Improved Combined Ratios And 9.5% Net Margin Challenge Horace Mann Educators Valuation Concerns

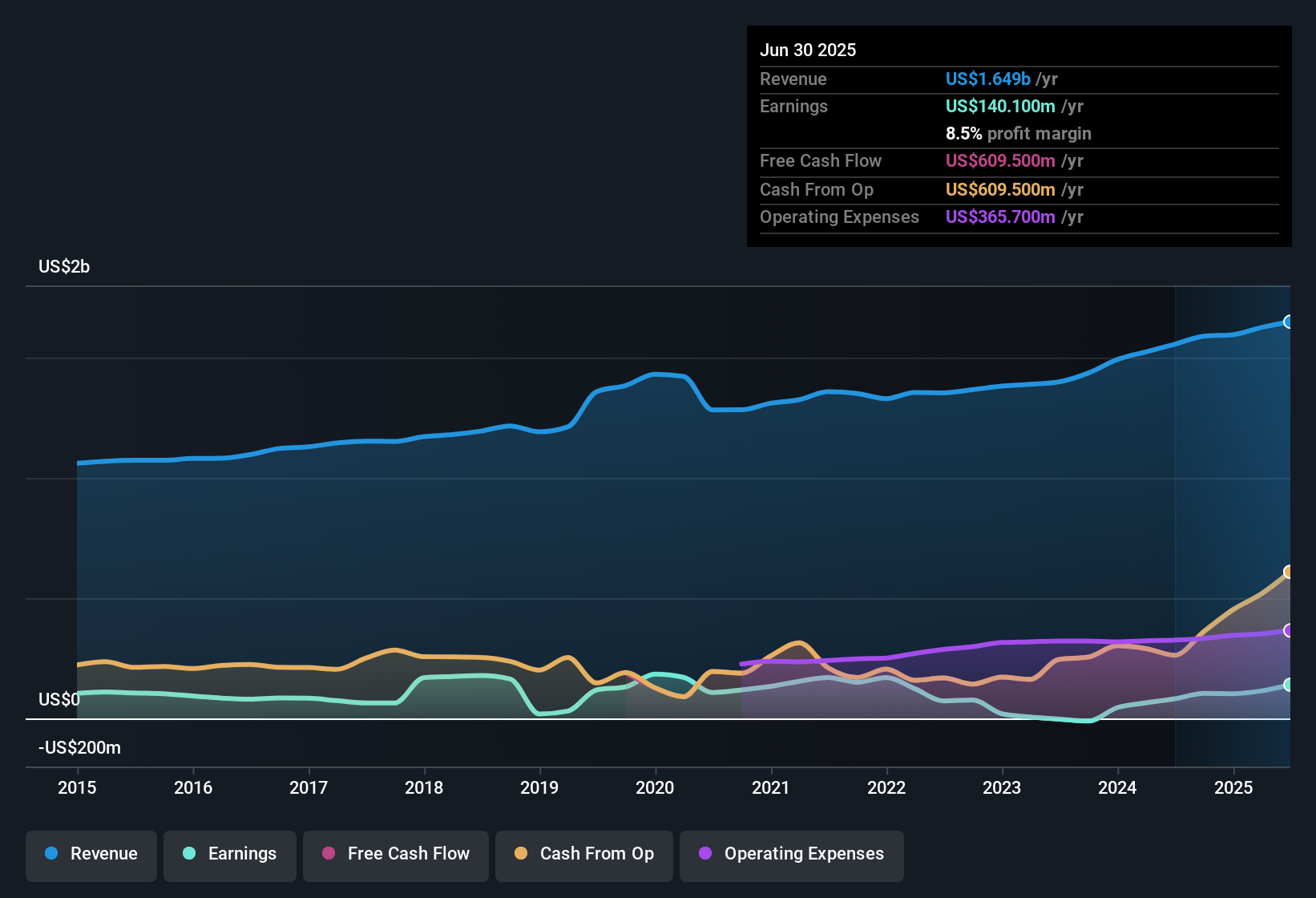

Horace Mann Educators (HMN) just wrapped up FY 2025 with Q4 revenue of US$434.8 million and basic EPS of US$0.89, rounding out a year in which trailing twelve month revenue reached about US$1.7 billion and EPS came in at roughly US$3.97. The company has seen quarterly revenue move from US$409 million in Q4 2024 to US$434.8 million in Q4 2025, with basic EPS over that span ranging between US$0.71 and US$1.42, highlighting how efficiently those premiums and fees are translating into profit. For investors, the key question now is how the improving earnings base and firmer margins shape the current risk and reward profile.

See our full analysis for Horace Mann Educators.With the headline numbers in place, the next step is to compare these results with the prevailing market and community narratives to see which views around growth, quality and risk still hold up and which may now be out of date.

Curious how numbers become stories that shape markets? Explore Community Narratives

Margin profile improves to 9.5% net

- Trailing net profit margin sits at 9.5% compared with 6.4% a year earlier, on about US$1.7b of revenue and US$162.1 million of net income.

- What stands out for the bullish view is how higher profitability lines up with the recent quarterly combined ratios of 95% to 98.5%. This suggests underwriting is contributing alongside investment income:

- The P&C combined ratio stayed below 100% in three of the last four quarters, including 95% in Q1 FY 2025 and 95.7% in Q3 FY 2025, which supports the idea that the core insurance book is adding to earnings rather than dragging on them.

- At the same time, trailing Basic EPS of US$3.97 is above the Q4 run rate of US$0.89. Bullish investors may point to this as evidence that the full year captured stronger periods that are not obvious from the latest quarterly snapshot alone.

Stronger margins paired with steady combined ratios give bulls a concrete earnings base to point to rather than relying only on top line trends. 📊 Read the full Horace Mann Educators Consensus Narrative.

Earnings growth outpaces revenue

