Top 3 Dividend Stocks To Consider For Your Portfolio

As January 2026 draws to a close, the U.S. stock market has shown resilience with the S&P 500 and Dow Jones Industrial Average posting gains despite a sluggish end to the month. In this dynamic environment, dividend stocks can offer investors stability and income potential, making them an attractive consideration for those looking to bolster their portfolios amidst fluctuating market conditions.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Provident Financial Services (PFS) | 4.34% | ★★★★★★ |

| Peoples Bancorp (PEBO) | 5.04% | ★★★★★★ |

| OTC Markets Group (OTCM) | 4.59% | ★★★★★★ |

| First Interstate BancSystem (FIBK) | 5.30% | ★★★★★★ |

| First Community Bankshares (FCBC) | 6.22% | ★★★★★★ |

| Farmers National Banc (FMNB) | 5.24% | ★★★★★★ |

| Ennis (EBF) | 5.13% | ★★★★★★ |

| Douglas Dynamics (PLOW) | 3.13% | ★★★★★☆ |

| Dillard's (DDS) | 5.14% | ★★★★★★ |

| Columbia Banking System (COLB) | 5.03% | ★★★★★★ |

Click here to see the full list of 103 stocks from our Top US Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

First Community Bankshares (FCBC)

Simply Wall St Dividend Rating: ★★★★★★

Overview: First Community Bankshares, Inc. serves as the financial holding company for First Community Bank, offering a range of banking products and services with a market cap of $660.42 million.

Operations: First Community Bankshares, Inc. generates revenue primarily from its Community Banking segment, which accounts for $167.43 million.

