PermRock Royalty Trust's (NYSE:PRT) Price Is Right But Growth Is Lacking After Shares Rocket 33%

PermRock Royalty Trust (NYSE:PRT) shareholders are no doubt pleased to see that the share price has bounced 33% in the last month, although it is still struggling to make up recently lost ground. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 16% in the last twelve months.

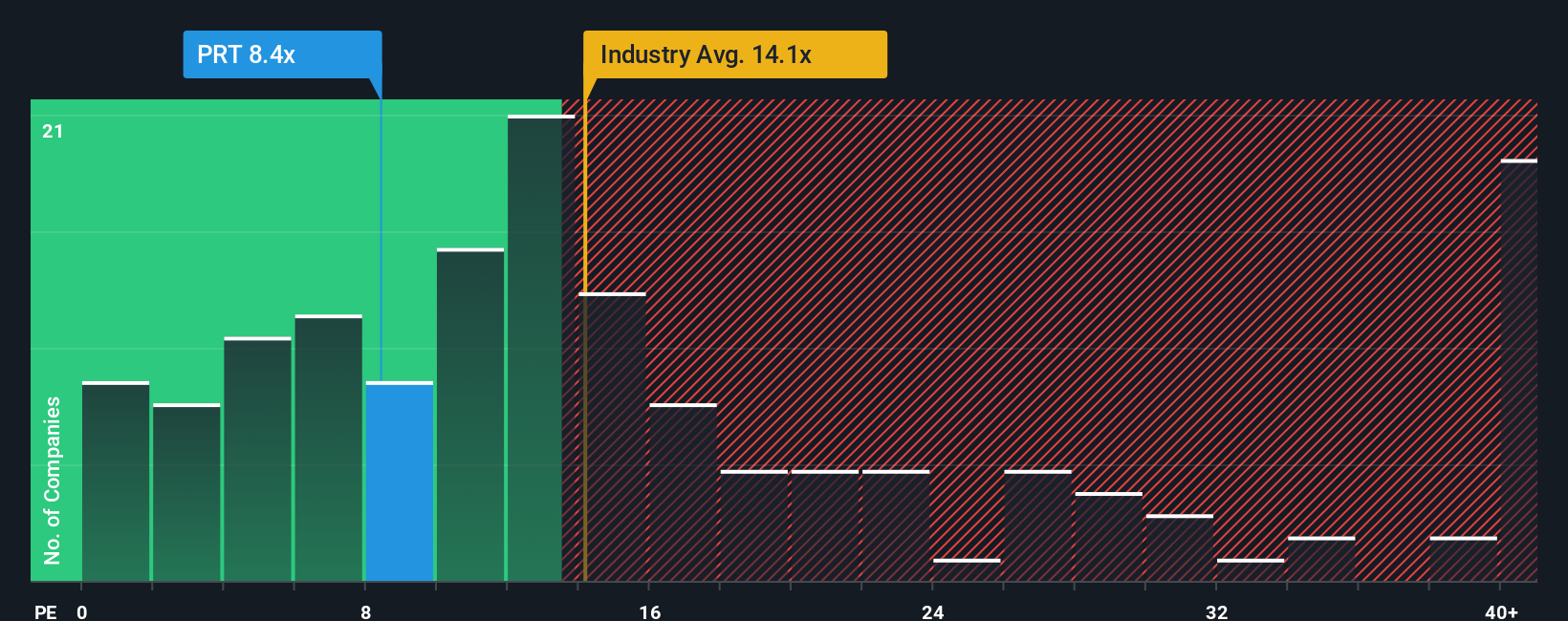

Although its price has surged higher, PermRock Royalty Trust may still be sending very bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 8.4x, since almost half of all companies in the United States have P/E ratios greater than 20x and even P/E's higher than 35x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/E.

We'd have to say that with no tangible growth over the last year, PermRock Royalty Trust's earnings have been unimpressive. One possibility is that the P/E is low because investors think this benign earnings growth rate will likely underperform the broader market in the near future. If not, then existing shareholders may be feeling optimistic about the future direction of the share price.

See our latest analysis for PermRock Royalty Trust

How Is PermRock Royalty Trust's Growth Trending?

The only time you'd be truly comfortable seeing a P/E as depressed as PermRock Royalty Trust's is when the company's growth is on track to lag the market decidedly.

If we review the last year of earnings, the company posted a result that saw barely any deviation from a year ago. The lack of growth did nothing to help the company's aggregate three-year performance, which is an unsavory 55% drop in EPS. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Comparing that to the market, which is predicted to deliver 16% growth in the next 12 months, the company's downward momentum based on recent medium-term earnings results is a sobering picture.

With this information, we are not surprised that PermRock Royalty Trust is trading at a P/E lower than the market. However, we think shrinking earnings are unlikely to lead to a stable P/E over the longer term, which could set up shareholders for future disappointment. There's potential for the P/E to fall to even lower levels if the company doesn't improve its profitability.

The Bottom Line On PermRock Royalty Trust's P/E

Shares in PermRock Royalty Trust are going to need a lot more upward momentum to get the company's P/E out of its slump. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that PermRock Royalty Trust maintains its low P/E on the weakness of its sliding earnings over the medium-term, as expected. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. If recent medium-term earnings trends continue, it's hard to see the share price moving strongly in either direction in the near future under these circumstances.

Before you settle on your opinion, we've discovered 2 warning signs for PermRock Royalty Trust that you should be aware of.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.