A Look At BankUnited (BKU) Valuation After Earnings Beat Buyback Expansion And Dividend Increase

Why BankUnited stock moved after its latest quarterly update

BankUnited (BKU) caught investor attention after fourth quarter 2025 results topped market expectations for revenue and profit, alongside an expanded share repurchase authorization and a higher dividend. The combination sharpened focus on capital returns and core earnings.

See our latest analysis for BankUnited.

At a share price of $47.64, BankUnited has seen a 22.22% 90 day share price return and a 20.63% 1 year total shareholder return. This suggests momentum has been building as investors react to earnings beats and a larger buyback program.

If BankUnited's capital return story has caught your eye, it can be worth scanning solid balance sheet and fundamentals stocks screener (None results) for other banks and financials with balance sheets that may support similar shareholder friendly policies.

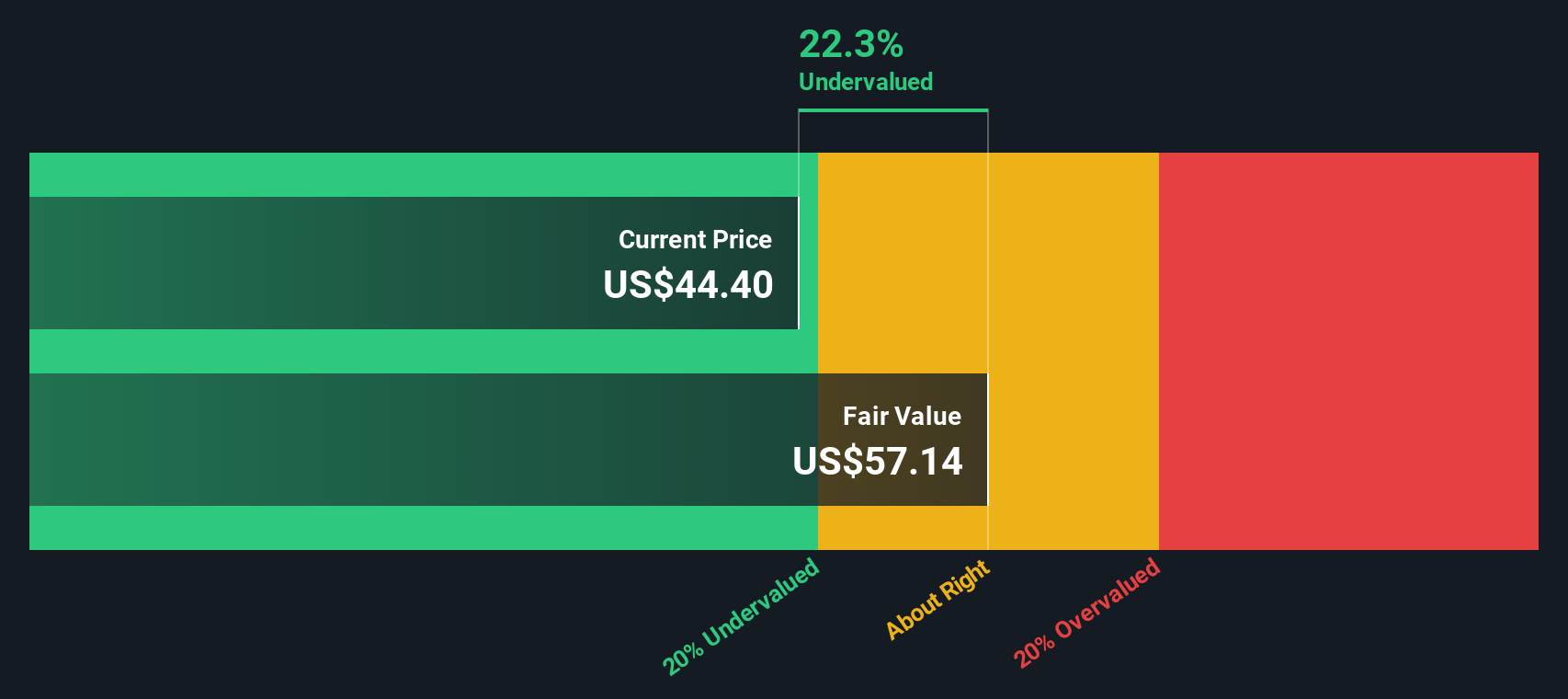

With BankUnited trading at $47.64, at a discount to both analyst targets and some intrinsic value estimates, the key question is whether there is still upside left or if the market is already pricing in future growth.

Most Popular Narrative: 0.9% Undervalued

BankUnited's most followed narrative pegs fair value at about $48.09, very close to the $47.64 last close. This puts the focus on the assumptions behind that call rather than a big valuation gap.

Recent research updates on BankUnited show a mix of optimism around earnings power and ongoing caution around sector risks. This helps explain the modest lift in fair value estimates.

Bullish analysts are raising price targets, which suggests greater confidence that the bank can support a higher P/E over time if it executes on loan growth and margin plans.

Curious what kind of revenue path, margin profile, and future earnings multiple need to line up for that fair value? The narrative spells out a detailed growth runway, a specific profitability reset, and an upgraded valuation framework that together support that price. If you want to see how those moving parts connect, the full story is where it gets interesting.

Result: Fair Value of $48.09 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, office-heavy commercial real estate exposure and any further build-up in nonperforming loans could quickly challenge the fair value story investors are leaning on.

Find out about the key risks to this BankUnited narrative.

Another View: Market Multiple Sends A Different Signal

Our DCF work suggests BankUnited at $47.64 is trading about 37.1% below an estimated fair value of $75.73, which points to an undervalued setup. At the same time, the current P/E of 13.4x sits above both the US Banks industry at 11.8x and a fair ratio of 12.7x. That mix of discount and premium raises a simple question: which signal do you trust more, the cash flow model or what peers are trading on?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own BankUnited Narrative

If you look at the numbers and come to a different conclusion, or simply prefer to test your own assumptions, you can build a custom view in just a few minutes with Do it your way.

A great starting point for your BankUnited research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If you stop with just one bank, you might miss opportunities that better fit your style, so widen your search and let the data do the heavy lifting.

- Spot potential bargain ideas early by checking out these 872 undervalued stocks based on cash flows that might be trading below what their cash flows suggest.

- Tap into growth themes by scanning these 24 AI penny stocks that are tied to artificial intelligence trends shaping parts of the market.

- Add income ideas to your watchlist by reviewing these 13 dividend stocks with yields > 3% that offer yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com