A Look At SEI Investments (SEIC) Valuation After Record Earnings Beat And Ongoing Buybacks

SEI Investments (SEIC) drew fresh investor attention after reporting record fourth quarter 2025 earnings that topped market forecasts, supported by broad-based revenue growth, margin improvement, and continued share repurchases.

See our latest analysis for SEI Investments.

Despite the strong Q4 results and ongoing buybacks, the latest 1-day share price return of a 5.14% decline to US$84.13 and a modest 30-day share price gain of 1.35% suggest momentum is consolidating, even as the 3-year total shareholder return of 37.24% and 5-year total shareholder return of 59.89% point to a stronger longer term picture.

If SEI’s earnings story has you looking beyond a single stock, this could be a good moment to broaden your search with fast growing stocks with high insider ownership.

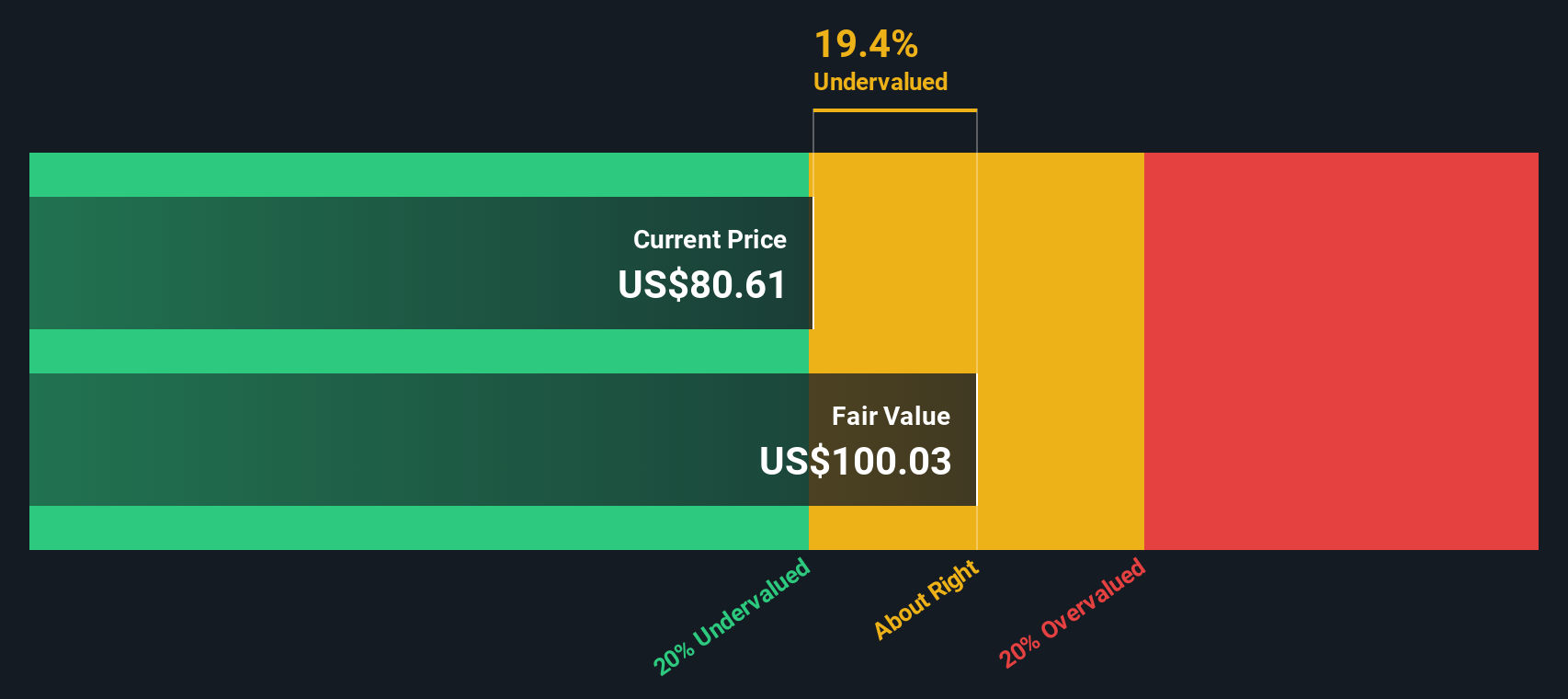

With record Q4 earnings, steady buybacks, and the share price still below some analyst targets, the key question now is whether SEI Investments is trading at a discount or if the market has already priced in future growth.

Most Popular Narrative: 14.9% Undervalued

SEI Investments most followed valuation narrative puts fair value at US$98.83 per share, above the latest close of US$84.13, which raises obvious questions about what assumptions are doing the heavy lifting.

The analysts have a consensus price target of $99.333 for SEI Investments based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $118.0, and the most bearish reporting a price target of just $81.0.

Curious what underpins a higher fair value than the current price, yet sits below the most optimistic targets? Revenue trends, margin assumptions and share count all quietly shape this story.

Result: Fair Value of $98.83 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the case for SEI can quickly look different if heavy spending on technology and talent squeezes margins, or if larger rivals pressure pricing and growth.

Find out about the key risks to this SEI Investments narrative.

Another View: Cash Flows Tell a Different Story

That 14.9% undervalued fair value of US$98.83 sits in sharp contrast to the SWS DCF model. The model puts SEI Investments’ future cash flow value at US$71.49 per share, below the current US$84.13. If earnings look supportive but cash flows say overvalued, which signal do you trust more?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out SEI Investments for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 869 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own SEI Investments Narrative

If you look at these numbers and reach a different conclusion, or simply prefer to test your own assumptions, you can build a custom view in just a few minutes with Do it your way.

A great starting point for your SEI Investments research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If SEI has sparked your research mindset, do not stop here. Widen your watchlist now so you are not catching up on the next opportunity later.

- Spot potential bargains early by checking out these 869 undervalued stocks based on cash flows that might line up with your return and risk expectations.

- Ride long term tech shifts by scanning these 25 AI penny stocks that are tied to artificial intelligence and automation themes.

- Add income angles to your portfolio by reviewing these 13 dividend stocks with yields > 3% that offer yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com