A Look At S&T Bancorp (STBA) Valuation After Earnings Beat And Dividend Increase

S&T Bancorp (STBA) is back on investor radars after reporting Q4 revenue up 11.5% year on year, edging past analyst forecasts, and pairing that update with a higher quarterly cash dividend.

See our latest analysis for S&T Bancorp.

At a share price of $44.12, S&T Bancorp has logged a 10.72% 1 month share price return and a 15.35% 3 month share price return. Its 5 year total shareholder return of 88.96% reflects long term compounding and indicates that momentum has been building around its recent earnings beat and dividend increase.

If strong banking results have your attention, this could be a good moment to widen your search with our screener of 22 top founder-led companies, where many investors look for the next big story.

With the stock now trading just above the average analyst price target, yet still sitting at an estimated 34.16% discount to one intrinsic value estimate, the key question is whether there is still a buying opportunity here or if the market is already pricing in future growth.

Most Popular Narrative: 1% Overvalued

With S&T Bancorp closing at $44.12 against a narrative fair value of $43.80, the current price sits just above that commonly referenced estimate, putting the spotlight on what is underpinning that view.

S&T Bancorp's strong historical and ongoing asset quality, reflected by exceptionally low nonperforming assets, modest charge-offs, and disciplined credit risk management, supports earnings stability and resilience through cycles, potentially preventing material deterioration in net margins or earnings. Robust, consistent loan growth across core business lines (including commercial real estate, mortgage, and home equity) and an expanding commercial banking team signal durable revenue momentum and organic asset expansion, which can underpin higher revenues over the long term.

Curious how that quality profile feeds into the $43.80 fair value? The narrative leans on measured revenue growth, steady margins and a higher future earnings multiple. The full breakdown spells out exactly how those ingredients are combined. Want the full playbook behind that pricing logic? Read it before you decide how these shares fit into your watchlist.

Result: Fair Value of $43.80 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, stronger-than-expected asset quality or sustained deposit growth could challenge the cautious narrative, especially if they support steadier margins than analysts currently assume.

Find out about the key risks to this S&T Bancorp narrative.

Another Angle On Valuation

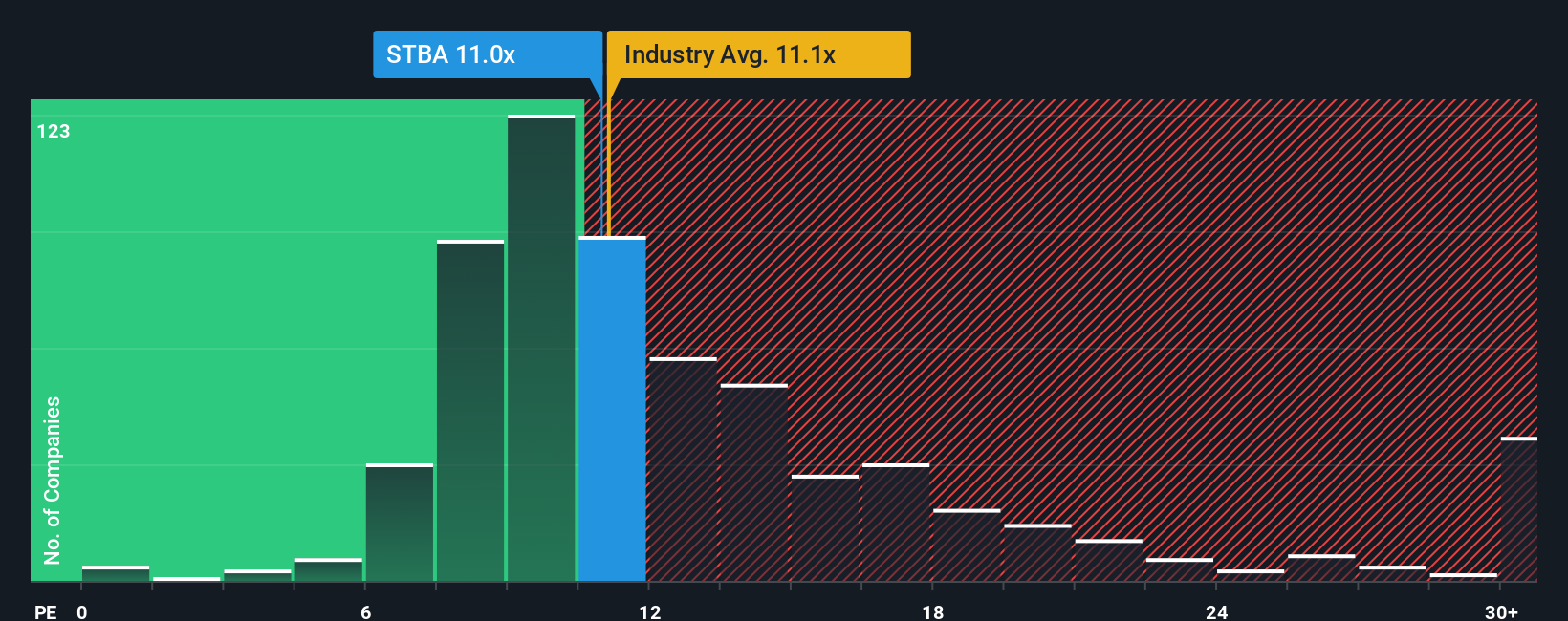

The narrative fair value has S&T Bancorp as slightly overvalued at $43.80, but the current P/E of 12.3x tells a different story. It sits just below peer banks at 12.7x, yet above a fair ratio of 10.9x, which hints at some valuation risk if sentiment cools.

So if the P/E is only a touch richer than where the fair ratio suggests the market could drift toward, how much premium are you really comfortable paying for this earnings profile?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own S&T Bancorp Narrative

If the story so far does not quite match your view, or you would rather test the numbers yourself, you can build a complete version of the thesis in just a few minutes. To get started, use Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding S&T Bancorp.

Ready To Find Your Next Idea?

If S&T Bancorp has sharpened your focus, do not stop here. Use the screener to spot other opportunities that could round out your watchlist.

- Target value, not noise, by scanning our list of 55 high quality undervalued stocks that combine quality fundamentals with prices that still look reasonable.

- Strengthen your cushion against shocks by checking companies in the solid balance sheet and fundamentals stocks screener (46 results) that prioritize financial resilience.

- Stay one step ahead by reviewing the screener containing 25 high quality undiscovered gems that have not yet attracted widespread attention but already show solid fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com