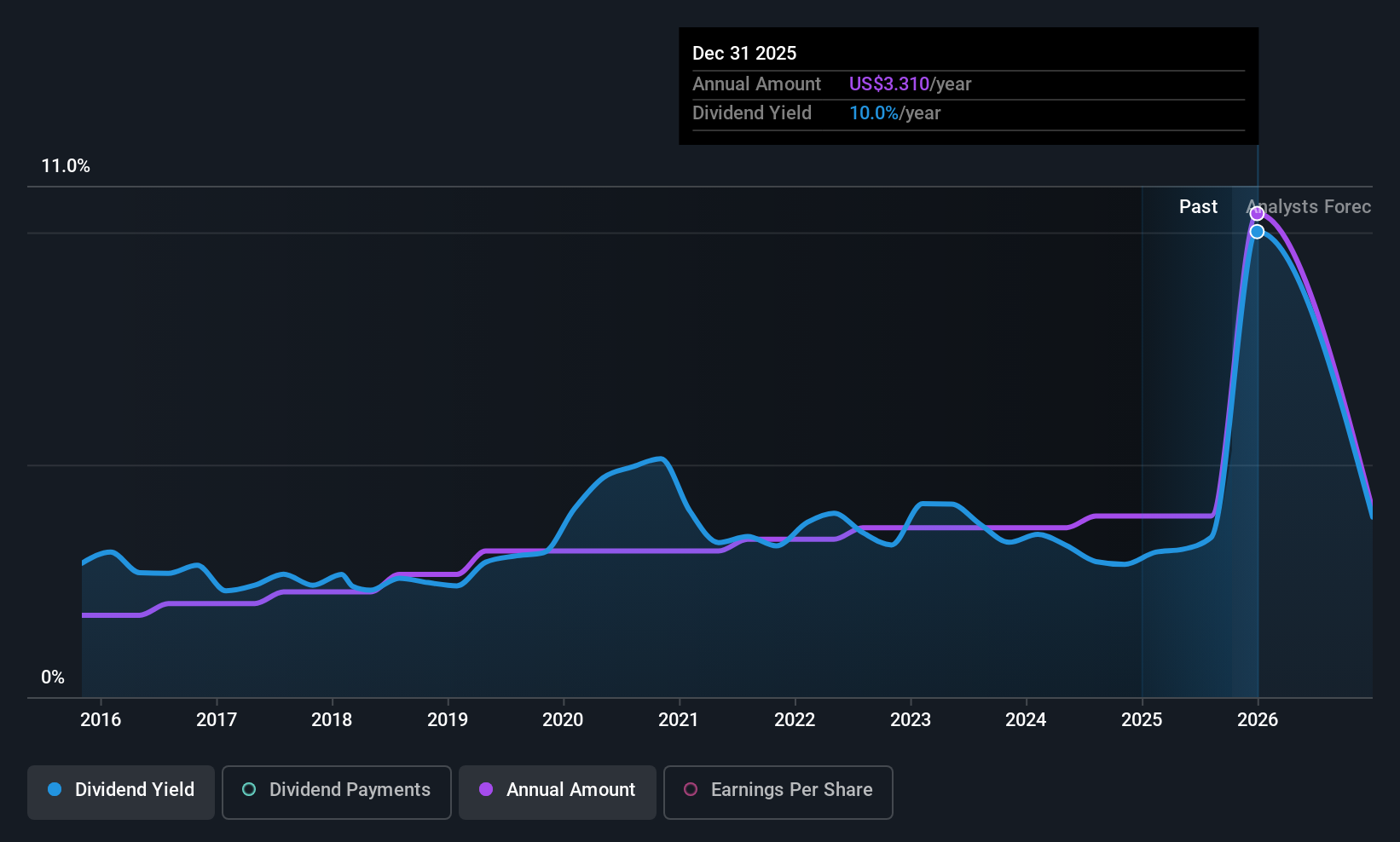

Dividend Yield: 6.2%

First Community Bankshares offers a compelling dividend profile, with a 6.22% yield placing it in the top 25% of U.S. dividend payers. The company has consistently increased its dividends for 16 consecutive years and maintained stable payouts over the past decade. With a payout ratio of 46.5%, dividends are well-covered by earnings, ensuring sustainability. Despite recent net charge-offs and slightly lower annual net income, the company declared both regular and special dividends recently, underscoring its commitment to shareholder returns amidst ongoing merger activities expected to close soon.

- Click here to discover the nuances of First Community Bankshares with our detailed analytical dividend report.

- The analysis detailed in our First Community Bankshares valuation report hints at an inflated share price compared to its estimated value.

First Merchants (FRME)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: First Merchants Corporation, with a market cap of $2.26 billion, operates as the financial holding company for First Merchants Bank, offering commercial and consumer banking services.

Operations: First Merchants Corporation generates its revenue primarily from its Community Banking segment, which accounts for $641.70 million.

