Assessing BankUnited (BKU) Valuation After Strong 2025 Earnings And Share Buyback Completion

BankUnited (BKU) just reported fourth quarter and full year 2025 results, and also completed a share repurchase tranche, giving investors fresh numbers on profitability, interest income and capital allocation decisions.

See our latest analysis for BankUnited.

The earnings release and completion of the recent US$50 million buyback tranche have arrived alongside a strong run in BankUnited’s shares, with a 24.68% 90 day share price return and a 28.46% 1 year total shareholder return suggesting momentum has been building rather than fading.

If this kind of move has your attention, it could be a good moment to widen your watchlist and check out solid balance sheet and fundamentals stocks screener (None results).

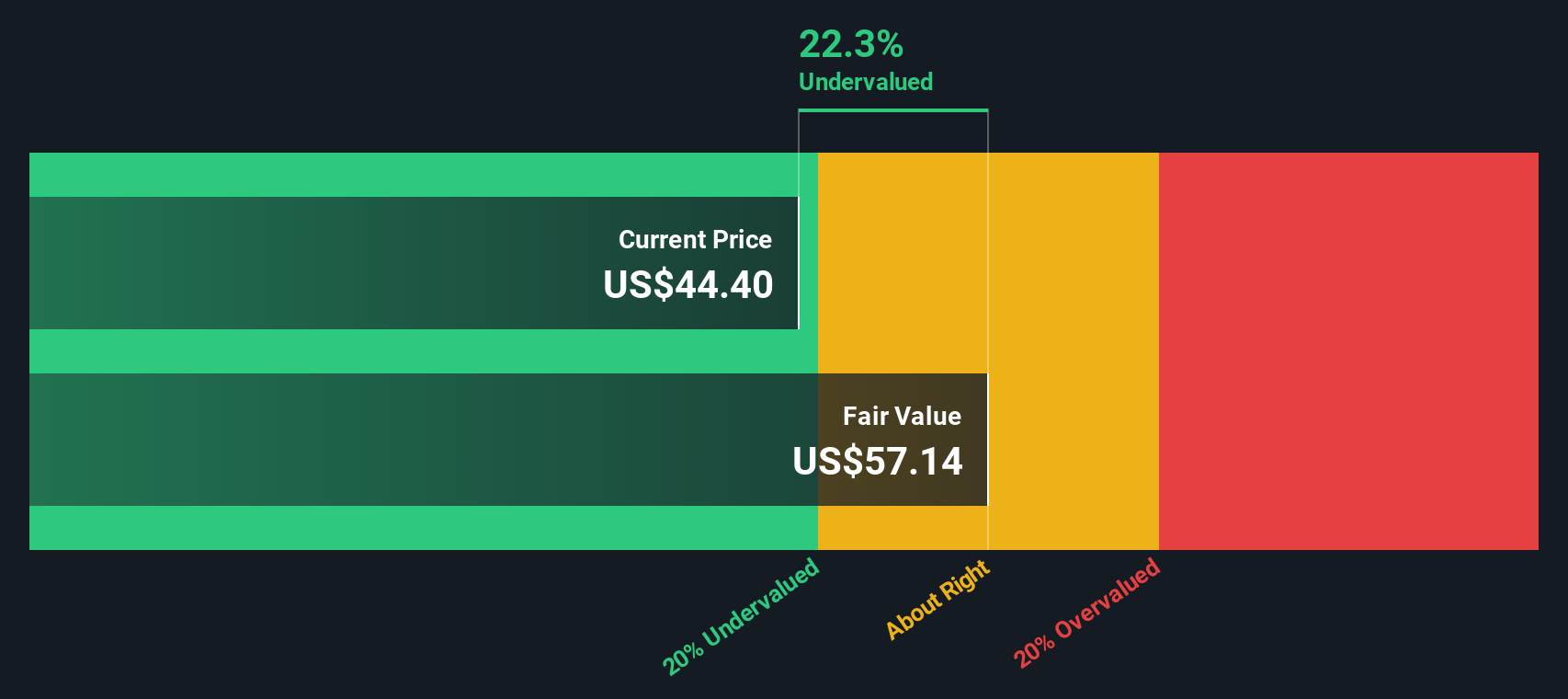

With the shares up strongly and trading at a roughly 34% discount to one intrinsic value estimate and a small 6% discount to the average analyst target, you have to ask: Is BankUnited still undervalued, or is the market already pricing in future growth?

Most Popular Narrative: 4.8% Overvalued

BankUnited’s most followed narrative puts fair value at about $48.09, slightly below the latest close of $50.41, which frames the current optimism.

Recent research updates on BankUnited show a mix of optimism around earnings power and ongoing caution around sector risks, which helps explain the modest lift in fair value estimates.

Bullish analysts are raising price targets, which suggests greater confidence that the bank can support a higher P/E over time if it executes on loan growth and margin plans.

Curious what earnings path and margin profile need to hold for that valuation to stack up, and which future P/E investors are implicitly signing up for?

Result: Fair Value of $48.09 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, you also need to weigh rising nonperforming office loans and concentration in commercial real estate, as well as the possibility of slower and less predictable deposit growth.

Find out about the key risks to this BankUnited narrative.

Another View: Cash Flows Point a Different Way

While the most popular narrative pegs BankUnited at about 4.8% overvalued on a fair value of $48.09, our DCF model presents a different perspective. On that approach, BKU at $50.41 screens around 34% below an estimated future cash flow value of $75.93. This raises a key question: are cash flow assumptions too generous, or is the market underestimating the long term earnings power here?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out BankUnited for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 870 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own BankUnited Narrative

If you see the story differently, or like to run the numbers yourself, you can build a custom view in just a few minutes by starting with Do it your way.

A great starting point for your BankUnited research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If BankUnited is on your radar, do not stop there. Broaden your watchlist with fresh stock ideas that match the kind of opportunities you actually care about.

- Target income potential by checking out these 13 dividend stocks with yields > 3% that might suit investors who want regular cash returns from established businesses.

- Hunt for future growth stories through these 25 AI penny stocks that tie into long term themes in automation, data and machine learning.

- Spot possible mispricings with these 870 undervalued stocks based on cash flows and see which companies currently trade below their estimated cash flow value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com