Cavco Industries (CVCO) Earnings Growth Outpaces Five Year Trend And Supports Premium P/E Narrative

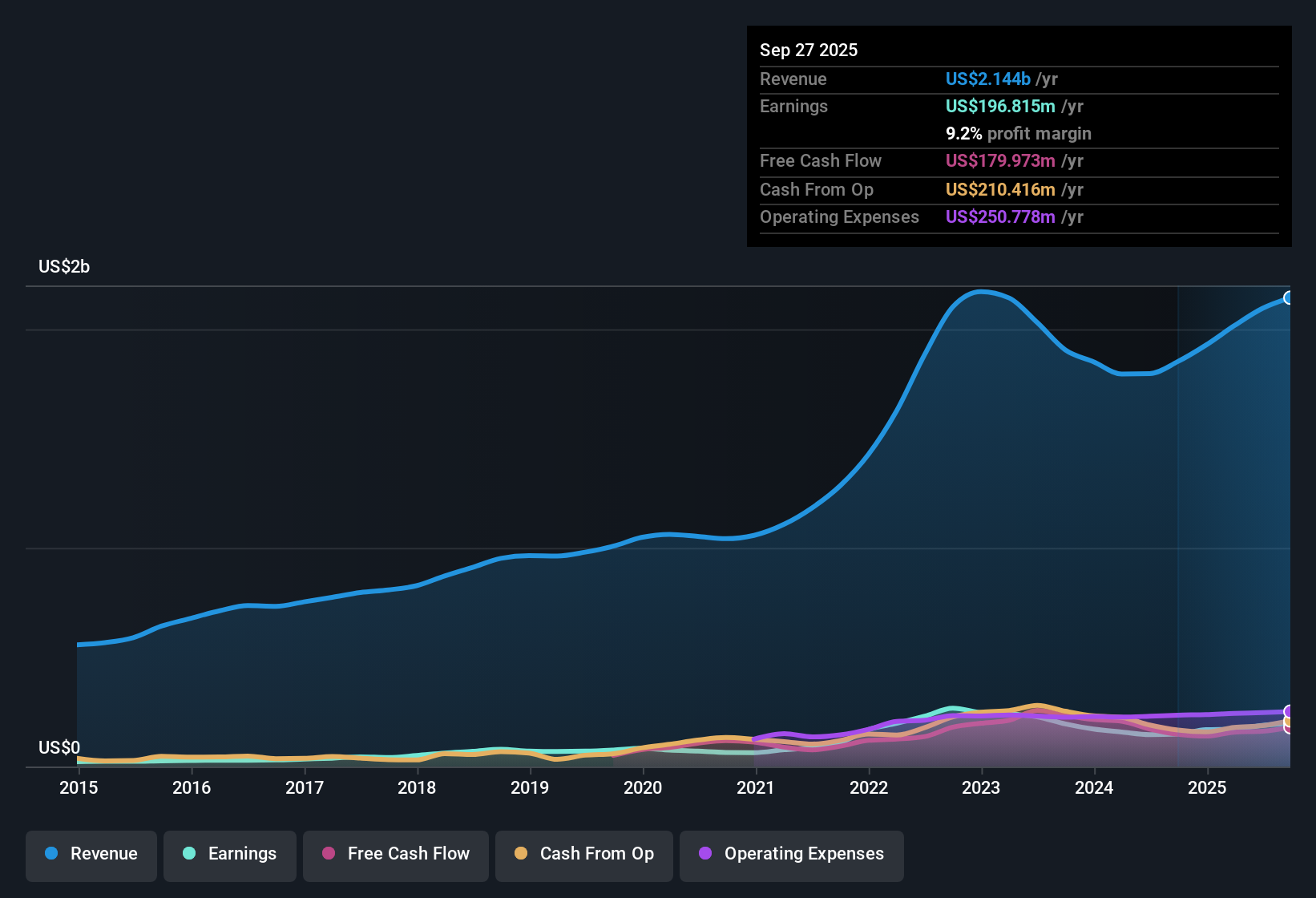

Cavco Industries (CVCO) opened its Q3 2026 update with revenue of US$581.0 million and basic EPS of US$5.65, alongside trailing twelve month figures of US$2.2 billion in revenue and EPS of US$23.28 that continue to frame the earnings story. The company has seen quarterly revenue move from US$508.4 million in Q4 2025 to the mid US$500 million range in the first half of 2026, while basic EPS has ranged between US$4.53 and US$6.97 over the past six reported quarters, giving investors a clear view of how the current print fits into recent trends. With a trailing net margin of 8.4% and only modest compression versus last year, this latest set of numbers keeps the focus on how sustainably Cavco can convert its top line into profit.

See our full analysis for Cavco Industries.With the headline figures on the table, the next step is to see how these results line up with the widely followed growth and profitability narratives around Cavco, and where the numbers start to challenge those stories.

Curious how numbers become stories that shape markets? Explore Community Narratives

TTM earnings growth outpaces 5 year trend

- Over the last 12 months, Cavco earned US$184.4 million of net income and US$23.28 in EPS, with earnings growth of 9.5% compared with a 5 year earnings growth rate of 7.3% per year.

- What stands out for a bullish view is that recent 9.5% earnings growth sits above the 7.3% 5 year pace, which lines up with the idea of a business rooted in affordable, factory built housing, yet

- TTM revenue at US$2.2b and net margin of 8.4% show that most of the profit story still comes from steady execution rather than rapid expansion.

- Forecast earnings growth of about 8.06% per year is lower than the latest 9.5% result, so anyone optimistic will likely watch whether that faster recent growth continues or settles closer to the forecast line.

Margins steady at 8.4% despite mixed quarterly EPS

- Net profit margin over the trailing 12 months sits at 8.4% compared with 8.7% last year, while quarterly EPS over the last six periods has ranged from US$4.53 to US$6.97, including US$6.62 and US$6.49 in Q2 and Q1 2026 followed by US$5.65 in Q3 2026.

- Bears who focus on profitability pressure get some support from the margin slip to 8.4% and the softer Q3 EPS, yet

- TTM net income of US$184.4 million and TTM revenue of US$2.2b still point to a business producing consistent profit in dollar terms even with that small margin compression.

- The year over year earnings growth of 9.5% sits alongside the margin dip, which means critics need to explain how a slightly lower margin fits with earnings that are still higher than a year ago.

Premium 19.7x P/E versus peers and DCF gap

- Cavco trades on a 19.7x P/E compared with peer and US consumer durables averages around 11x to 11.7x, while a DCF fair value of about US$793.72 sits above the current share price of US$465.80 and an analyst price target of US$587.50.

- For a bullish angle, the roughly 41% gap between the DCF fair value and the current share price is a key part of the argument, but

- The 19.7x P/E multiple is materially higher than peers around 11x, so the case that the shares are attractive on this model depends on earnings growth around the 8.06% forecast and the 9.5% trailing increase continuing to justify that premium.

- With no significant insider selling flagged in the last three months, supporters might point to that alongside the DCF gap, while others will still focus on how the higher multiple compares with sector norms.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Cavco Industries's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

Explore Alternatives

Cavco’s premium 19.7x P/E against peers near 11x, alongside slightly softer margins and EPS, leaves valuation and consistency as key pressure points for some investors.

If that kind of premium multiple makes you uneasy, check out these 876 undervalued stocks based on cash flows today to quickly focus on companies where pricing looks more aligned with their fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com