Does Acquisition-Led Growth Amid Buybacks Shift the Bull Case For Lennox International (LII)?

- Lennox International reported full-year 2025 results showing sales of US$5,195.3 million and net income of US$805.8 million, alongside 2026 guidance for revenue to grow by about 6% to 7% with acquisitions contributing roughly 4%.

- Despite softer end-market demand and an 11% quarterly revenue drop cited by management, Lennox continued its long-running buyback, retiring 299,169 shares in the latest quarter and 16,414,263 shares in total under the program launched in 2014.

- Next, we consider how Lennox’s reliance on acquisition-driven growth, amid weak HVAC demand, shapes the company’s investment narrative for investors.

Find 55 companies with promising cash flow potential yet trading below their fair value.

What Is Lennox International's Investment Narrative?

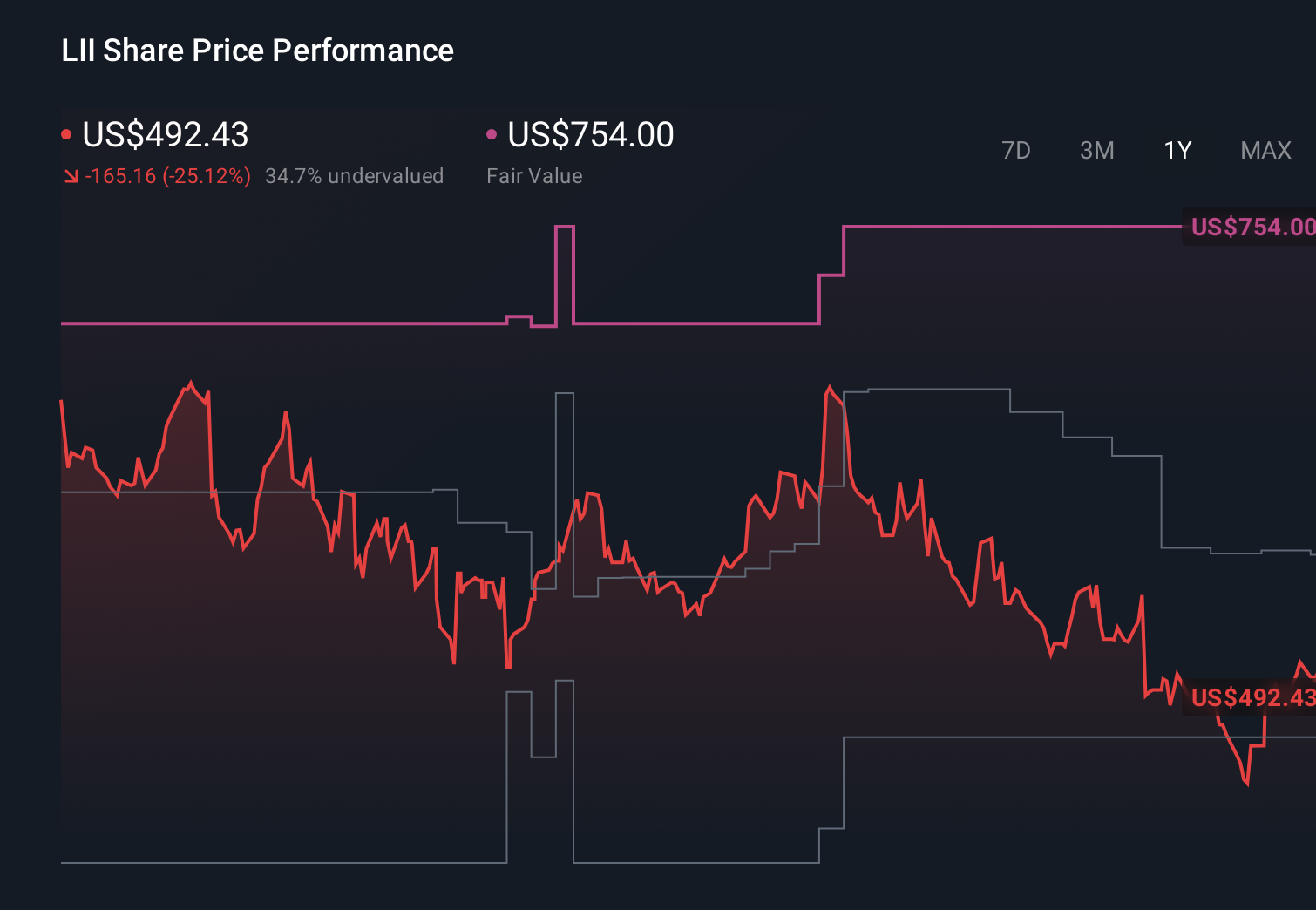

To own Lennox International today, you have to be comfortable with a story that leans heavily on disciplined execution rather than outsized growth. The 2025 results show essentially flat sales and earnings, yet management is guiding to 2026 revenue growth of about 6% to 7%, with completed acquisitions doing much of the lifting. That guidance lands against a backdrop of weak HVAC demand, an 11% quarterly revenue drop and a share price that has fallen over 10% in total return over the past year, even after a recent bounce. In the near term, the key catalysts are whether demand stabilizes, acquisitions integrate cleanly and buybacks remain a meaningful support. The big risks now look more skewed to overreliance on deal-driven growth and a high-debt balance sheet if end markets stay soft for longer than expected.

However, one risk stands out that investors might be underestimating right now. Lennox International's shares are on the way up, but they could be overextended by 8%. Uncover the fair value now.Exploring Other Perspectives

Two Simply Wall St Community fair value estimates span roughly US$479 million to US$555 million, showing how far apart individual views can sit. Set against Lennox’s reliance on acquisition-fueled growth at a time of weaker HVAC demand, these differing perspectives highlight why many market participants are rethinking what could drive performance from here and why it is worth weighing several viewpoints before forming your own view.

Explore 2 other fair value estimates on Lennox International - why the stock might be worth as much as 7% more than the current price!

Build Your Own Lennox International Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Lennox International research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Lennox International research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Lennox International's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Invest in the nuclear renaissance through our list of 87 elite nuclear energy infrastructure plays powering the global AI revolution.

- This technology could replace computers: discover 22 stocks that are working to make quantum computing a reality.

- We've uncovered the 15 dividend fortresses yielding 5%+ that don't just survive market storms, but thrive in them.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com