Independent Bank (INDB) Valuation Check After Barclays Downgrade Of Conservative Regional Lender

Barclays analyst Jared Shaw recently downgraded Independent Bank (INDB) to a sell rating, an event that has sharpened investor focus on this regional lender and its role as a conservative, income oriented bank stock.

See our latest analysis for Independent Bank.

Despite the downgrade, Independent Bank’s recent trading paints a different short term picture, with a 30 day share price return of 13.38% and a year to date share price return of 16.37%, alongside a 1 year total shareholder return of 25.47%. This suggests momentum has been building rather than fading.

If this conservative regional lender has you rethinking your financials exposure, it could be a good moment to broaden your scope and check out 22 top founder-led companies as another set of potential ideas.

So with Independent Bank trading near its analyst target and showing solid recent returns, is the conservative regional lender still quietly undervalued, or is the market already pricing in the growth investors are hoping for?

Most Popular Narrative: 2.3% Undervalued

Independent Bank’s narrative fair value of $87.20 sits slightly above the recent $85.17 close, putting a modest spotlight on how future earnings and margins are expected to carry the story.

Resilient, lower cost core deposit franchise (seen in consistent growth and disciplined funding costs) provides a structural advantage in a high rate and competitive environment, helping protect and expand net interest margin and supporting long term earnings power.

Curious what kind of revenue path and margin profile need to line up to justify that fair value uplift, while assuming a future earnings multiple below many peers? The full narrative walks through the growth, profitability and valuation bridge that ties today’s price to that $87.20 figure.

Result: Fair Value of $87.20 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this depends on effective execution, as higher net charge offs, the Enterprise integration, and the core systems migration all carry meaningful potential to disrupt the earnings path.

Find out about the key risks to this Independent Bank narrative.

Another View: Valuation Looks Full On Earnings

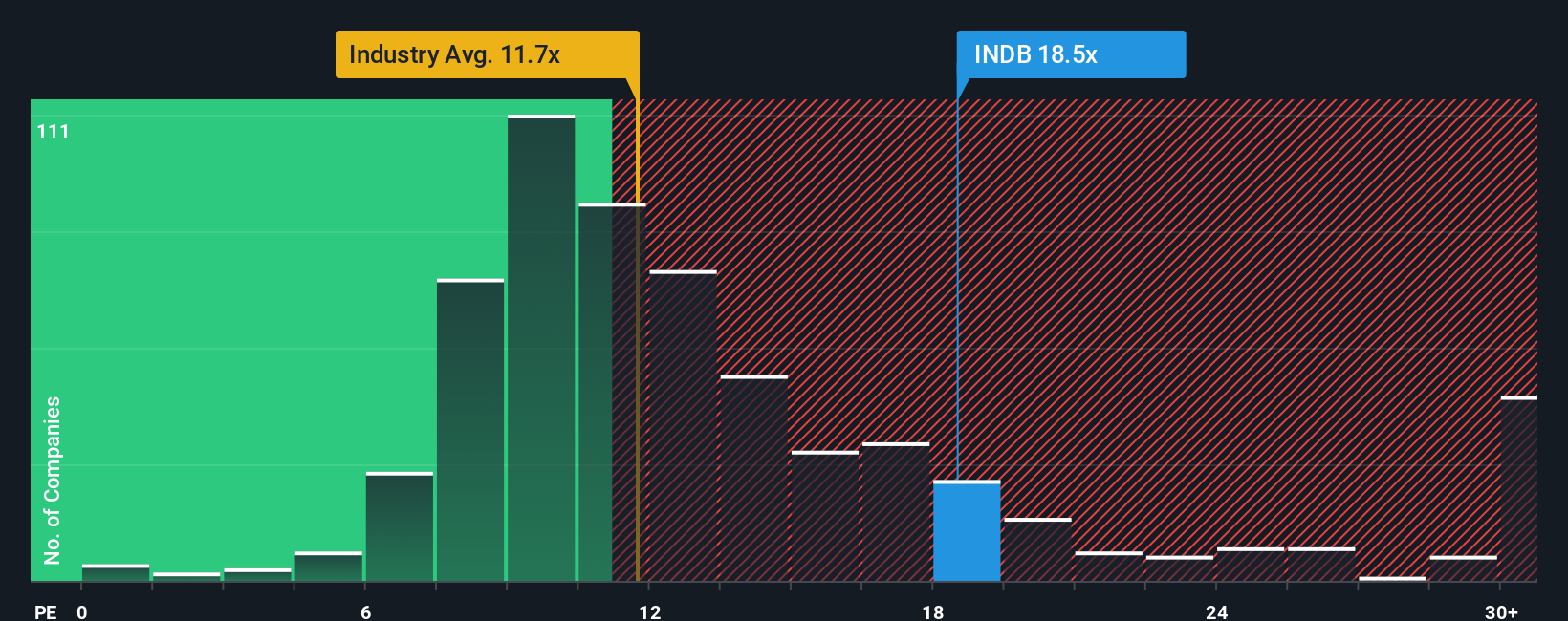

That 2.3% discount to fair value paints Independent Bank as slightly undervalued, but its current P/E of 20.4x tells a different story. The P/E sits above the US Banks industry at 12x and above the fair ratio of 17.2x, although it is just below the peer average of 21.1x. In practice, that means there is less room for disappointment if growth or margins fall short, and less obvious upside if everything goes right. So is this a quality franchise at a full price, or a small mispricing that still works in your favor?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Independent Bank Narrative

If you see the numbers differently or prefer to test your own assumptions, you can quickly build a custom view in just a few minutes, then Do it your way.

A great starting point for your Independent Bank research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Independent Bank has sharpened your thinking, do not stop here. Use this momentum to scan for other opportunities that might fit your style and risk comfort.

- Target potential value opportunities by checking out 55 high quality undervalued stocks, where price and fundamentals line up more closely.

- Prioritize balance sheet strength by reviewing our solid balance sheet and fundamentals stocks screener (46 results) for companies built on sturdier financial footing.

- Spot early stage potential by scanning the 25 elite penny stocks with strong financials that pair smaller market caps with stronger underlying numbers.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com