Why Precigen (PGEN) Is Up 5.3% After PAPZIMEOS Becomes First-Line RRP Standard of Care – And What's Next

- Precigen, Inc. recently announced that an expert consensus paper in The Laryngoscope, sponsored by the Recurrent Respiratory Papillomatosis Foundation and authored by 16 leading physicians, recommends PAPZIMEOS (zopapogene imadenovec) as the new first-line standard of care for adults with recurrent respiratory papillomatosis.

- This independently authored guidance marks a pivotal shift away from repeated surgical procedures toward an FDA-approved HPV-specific immunotherapy that targets the underlying infection and formalizes a modern treatment algorithm for RRP management.

- Next, we will explore how PAPZIMEOS being endorsed as first-line standard of care could influence Precigen’s broader investment narrative.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

What Is Precigen's Investment Narrative?

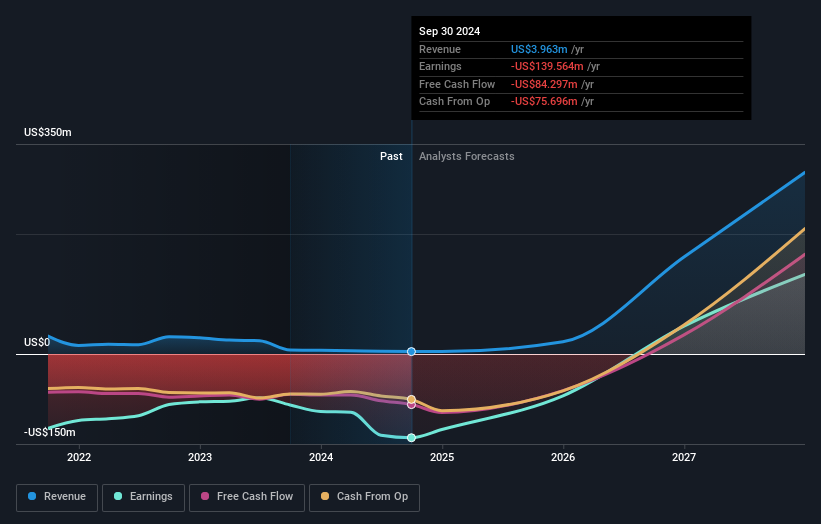

For Precigen to make sense as a holding, you have to believe that PAPZIMEOS can grow from a niche RRP treatment into a durable commercial asset that justifies heavy current losses and a rich valuation. The new expert consensus naming PAPZIMEOS as first-line standard of care clearly reinforces the near term commercial story and could strengthen one of the key short term catalysts: evidence of sustained uptake following the FDA’s broad approval and the company’s recent commercialization push. At the same time, it sharpens some existing risks rather than removing them, including execution on access and reimbursement, the cash burn needed to build out this franchise, and potential dilution after the increase in authorized shares and sizeable recent losses. With the share price already up very sharply over the past year, expectations around PAPZIMEOS are now central.

However, investors should also be aware of how future funding needs might affect their stake. Precigen's shares are on the way up, but could they be overextended? Uncover how much higher they are than fair value.Exploring Other Perspectives

Explore 12 other fair value estimates on Precigen - why the stock might be worth less than half the current price!

Build Your Own Precigen Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Precigen research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free Precigen research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Precigen's overall financial health at a glance.

Contemplating Other Strategies?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- These 9 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- AI is about to change healthcare. These 109 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com