A Look At Forestar Group’s (FOR) Valuation After Margin Pressures In The Latest Earnings Report

Forestar Group (FOR) is back in focus after its recent earnings update, where revenue reflected a heavier tilt toward higher priced lot deliveries and western market exposure, while margins stayed under pressure.

See our latest analysis for Forestar Group.

The recent earnings miss and commentary on softer gross margins came after a sharp pullback around the fourth quarter release. Even so, the 7% year to date share price return and 69.6% three year total shareholder return show that longer term holders have still seen meaningful gains. This suggests that momentum has cooled but not disappeared as investors reassess growth versus margin risk.

If Forestar’s update has you thinking about where else capital might work harder, this could be a useful moment to look across fast growing stocks with high insider ownership for fresh ideas with different risk profiles.

With Forestar posting US$273 million in quarterly sales, softer net income, and analysts setting price targets above the current US$26.02 share price, you have to ask: is there still upside here, or is future growth already baked in?

Most Popular Narrative: 19.9% Undervalued

With Forestar Group’s fair value narrative sitting at $32.50 against a last close of $26.02, the story hinges on how future cash flows are expected to play out under a 10.55% discount rate.

Forestar's record-high backlog of lots under contract (up 26% YoY and representing 38% of owned lots with $2.3b of future secured revenue) positions the company to capture sustained demand driven by ongoing U.S. population growth, continued household formation, and the national shortage of housing supply likely driving multi-year growth in both top-line revenue and future earnings.

Curious what sits behind that secured lot backlog, mid single digit revenue growth assumptions, and a future earnings multiple below the wider real estate group? The most followed narrative ties together backlog, margins, and a tighter P/E band to arrive at $32.50. If you want to see how those pieces fit together over the next few years, the full story is worth a closer read.

Result: Fair Value of $32.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that story can shift quickly if reliance on D.R. Horton as a key customer becomes more problematic than expected or if gross margins remain under pressure for longer.

Find out about the key risks to this Forestar Group narrative.

Another View: Cash Flows Tell a Tougher Story

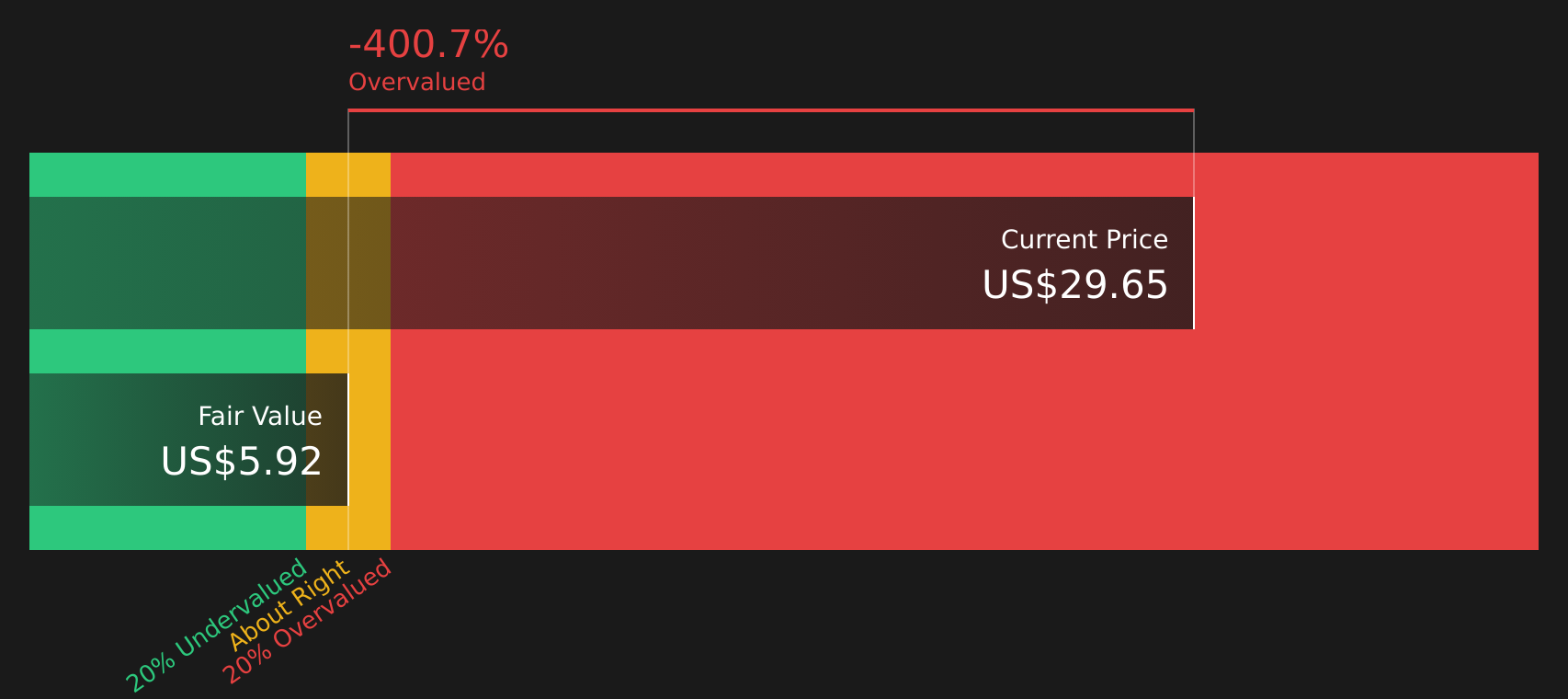

While the fair value narrative points to Forestar Group as 19.9% undervalued at $32.50, our DCF model paints a very different picture. On that approach, the estimated future cash flow value sits at $5.64 per share, which suggests the current $26.02 price is rich rather than cheap. Which lens do you trust more, earnings power or cash flows?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Forestar Group for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 868 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Forestar Group Narrative

If you look at these numbers and reach a different conclusion, or simply prefer to work from your own assumptions, you can create a personalised view in a few minutes by starting with Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Forestar Group.

Looking for more investment ideas?

If you are serious about putting your capital to work, do not stop at one stock. Use the screener to surface opportunities you would otherwise miss.

- Spot potential value by scanning these 868 undervalued stocks based on cash flows, which may offer a different balance of price and fundamentals to what you see in Forestar.

- Capture growth themes by checking these 25 AI penny stocks, which are tied to long term trends in automation and data driven business models.

- Strengthen your income focus by reviewing these 14 dividend stocks with yields > 3%, which might complement a holdings mix centered on capital growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com