A Look At Certara (CERT) Valuation After Weaker Q4 Bookings And Guidance Trim Under New CEO

Certara (CERT) is back on investors’ radar after Meridian Growth Fund flagged the stock as a relative detractor, citing weaker-than-expected Q4 2025 service bookings and a modest guidance cut.

See our latest analysis for Certara.

At a share price of $9.40, Certara has seen a 6.21% 1 month share price return but a 17.25% 3 month share price decline. Its 1 year total shareholder return of 32.33% and 5 year total shareholder return of 73.68% point to pressure building over longer periods as investors weigh weaker service bookings, the guidance trim, and leadership changes.

If this kind of mixed sentiment has you comparing options, it could be a good moment to scan other healthcare stocks that might better fit your portfolio goals.

With Certara trading at US$9.40 alongside weaker bookings, trimmed guidance, and a reported intrinsic discount, the key question is whether the recent weakness signals an undervalued niche player or if the market already reflects its future growth.

Most Popular Narrative: 24% Undervalued

With Certara last closing at $9.40 and the most followed narrative pointing to a fair value around $12.38, the gap between price and story is clear enough to warrant a closer look.

The upcoming commercial launch of Certara's next-generation, AI-enabled MIDD platform and CertaraIQ QSP software leverages advanced analytics and machine learning, providing differentiated capabilities that democratize access and increase the potential customer base, which should translate to higher recurring revenue and margin expansion through cloud-based SaaS models.

Want to see what kind of revenue mix and earnings power this assumes? The narrative leans on specific growth rates, margin shifts, and a rich future earnings multiple.

Result: Fair Value of $12.38 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, softer services bookings and cautious biopharma budgets, combined with execution risk around new AI platforms, could easily challenge that view of the shares being 24% undervalued.

Find out about the key risks to this Certara narrative.

Another View: High P/E Puts Pressure On The Story

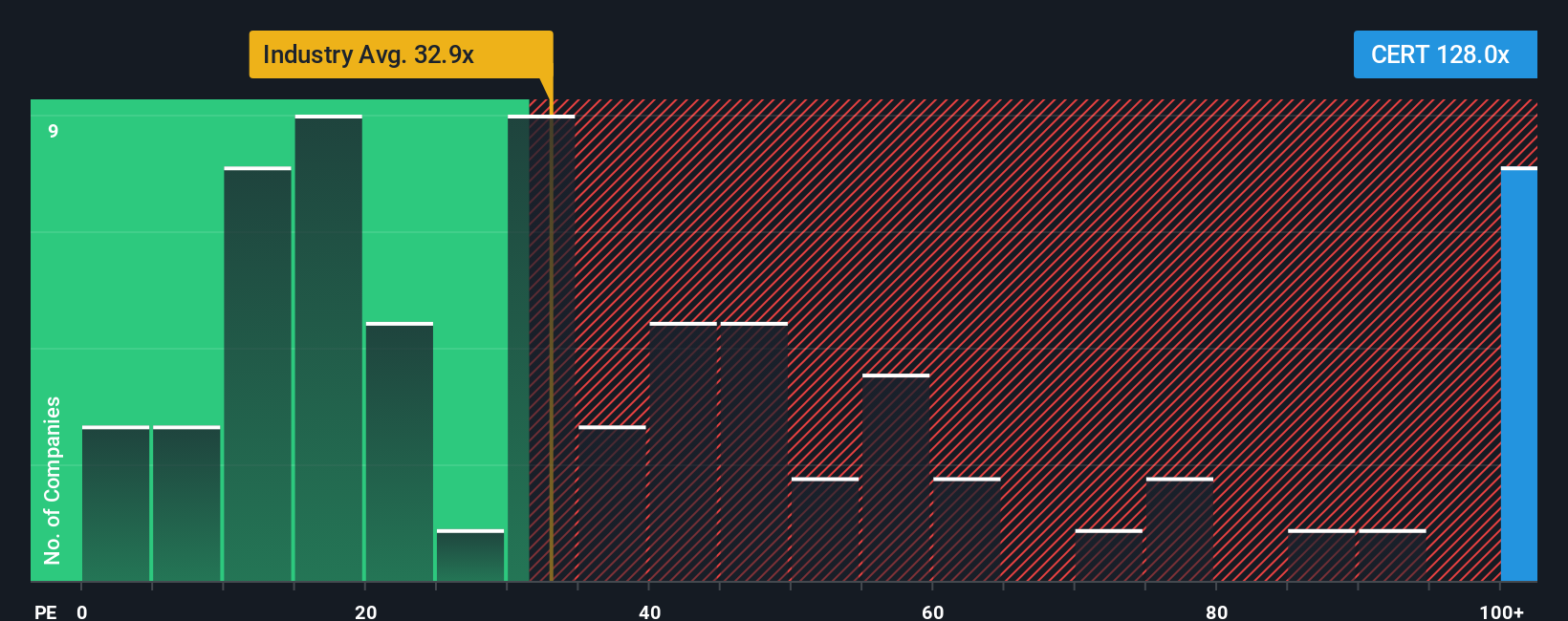

That 24% “undervalued” fair value sits next to a very different signal from simple market ratios. Certara trades on a P/E of 137.6x, compared with about 31.1x for the global Healthcare Services group and a peer average of 33.1x, while our fair ratio sits closer to 38x.

Put plainly, the stock price already bakes in a much richer multiple than both the industry and the fair ratio suggest. This can leave less room for error if the growth and margin story wobbles. The question is whether you are comfortable paying a premium today for that potential.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Certara Narrative

If you are not fully on board with this view, or simply prefer to test the numbers yourself, you can build a custom Certara story in minutes by starting with Do it your way.

A great starting point for your Certara research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If Certara has sharpened your thinking, do not stop here. Broaden your watchlist with focused stock ideas that match how you like to invest.

- Target potential turnaround stories by scanning these 3523 penny stocks with strong financials that pair smaller size with stronger financial profiles than many peers.

- Ride long term tech trends by reviewing these 24 AI penny stocks that are positioned around artificial intelligence themes you might want exposure to.

- Hunt for value by checking these 881 undervalued stocks based on cash flows where current prices sit below cash flow based estimates.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com