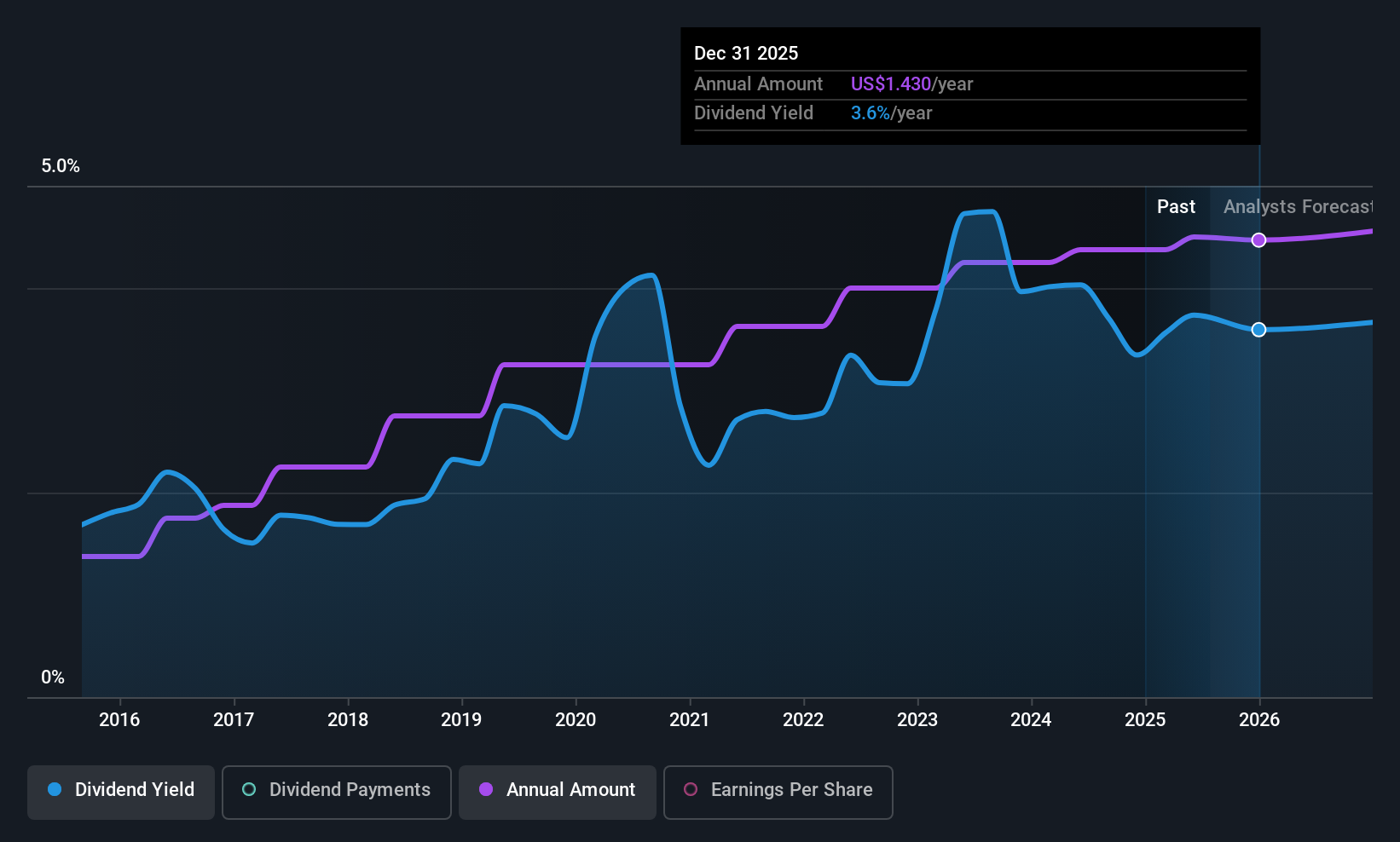

Dividend Yield: 3.6%

First Merchants Corporation maintains a solid dividend profile with a payout ratio of 36.7%, ensuring dividends are well-covered by earnings. The company declared a recent common dividend of US$0.36 per share, demonstrating stability and growth over the past decade. Despite an increase in net charge-offs to US$6.02 million, net income rose to US$226 million for 2025, supporting its reliable 3.62% yield amidst trading at good value compared to peers and industry standards.

- Take a closer look at First Merchants' potential here in our dividend report.

- Our comprehensive valuation report raises the possibility that First Merchants is priced lower than what may be justified by its financials.

John B. Sanfilippo & Son (JBSS)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: John B. Sanfilippo & Son, Inc., operating through its subsidiary JBSS Ventures, LLC, processes and distributes tree nuts and peanuts in the United States with a market cap of approximately $945.46 million.

Operations: John B. Sanfilippo & Son, Inc. generates revenue primarily from selling various nut and nut-related products and bars, totaling approximately $1.14 billion.

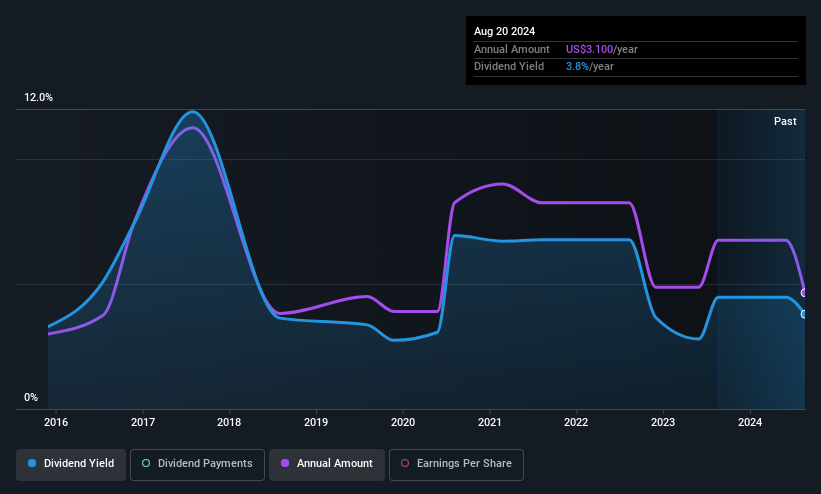

Dividend Yield: 3.1%

John B. Sanfilippo & Son's dividends are well-covered by earnings with a low payout ratio of 14.9%, though the cash payout ratio is higher at 89.2%. The dividend yield of 3.09% falls short compared to top US payers, and past payments have been volatile, indicating an unstable track record despite growth over the last decade. Trading at a discount to fair value, its recent earnings growth suggests potential for future stability in payouts.

- Unlock comprehensive insights into our analysis of John B. Sanfilippo & Son stock in this dividend report.

- Our valuation report here indicates John B. Sanfilippo & Son may be undervalued.

Key Takeaways

- Discover the full array of 103 Top US Dividend Stocks right here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com