A Look At Bentley Systems (BSY) Valuation After Recent Share Price Weakness

Context for Bentley Systems after recent share performance

Bentley Systems (BSY) has seen its share price weaken recently, with returns of about 7% over the past day, 14% over the week, and 17% over the month. This performance has put the stock on many investors’ radar.

See our latest analysis for Bentley Systems.

At a share price of US$31.79, Bentley Systems’ recent 30-day share price return of 16.67% decline and 90-day share price return of 34.43% decline line up with a 1-year total shareholder return of 31.51% decline. This points to fading momentum as investors reassess growth prospects and risk.

If this pullback has you reassessing your tech exposure, it could be a moment to widen your watchlist with high growth tech and AI stocks.

With Bentley Systems now trading at US$31.79 and showing an intrinsic discount alongside a gap to analyst price targets, the key question is whether this pullback signals undervaluation or whether the market already reflects its future growth potential.

Most Popular Narrative: 45.4% Undervalued

Against Bentley Systems' last close at $31.79, the most followed narrative pegs fair value at $58.21, built on detailed long term growth and profitability assumptions discounted at 8.73%.

Sustained global investment in infrastructure, driven by government initiatives in the US, UK, EU, and high-growth regions like India and the Middle East, continues to expand Bentley's addressable market, supporting durable double-digit ARR and revenue growth.

Curious what has to happen for that higher value to stack up? Revenue, earnings, margins, and the future earnings multiple all have to line up just right.

Result: Fair Value of $58.21 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this hinges on AI investments paying off and subscription growth staying on track. Rising competition and execution missteps could quickly weaken that upbeat case.

Find out about the key risks to this Bentley Systems narrative.

Another angle on valuation

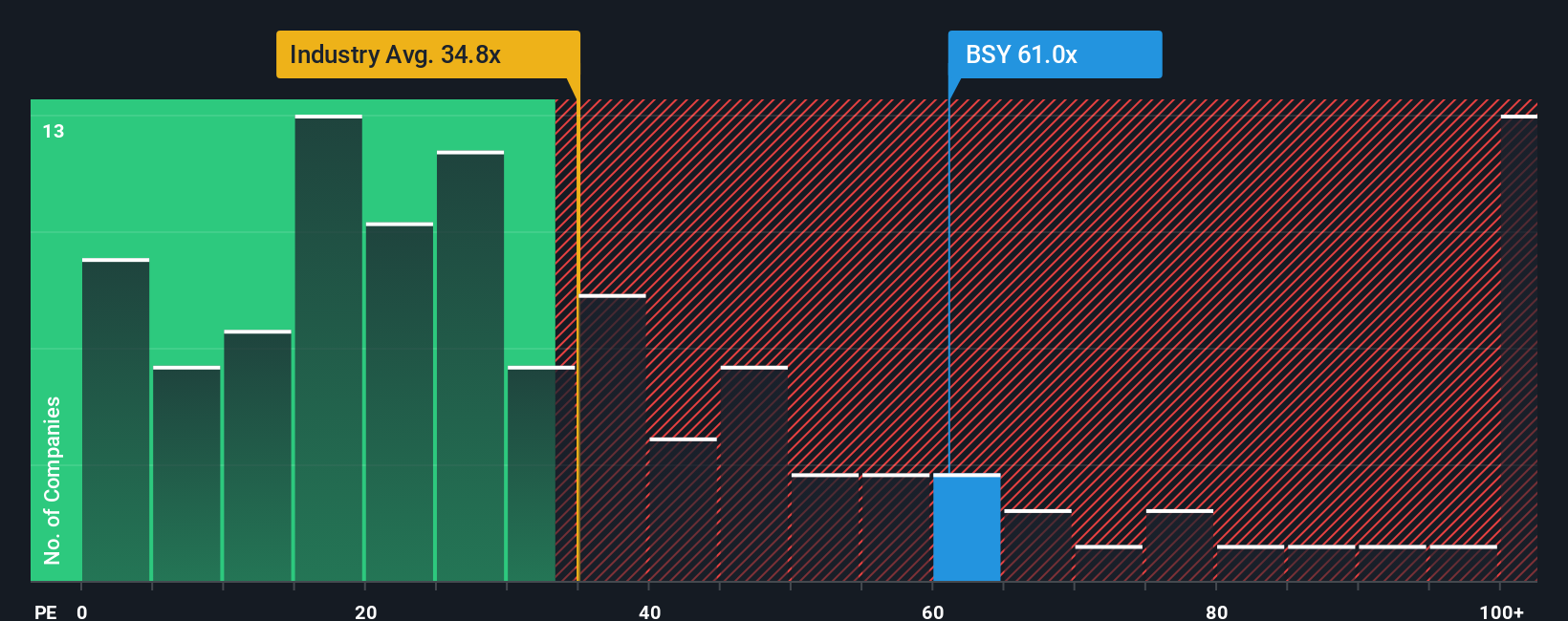

While the narrative and SWS fair value suggest Bentley Systems is 14.2% below that estimate, the current P/E of 37.1x looks steep next to a fair ratio of 28.4x and the US Software average of 27.7x. That gap points to valuation risk if growth or sentiment cools further. How comfortable are you with that trade off?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Bentley Systems Narrative

If you are not fully on board with this view or prefer to work through the numbers yourself, you can build a custom thesis for Bentley in just a few minutes with Do it your way.

A great starting point for your Bentley Systems research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Bentley Systems is on your radar, do not stop there. Use this pullback as a prompt to line up your next few ideas before the market moves.

- Spot potential value ahead of the crowd by scanning these 873 undervalued stocks based on cash flows that might line up with your return and risk expectations.

- Capture the AI trend with focus by zeroing in on these 26 AI penny stocks that already pass a basic fundamental filter.

- Add extra income angles to your watchlist by hunting through these 13 dividend stocks with yields > 3% that meet your yield and quality preferences.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com