Record Earnings and Higher Dividend Could Be A Game Changer For Community Trust Bancorp (CTBI)

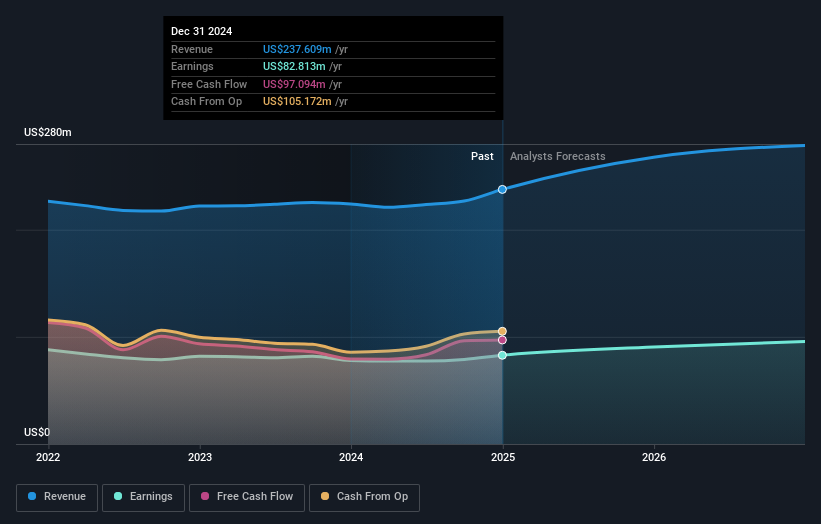

- Community Trust Bancorp, Inc. reported past fourth-quarter 2025 net interest income of US$58.12 million and net income of US$27.28 million, contributing to record full-year earnings supported by higher net interest income and disciplined expenses.

- An interesting takeaway is that the bank paired this profit growth with an increased quarterly dividend of US$0.53 per share, underlining its focus on returning cash to shareholders.

- Next, we’ll examine how this record earnings performance, underpinned by stronger net interest income, shapes Community Trust Bancorp’s broader investment narrative.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

What Is Community Trust Bancorp's Investment Narrative?

For Community Trust Bancorp, the core belief you’d need as a shareholder is that a steady, regionally focused bank can keep turning solid net interest income into dependable earnings and dividends. The latest quarterly report reinforces that story: record 2025 profits, stronger net interest income of US$58.12 million in the fourth quarter, and an increased US$0.53 dividend come alongside a share price not far from consensus targets. That combination likely strengthens the near term catalyst around income-focused investor interest rather than creating a new one. At the same time, the tick up in net charge-offs to US$1.76 million reminds you that credit costs are still a swing factor, and could blunt some of the benefit from higher margins if they continue to build from here.

However, rising net charge-offs are a developing risk that investors should not ignore. Community Trust Bancorp's shares have been on the rise but are still potentially undervalued by 49%. Find out what it's worth.Exploring Other Perspectives

Explore 4 other fair value estimates on Community Trust Bancorp - why the stock might be worth 15% less than the current price!

Build Your Own Community Trust Bancorp Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Community Trust Bancorp research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Community Trust Bancorp research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Community Trust Bancorp's overall financial health at a glance.

Contemplating Other Strategies?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- We've found 13 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

- AI is about to change healthcare. These 109 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com