Marzetti (MZTI) Valuation Check After Recent Pullback And Mixed Undervaluation Signals

Recent trading context for Marzetti

Marzetti (MZTI) has caught investor attention after a recent stretch of mixed returns, with the share price roughly flat over the past day but negative over the past week, month, and past 3 months.

See our latest analysis for Marzetti.

Zooming out, Marzetti’s share price has slipped over the past week, month and quarter, and its 1 year total shareholder return of 16.18% decline points to pressure building over a longer stretch. This may reflect shifting views on its growth prospects and risk profile rather than any single recent event.

If this kind of pullback has you thinking about where else to put your attention, it could be a good moment to scan a carefully curated list of 22 top founder-led companies and see what stands out.

With Marzetti showing a 16.18% decline over the past year yet trading at a reported 26% discount to analyst targets, the key question is simple: is this a potential opportunity, or is the market already factoring in future growth?

Most Popular Narrative: 23.2% Undervalued

Marzetti's most followed narrative sets a fair value of $201.50 a share, well above the last close at $154.74, framing the current pullback in a very different light.

The launch of newly licensed and branded products (like national rollout of Texas Roadhouse dinner rolls and new core brand innovations) is expected to drive retail volume growth and further premiumization, directly supporting top-line revenue and, given the mix shift, potentially expanding net margins.

Curious what sits behind that confidence? The narrative leans on measured revenue growth, firmer margins, and a richer earnings multiple than many packaged food peers. The full story joins these pieces into one valuation map.

Result: Fair Value of $201.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this story can change quickly if consumer demand continues to shift toward fresher, private label and clean label options, or if swings in key input costs begin to squeeze margins more than expected.

Find out about the key risks to this Marzetti narrative.

Another View: Price Tag Looks Demanding

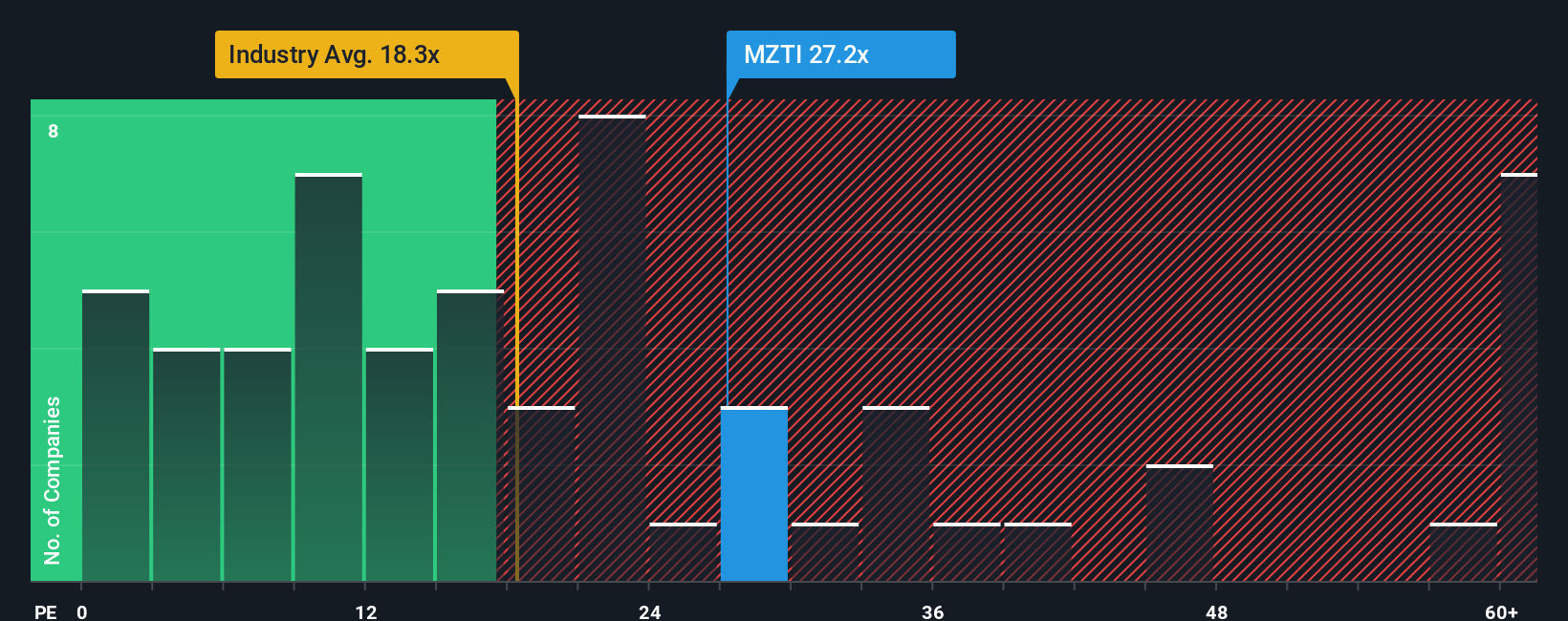

That 23.2% undervaluation story sits awkwardly next to the earnings multiple. Marzetti trades on a P/E of 23.6x, compared with a fair ratio of 16.2x, the US Food industry at 22.9x and peers at 12.9x. This points to higher valuation risk if expectations cool.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Marzetti Narrative

If you are not fully on board with the existing stories or prefer to work from your own checks and data, you can build a custom view in just a few minutes, starting with Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Marzetti.

Looking for more investment ideas?

If Marzetti does not fully fit what you are looking for, do not sit on the sidelines when there are other ideas to review right now.

- Zero in on value by scanning companies our screener tags as 53 high quality undervalued stocks and see which ones line up with your expectations.

- Prioritise resilience by reviewing 86 resilient stocks with low risk scores that may better match your comfort with volatility and company specific risk.

- Hunt for new stories by checking our screener containing 25 high quality undiscovered gems that many investors might not be watching yet.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com