Assessing Cheniere Energy Partners (CQP) Valuation After Sustained Returns And A Modest P/E Premium

What Cheniere Energy Partners’ Recent Performance Tells You

Cheniere Energy Partners (CQP) has drawn investor attention after a period of steady returns, with the unit price recently closing at $56.67 and showing gains over the past month and past 3 months.

See our latest analysis for Cheniere Energy Partners.

Looking beyond the recent strength, CQP’s 6.0% 1 month share price return sits alongside a 4.9% year to date share price return and a 5 year total shareholder return of 104%. This points to momentum that has been sustained over time rather than only in the latest move.

If this kind of steady energy name is on your radar, it can also be useful to widen the search and see how other aerospace and defense stocks are trading right now.

Given CQP’s recent returns, revenue of US$10.3b and net income of US$1.9b, plus a unit price that sits slightly above one analyst target and intrinsic estimates, is there still a potential entry point here, or is the market already pricing in future growth?

Price-to-Earnings of 14.8x: Is it justified?

CQP trades on a P/E of 14.8x, which sits below the broader US market but above the US Oil and Gas industry average. This means the market is not clearly discounting or stretching the price based on earnings alone.

The P/E multiple compares the current unit price to earnings per unit. It effectively tells you how much investors are paying today for each dollar of CQP’s profits. For a business with established LNG infrastructure and long term contracts, earnings based measures are often a key reference point because cash flows are tied closely to those contracts.

Here, CQP’s 14.8x P/E looks lower than the estimated fair P/E of 18.1x. This suggests investors are paying less than the level our fair ratio work indicates the market could move toward if sentiment or assumptions shifted. At the same time, that 14.8x sits above the US Oil and Gas industry average of 13.6x, which is a clear sign that the market is already assigning CQP a premium over the typical peer in its sector.

Explore the SWS fair ratio for Cheniere Energy Partners

Result: Price-to-Earnings of 14.8x (ABOUT RIGHT)

However, you still need to weigh risks such as LNG contract or volume disruptions, as well as any shift in analyst or market expectations, given CQP trades above its target.

Find out about the key risks to this Cheniere Energy Partners narrative.

Another View: Cash Flows Paint a Tighter Picture

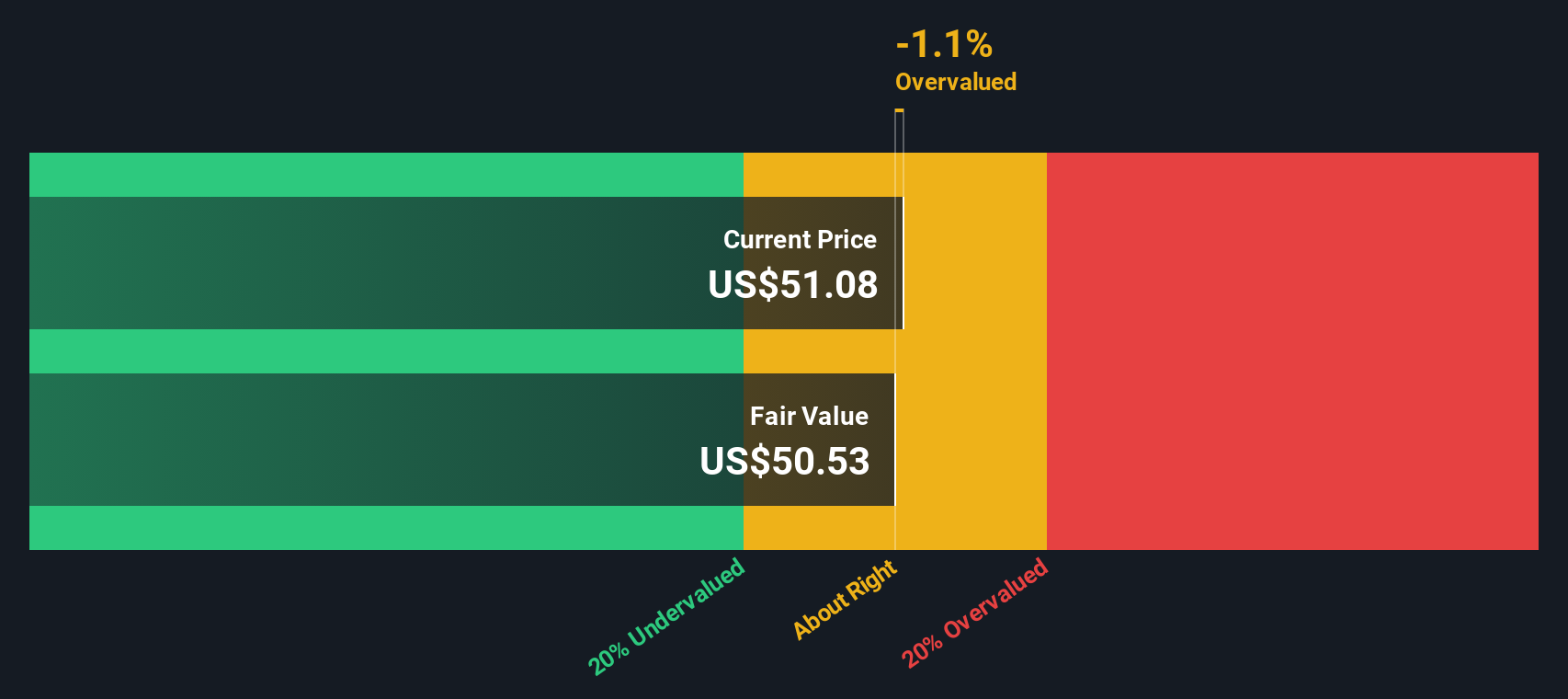

While the P/E of 14.8x makes Cheniere Energy Partners look reasonably priced versus the US market and peer average, our DCF model points to a fair value of $54.12, with the current $56.67 unit price sitting above that level. That raises a simple question for you: is there much of a margin of safety here?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Cheniere Energy Partners for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 888 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Cheniere Energy Partners Narrative

If you see the numbers differently or prefer to test your own assumptions, you can build a personalized Cheniere Energy Partners view in minutes with Do it your way.

A great starting point for your Cheniere Energy Partners research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If CQP is on your radar, do not stop there. Use the Simply Wall St Screener to quickly surface other opportunities that match the way you like to invest.

- Target higher income potential by scanning these 13 dividend stocks with yields > 3% that already offer yields above 3% and might fit a more cash focused portfolio.

- Spot early stage growth stories by filtering for these 3514 penny stocks with strong financials that pair smaller market prices with solid underlying financials.

- Position ahead of tech shifts by reviewing these 23 AI penny stocks that are tied to artificial intelligence themes and related opportunities.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com