Helios CODESYS OpenView Update Meets Fair Value And Momentum Story

- Helios Technologies expanded its OpenView™ display platform with integrated CODESYS® functionality.

- The update gives industrial customers new interoperability options and remote monitoring capabilities for their equipment.

- The move targets OEMs and system integrators that already use CODESYS® in their control architectures.

For investors watching NYSE:HLIO, this product update sits alongside a share price of $70.73 and recent momentum, with the stock up 10.4% over the past week, 25.7% over the past month and 29.3% year to date. Over longer periods, reported gains of 63.9% over 1 year, 8.5% over 3 years and 19.0% over 5 years provide additional context on how the market has priced Helios Technologies during different cycles.

This CODESYS® integration moves Helios Technologies further into software centric control solutions, an area many industrial customers already rely on in their day to day operations. For investors, the key questions are how widely OpenView™ with CODESYS® is adopted and whether remote HMI access becomes a meaningful selling point in future product wins.

Stay updated on the most important news stories for Helios Technologies by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on Helios Technologies.

How Helios Technologies stacks up against its biggest competitors

Quick Assessment

- ⚖️ Price vs Analyst Target: At US$70.73, the share price sits almost exactly in line with the US$70.83 analyst target.

- ⚖️ Simply Wall St Valuation: Shares are described as trading close to estimated fair value, suggesting a limited valuation gap right now.

- ✅ Recent Momentum: A 30 day return of about 25.7% points to strong short term momentum around the stock.

Check out Simply Wall St's in depth valuation analysis for Helios Technologies.

Key Considerations

- 📊 CODESYS® integration pushes Helios Technologies further into software centric control solutions, which could strengthen its position with OEMs that already use that ecosystem.

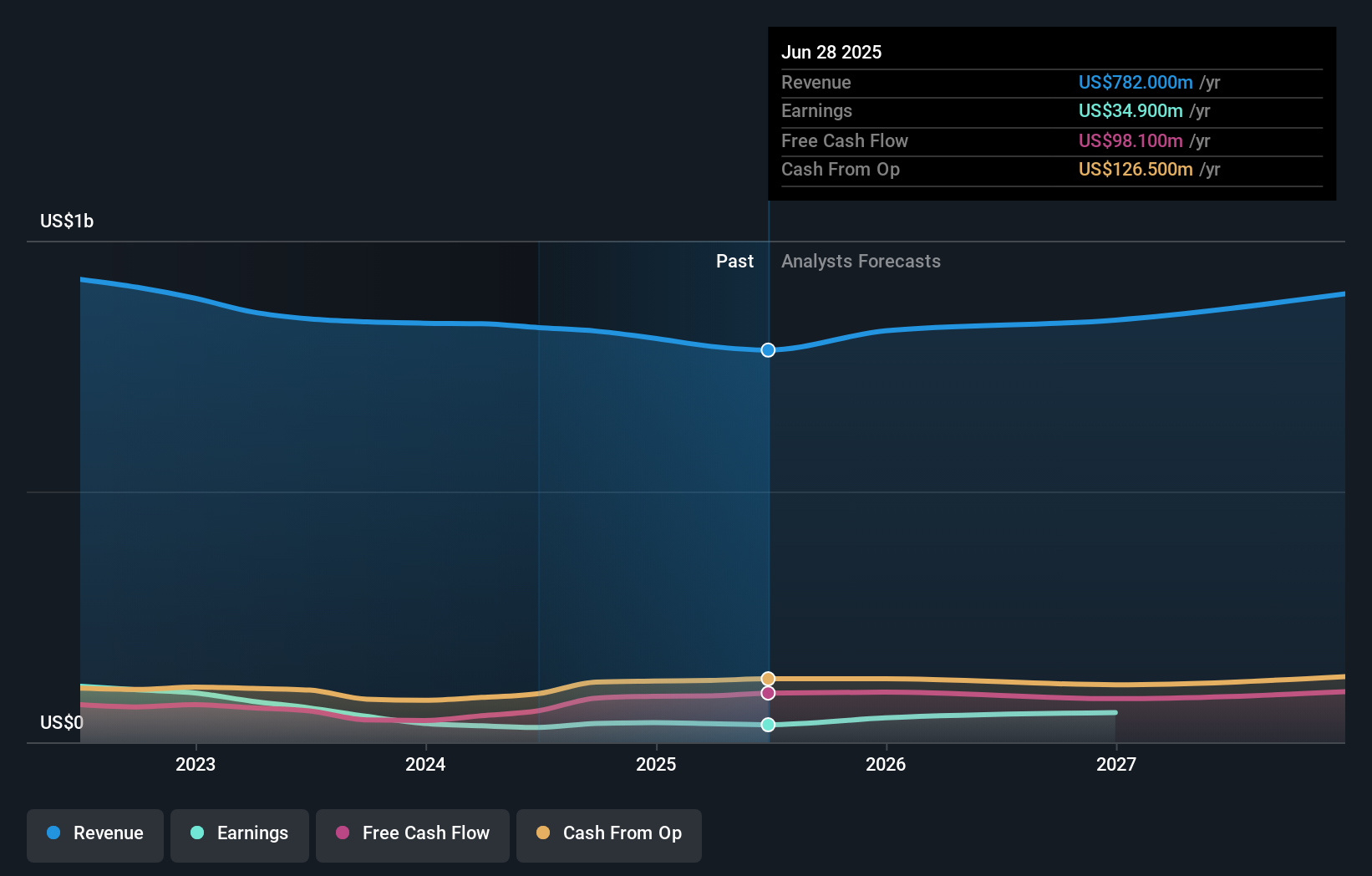

- 📊 Watch how many OpenView™ units ship with CODESYS®, any comments on remote monitoring demand, and whether this supports revenue and earnings growth expectations.

- ⚠️ One flagged risk is that reported results include large one off items, so you may want to separate these from underlying performance when judging the impact of this launch.

Dig Deeper

For the full picture including more risks and rewards, check out the complete Helios Technologies analysis.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com