- Over the last year, earnings grew 57.7% while revenue growth is projected at about 5.8% per year, so profits have moved much faster than the top line.

- Bulls often say this kind of gap between earnings and revenue growth reflects better efficiency, and the recent numbers give them some backing but also a few reality checks:

- Trailing Basic EPS of US$3.97 compares with Q4 FY 2025 EPS of US$0.89 and Q2 FY 2025 EPS of US$0.71, which shows that profitability has varied across quarters even though the full year looks strong on paper.

- Analysts are looking for earnings growth of about 14.2% per year versus broader US market expectations of 15.6%, so while recent earnings momentum is solid, the forecasts do not point to an outsized growth story compared with the wider market.

Low P/E and 3.24% yield

- The shares trade on a P/E of 10.9x versus a peer average of 25.6x and a US insurance industry average of 13.3x, and the dividend yield is 3.24% on a share price of US$43.23.

- Critics point out that these value signals sit alongside a DCF fair value of US$27.77 and slower expected revenue growth, which gives the bearish angle some data to lean on:

- The current share price of US$43.23 is above the DCF fair value estimate of US$27.77, so anyone focused on discounted cash flows could argue the stock screens as expensive on that particular model despite the lower headline P/E.

- Revenue growth is forecast at 5.8% per year, below the US market forecast of 10.1% per year, which bears may use to question how long the combination of a low P/E and improving margins can persist without faster top line expansion.

Some investors lean into the income and low P/E story, while others focus on the DCF gap and softer revenue growth outlook. 🐻 Horace Mann Educators Bear Case

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Horace Mann Educators's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

For all the progress on margins and earnings, HMN still faces questions around a share price that sits above the DCF fair value and slower forecast revenue growth.

If you are uneasy about paying up when valuation models flag a gap and growth expectations are softer, use our these 867 undervalued stocks based on cash flows to zero in on pre-screened ideas that look cheaper based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com