A Look At Amprius Technologies (AMPX) Valuation After New Nanotech Energy Manufacturing Partnership

Why the Nanotech Energy deal matters for Amprius shares

Amprius Technologies (AMPX) is back in focus after announcing a manufacturing partnership with Nanotech Energy, its first U.S. based production ally, securing a domestic supply chain for high performance silicon battery cells.

The agreement is geared toward mission critical customers such as L3Harris Technologies and is designed to fit updated National Defense Authorization Act sourcing rules, which prioritize trusted domestic suppliers for defense and aerospace programs.

See our latest analysis for Amprius Technologies.

Even with the Nanotech partnership and a busy schedule of investor conferences, Amprius has been volatile, with a 21.05% year to date share price return and a 210.26% total shareholder return over the past year, suggesting strong momentum despite recent pullbacks.

If this battery news has you thinking more broadly about electrification and infrastructure, it could be worth checking our screener for 22 power grid technology and infrastructure stocks as another way to spot ideas tied to energy reliability and demand growth.

With Amprius now trading at US$10.58 after a sharp 1 year run, and with analysts' average price target sitting higher at US$17.57, investors may be asking whether there is still a gap to close or if the market has already priced in the next chapter of growth.

Most Popular Narrative: 13.6% Undervalued

At $10.58, Amprius Technologies sits below a fair value of $12.25 suggested by the most followed valuation narrative, which frames today’s price as a discount.

Based on Amprius''s recent performance and benchmarks from established battery manufacturers, a reasonable estimated gross profit margin for Amprius in three years would be in the 18% to 25% range. Future PE Justification: The justification rests on the assumption that Amprius is not just a growth company, but a hyper-growth company. While an average company growing at 10-15% might get a 20x P/E, a company expected to grow earnings at 40-50% annually for many years can easily command a multiple of 35x or higher.

According to goodvalue, this fair value leans heavily on rapid revenue compounding, rising margins and a premium earnings multiple more often linked to mature market leaders. Curious which specific growth and profitability milestones need to line up to support that price tag over the next few years.

Result: Fair Value of $12.25 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this hinges on Amprius turning US$58.408 million of revenue and a US$31.051 million loss into durable profitability, and on the market sustaining a 35x P/E narrative.

Find out about the key risks to this Amprius Technologies narrative.

Another View: Price Tells a Tougher Story

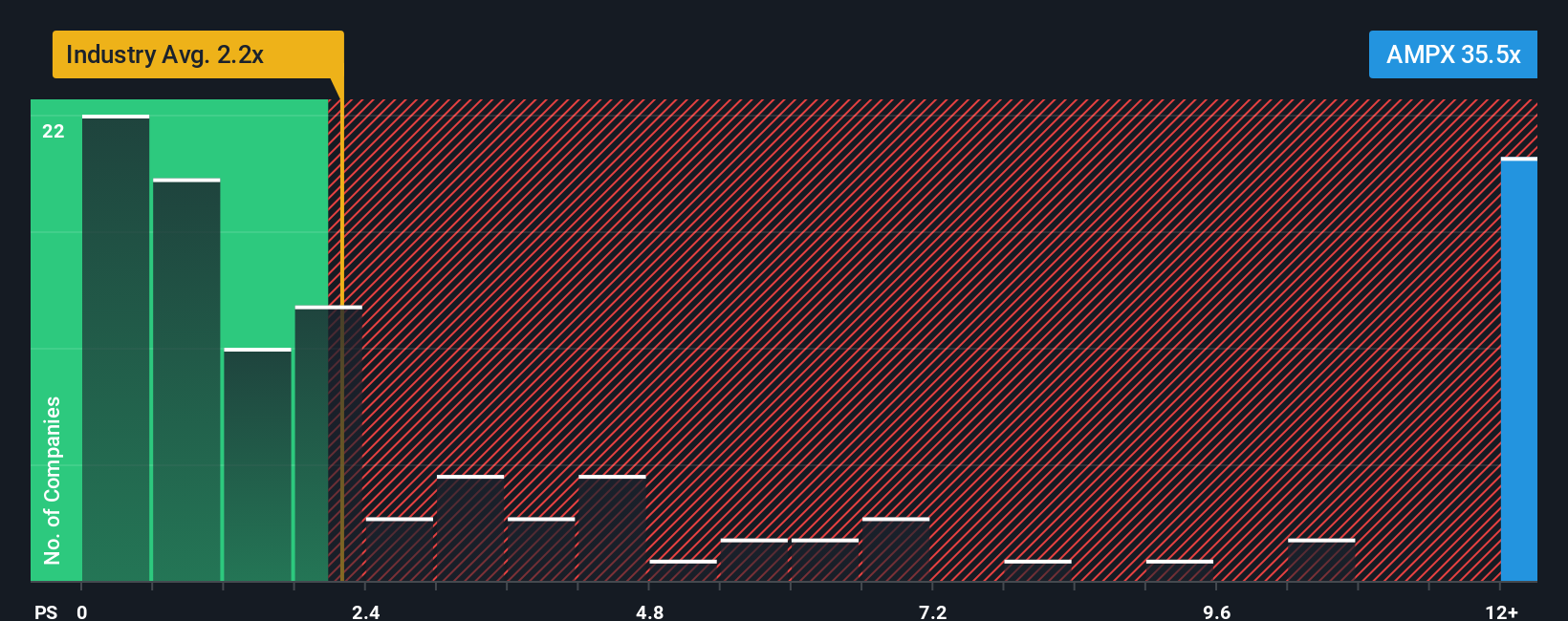

That user narrative presents Amprius as 13.6% undervalued at $12.25, but our multiple-based work points the other way. At $10.58, the stock trades on a P/S of 23.6x versus 19.8x for peers and 2.4x for the wider US Electrical industry, while our fair ratio estimate sits at 2.8x.

In simple terms, the current P/S suggests the market is already assigning a premium to Amprius that is many times above where the fair ratio indicates it could settle. This increases the risk that any setback in execution or sentiment could affect the share price more than expected. How comfortable are you paying that kind of premium for a business that is still loss making?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Amprius Technologies Narrative

If you are looking at these numbers and feel you would rather rely on your own view, you can pull the data, set your assumptions, and Do it your way in just a few minutes.

A great starting point for your Amprius Technologies research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Amprius has sharpened your interest, do not stop here. Use the Simply Wall St screener to uncover other stocks that could suit your approach.

- Target quality at a discount by scanning for companies our models flag as attractively priced using 55 high quality undervalued stocks.

- Prioritise financial resilience by focusing on businesses with strong balance sheets and solid fundamentals through solid balance sheet and fundamentals stocks screener (46 results).

- Hunt for underfollowed opportunities by reviewing our screener containing 25 high quality undiscovered gems that combine quality metrics with relatively low market attention.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com