Assessing Credit Acceptance (CACC) Valuation After Mixed Q4 Results, Leadership Changes And A Major Shareholder Exit

Credit Acceptance (CACC) has drawn fresh attention after fourth quarter results showed revenue of US$579.9 million, alongside lower net income and earnings per share, paired with leadership changes and a large shareholder exit.

See our latest analysis for Credit Acceptance.

That mix of higher revenue, lower earnings, leadership changes and completed share repurchases has coincided with a 7 day share price return of 13.31% and a 30 day share price return of 9.26%. However, the 1 year total shareholder return is 4.39% lower, which hints that recent momentum has picked up after a weaker longer term experience for shareholders.

If Credit Acceptance’s recent moves have you reassessing the auto finance space, it could be a useful moment to broaden your search with auto manufacturers.

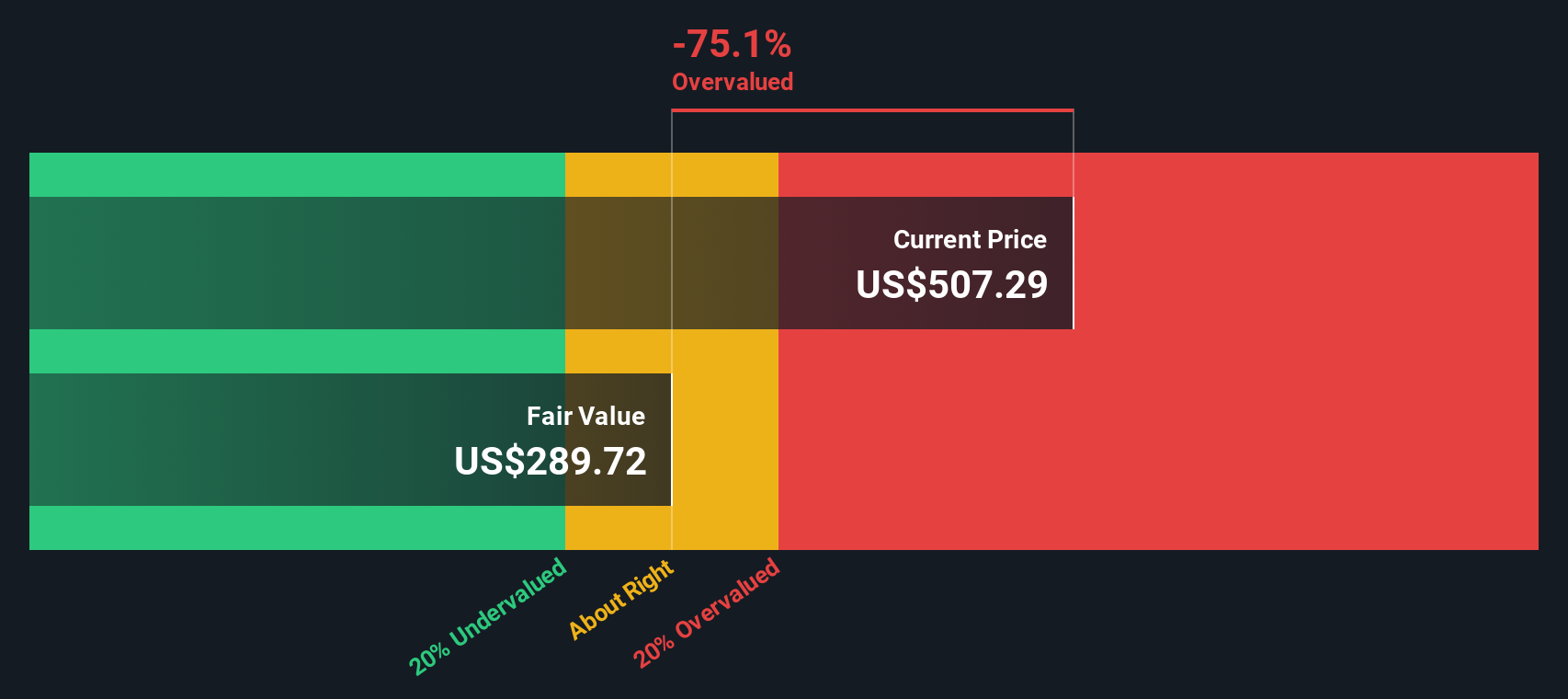

With revenue at US$579.9 million, lower earnings, a completed buyback and a major shareholder walking away, is Credit Acceptance now trading below what it is worth, or is the market already pricing in whatever growth lies ahead?

Most Popular Narrative: 8.3% Overvalued

At a last close of $495.97 versus a most-followed fair value estimate of $458, the current price sits above where this narrative lands.

The analysts have a consensus price target of $467.5 for Credit Acceptance based on their expectations of its future earnings growth, profit margins and other risk factors.

We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Curious what has to happen with revenue growth, margins and future earnings for that fair value to add up? The narrative relies on a tight set of projections and a compressed future earnings multiple. The full breakdown explains the chain of assumptions behind that $458 figure.

Result: Fair Value of $458 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that fair value story could be knocked off course if loan performance from recent vintages weakens further, or if competition continues to pressure core subprime volumes and margins.

Find out about the key risks to this Credit Acceptance narrative.

Another View: Earnings Multiple Paints A Different Picture

Our DCF model points to a fair value of $302.59 per share, which is well below the current $495.97 price and flags Credit Acceptance as overvalued on future cash flows. That is a sharp contrast to the $458 narrative fair value; which story do you think holds up better?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Credit Acceptance Narrative

If this version of the story does not quite fit your view, stress test the numbers yourself and shape a version you trust, then Do it your way.

A great starting point for your Credit Acceptance research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Credit Acceptance has sharpened your focus, do not stop here. The broader market holds plenty of other ideas that could better match your goals and risk comfort.

- Scan for potential mispricings by checking out these 870 undervalued stocks based on cash flows, where the focus is on companies that may be trading below what their cash flows suggest.

- Ride the AI wave more intentionally by reviewing these 25 AI penny stocks, highlighting businesses linked to artificial intelligence themes across different sectors.

- Lean into income opportunities by assessing these 13 dividend stocks with yields > 3%, which concentrates on companies offering dividend yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com