Enovix (ENVX) Valuation Check As Operations Leadership Resets For Mass Battery Production

Enovix (ENVX) has reshaped its operations leadership as it prepares for mass production, with the planned retirement of its Chief Operating Officer and expanded roles for senior manufacturing executives focused on high-volume battery output.

See our latest analysis for Enovix.

The leadership reshuffle comes after a tough stretch for investors, with a 90 day share price return of a 45.78% decline and a 1 year total shareholder return of a 45.11% loss. This suggests sentiment has cooled even as Enovix moves closer to volume production and seeks to reduce execution risk.

If this kind of transition has you thinking beyond a single stock, it could be a good moment to scan high growth tech and AI stocks for other battery, hardware, and AI names shaping the next wave of electronics.

So, with the share price under pressure, a value score of 2, an intrinsic discount of about 79%, and a price target well above the last close, is Enovix a discounted growth story, or is the market already factoring in everything ahead?

Most Popular Narrative: 75.4% Undervalued

With Enovix last closing at $6.62 against a widely followed fair value of $26.90, the current price sits well below that narrative anchor.

Development and anticipated shipments of custom battery cells for smart eyewear devices and AR/VR markets starting mid-2025 create potential for higher margins due to premium pricing in these high-energy density applications.

Analysts are tying this fair value to very fast revenue expansion, a swing from heavy losses toward healthier margins, and a rich future earnings multiple. Curious which assumptions really carry the weight here? The full narrative lays out the sequence behind that $26.90 figure.

Result: Fair Value of $26.90 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that upside story still depends heavily on a smooth smartphone ramp and capital-intensive factory buildout. Any delays or weaker demand could quickly challenge the bullish case.

Find out about the key risks to this Enovix narrative.

Another View: Price To Sales Paints A Tougher Picture

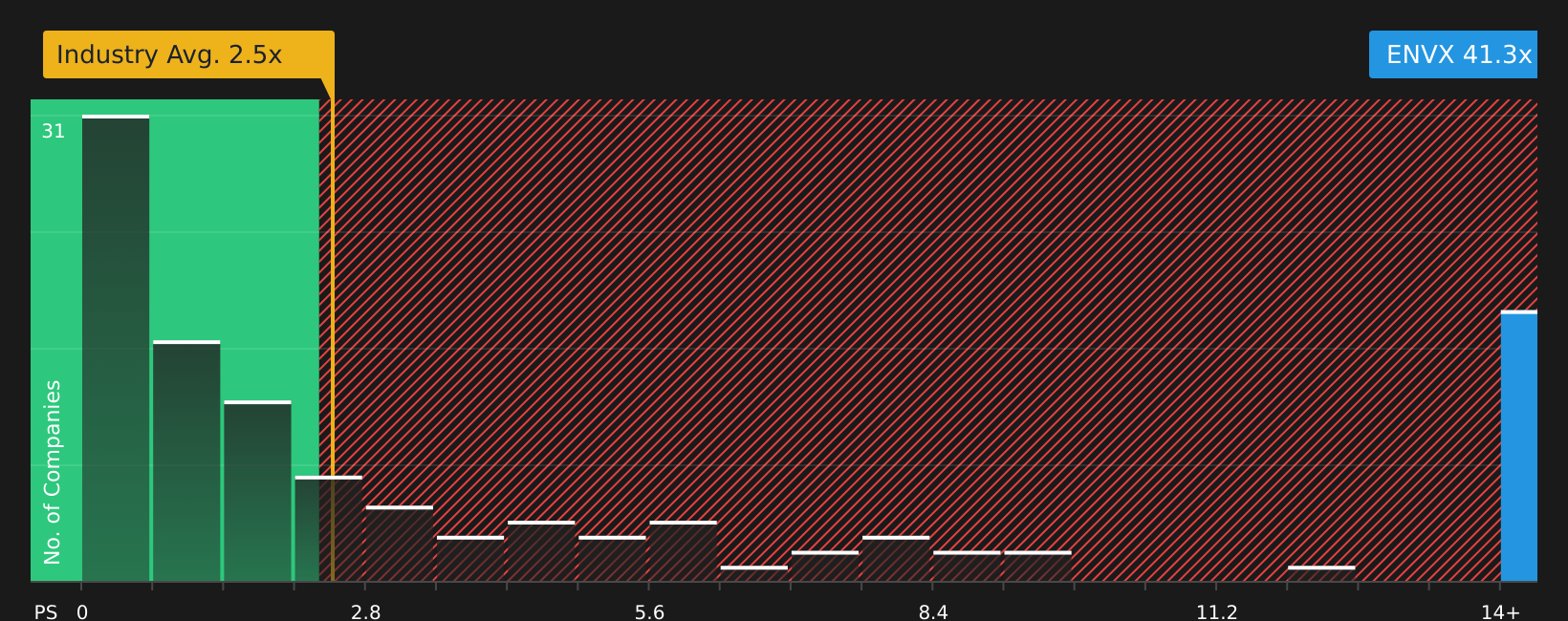

While the SWS fair value and analyst narrative lean toward undervaluation, the simple P/S check is far less forgiving. Enovix trades on a P/S of 46x compared with 2.4x for the US Electrical industry, and a fair ratio of 3.1x that the market could move toward over time.

That gap suggests the story already carries a heavy premium, so the question for you is whether execution can catch up quickly enough to justify paying so much revenue up front.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Enovix Narrative

If you are not fully on board with this framing, or prefer to work through the numbers yourself, you can build a custom view in minutes with Do it your way.

A great starting point for your Enovix research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If you stop at Enovix, you risk missing other setups that might fit your style even better, so broaden your watchlist before the next move arrives.

- Spot potential value pockets by scanning these 875 undervalued stocks based on cash flows that line up with your preferred quality and pricing criteria.

- Ride the AI trend more deliberately by checking out these 24 AI penny stocks that tie real business models to artificial intelligence themes.

- Add income angles to your research by reviewing these 12 dividend stocks with yields > 3% that offer yields above 3% alongside fundamental checks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com