flags ACV Auctions as undervalued, trading about 85% below its fair value estimate of $61.07. Yet on simple P/S, the shares look expensive at 2.1x versus peers and a fair ratio of 1.2x. Which signal do you trust more?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own ACV Auctions Narrative

If this narrative does not quite line up with your view, or you prefer to work directly with the numbers, you can build a version that fits your thesis in just a few minutes: Do it your way.

A great starting point for your ACV Auctions research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Ready for more investment ideas?

If ACV Auctions has sharpened your thinking, do not stop here, use the Simply Wall St Screener to spot other opportunities that could better match your goals.

- Target potential mispricing by checking out these 868 undervalued stocks based on cash flows that may offer a wider margin between fundamentals and current market prices.

- Position yourself for long term themes by scanning these 24 AI penny stocks that are tied to artificial intelligence growth stories across multiple industries.

- Add income angles to your watchlist by reviewing these 12 dividend stocks with yields > 3% that currently offer yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com