First Horizon Dividend Declarations Highlight Ongoing Capital Return Balance

- First Horizon (NYSE:FHN) has declared new dividends on its common stock.

- The company also announced fresh dividend payments across multiple preferred stock series.

- The decision affects both income focused common shareholders and holders of its preferred securities.

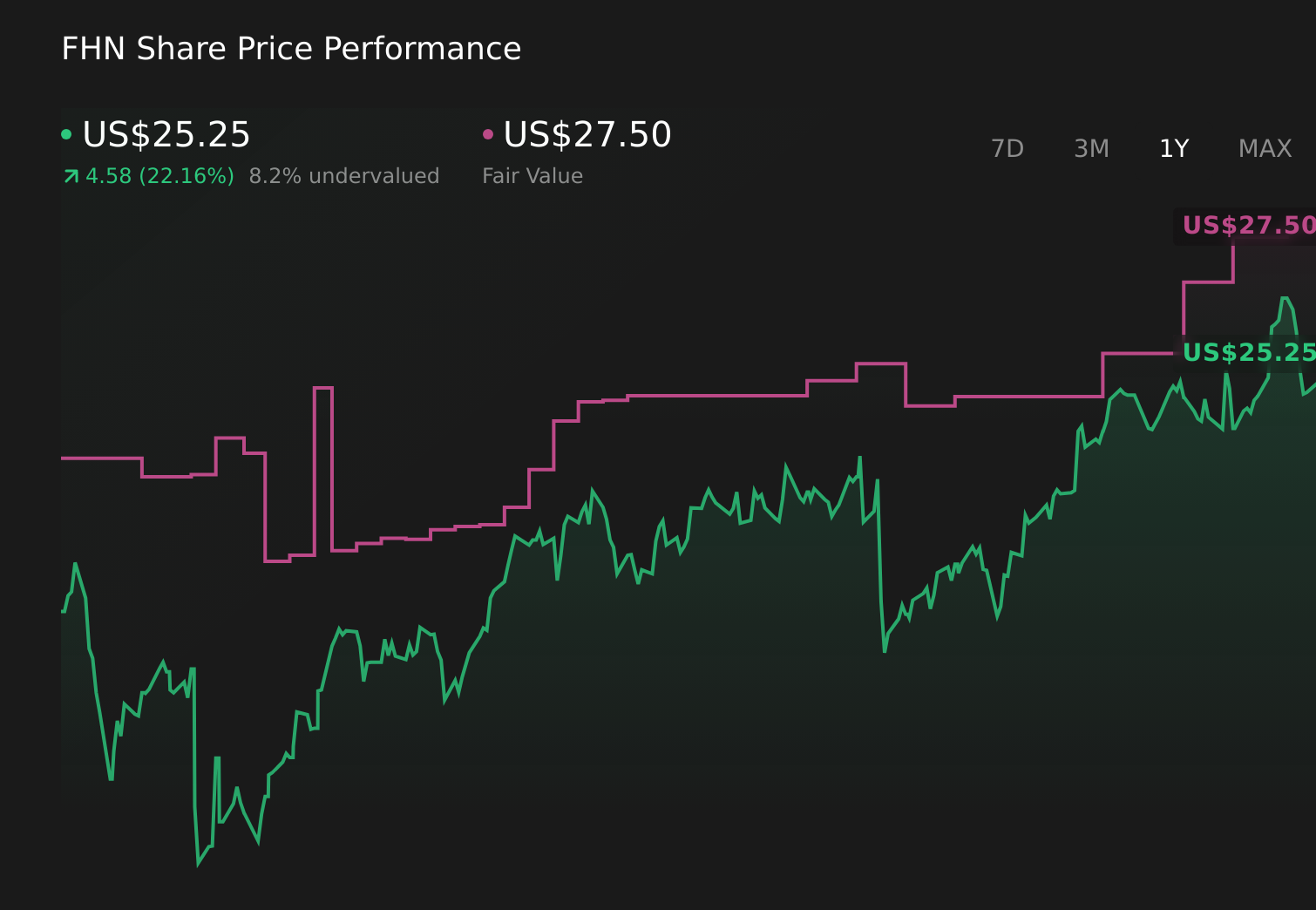

For investors watching NYSE:FHN, the latest dividend declarations come with the stock trading around $26.23. Over the past year, the share price has returned 21.0%, and 99.8% over five years, while the year to date move sits at 8.7%. These figures show how the bank has rewarded shareholders over different time frames alongside its cash distributions.

New dividends on both common and preferred shares can indicate how management is approaching capital use and balance sheet resilience. If you already own FHN or are tracking it, this payout update may serve as a reference point as you compare income opportunities across the sector and consider how this fits your wider portfolio goals.

Stay updated on the most important news stories for First Horizon by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on First Horizon.

Why First Horizon could be great value

The fresh dividend on common stock at US$0.17 per share, alongside continued cash payments on multiple preferred series, points to a capital return profile that currently balances common equity holders with preferred investors. For income focused holders, the scheduled April and May 2026 pay dates and clear record dates give visibility on near term cash flows while also signaling how First Horizon is currently prioritizing shareholder payouts versus retaining capital.

How This Fits Into The First Horizon Narrative

This dividend update lines up with the existing narrative that First Horizon is using capital return as one of several tools, alongside cost discipline and share repurchases, to support earnings per share. For investors following that storyline, regular common and preferred dividends can be viewed as one more data point on how management is deploying capital in a sector where peers like Regions Financial and Fifth Third Bancorp are also competing for investor attention.

Risks And Rewards To Keep In Mind

- Regular cash dividends on both common and preferred shares may appeal to investors looking for bank stocks with ongoing income streams.

- The mix of common and preferred payouts suggests the company is currently comfortable servicing multiple layers of its capital structure.

- Non cumulative preferred dividends mean payments can be skipped in tougher periods without being made up later, which is important for risk aware holders to remember.

- Analysts have flagged credit quality and macro uncertainty as key swing factors, so sustained dividends are not guaranteed if conditions deteriorate.

What To Watch Next

From here, it is worth watching whether First Horizon keeps this common dividend level, adjusts preferred payouts, or rebalances toward buybacks as conditions change, especially compared with regional peers like Truist and PNC Financial. If you want to see how other investors are thinking about these moves and the longer term story, check out community narratives on First Horizon here.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com