Does New Real-World MIPLYFFA Data Reshape the Bull Case for Zevra Therapeutics (ZVRA)?

- Zevra Therapeutics recently presented four posters at the 22nd Annual WORLDSymposium showcasing long-term real-world and clinical data for its approved Niemann-Pick Disease Type C therapy MIPLYFFA (arimoclomol), alongside its ongoing European Medicines Agency review.

- The breadth of patient exposure and multi-year safety and effectiveness data position MIPLYFFA as one of the most extensively studied treatments in this ultra-rare disease area.

- We’ll now examine how the extensive real-world safety and effectiveness data for MIPLYFFA shape Zevra’s evolving investment narrative.

The future of work is here. Discover the 28 top robotics and automation stocks leading the charge in AI-driven automation and industrial transformation.

What Is Zevra Therapeutics' Investment Narrative?

For Zevra, you really have to believe in a focused rare-disease story where MIPLYFFA is the anchor asset and execution around it determines most of the value. The WORLDSymposium data meaningfully reinforces the short-term catalyst that matters most: the ongoing EMA review for arimoclomol, now backed by one of the deepest long-term real-world datasets in Niemann-Pick Type C. That should help the company’s case with regulators and payers, even if it does not instantly change revenue expectations. At the same time, the stock’s recent muted price reaction suggests the market is still weighing execution risks, including the CFO transition, the quality of past earnings boosted by one-off gains, and the challenge of commercializing an ultra-rare disease therapy globally. Together, these factors shape a thesis that is compelling but far from risk free.

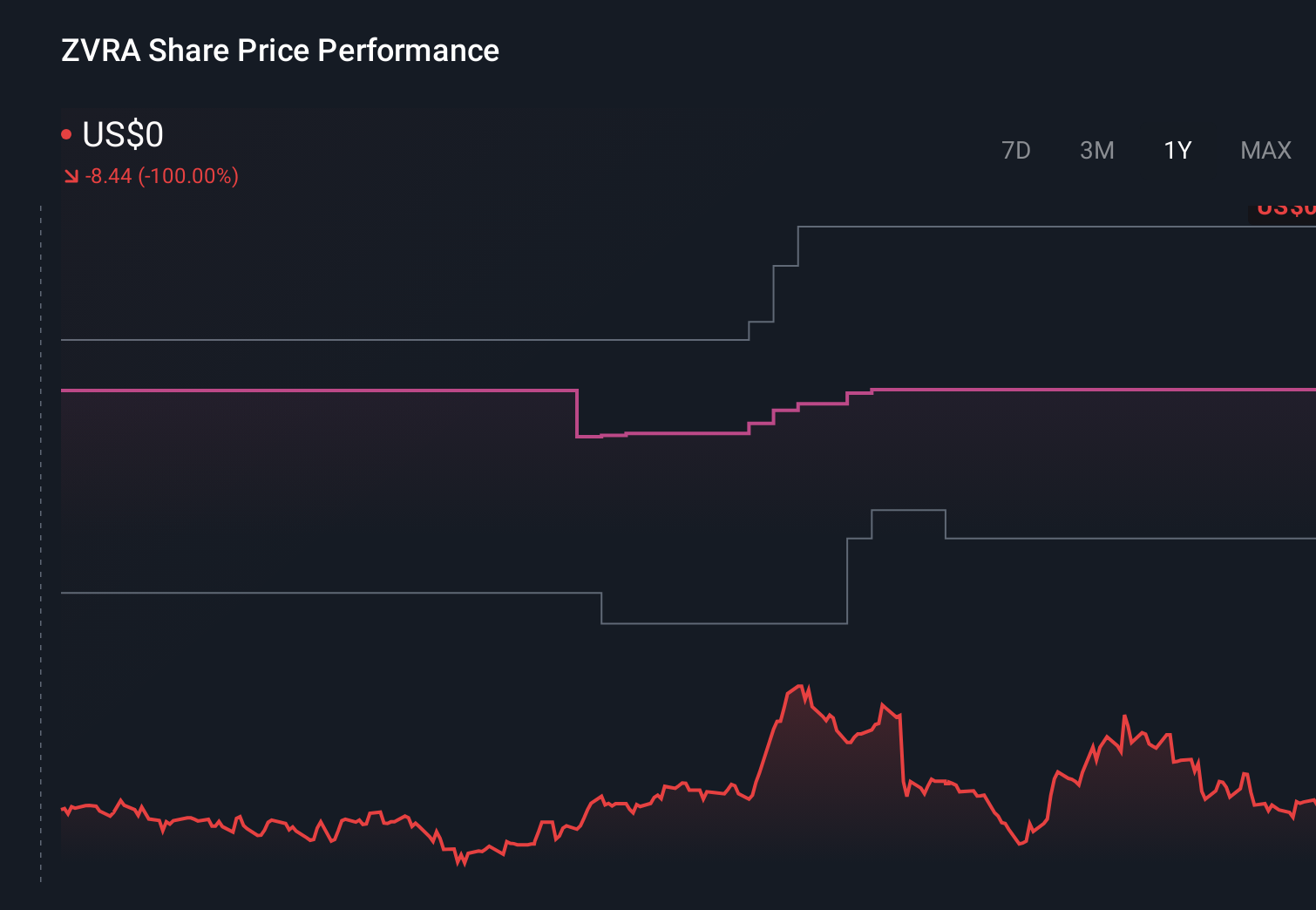

However, there is one business risk here that investors really should not overlook. Despite retreating, Zevra Therapeutics' shares might still be trading above their fair value and there could be some more downside. Discover how much.Exploring Other Perspectives

Explore 11 other fair value estimates on Zevra Therapeutics - why the stock might be a potential multi-bagger!

Build Your Own Zevra Therapeutics Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Zevra Therapeutics research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Zevra Therapeutics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Zevra Therapeutics' overall financial health at a glance.

Interested In Other Possibilities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Invest in the nuclear renaissance through our list of 87 elite nuclear energy infrastructure plays powering the global AI revolution.

- Uncover the next big thing with 25 elite penny stocks that balance risk and reward.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 28 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com