Assessing Univest Financial (UVSP) Valuation After Earnings Growth Buybacks And A Maintained Dividend

Univest Financial (UVSP) has drawn fresh attention after reporting fourth quarter and full year 2025 results, as well as confirming its quarterly dividend and updating investors on progress under a long running share repurchase program.

See our latest analysis for Univest Financial.

Those earnings, dividend and buyback updates sit alongside a solid run in the share price, with a 90 day share price return of 21.25% and a 1 year total shareholder return of 18.64%. This suggests momentum has been building rather than fading for both recent and longer term holders.

If Univest Financial's mix of earnings growth, dividends and buybacks has your attention, you might also want to scan our list of 22 top founder-led companies as a way to spot other interesting names shaping their own long term stories.

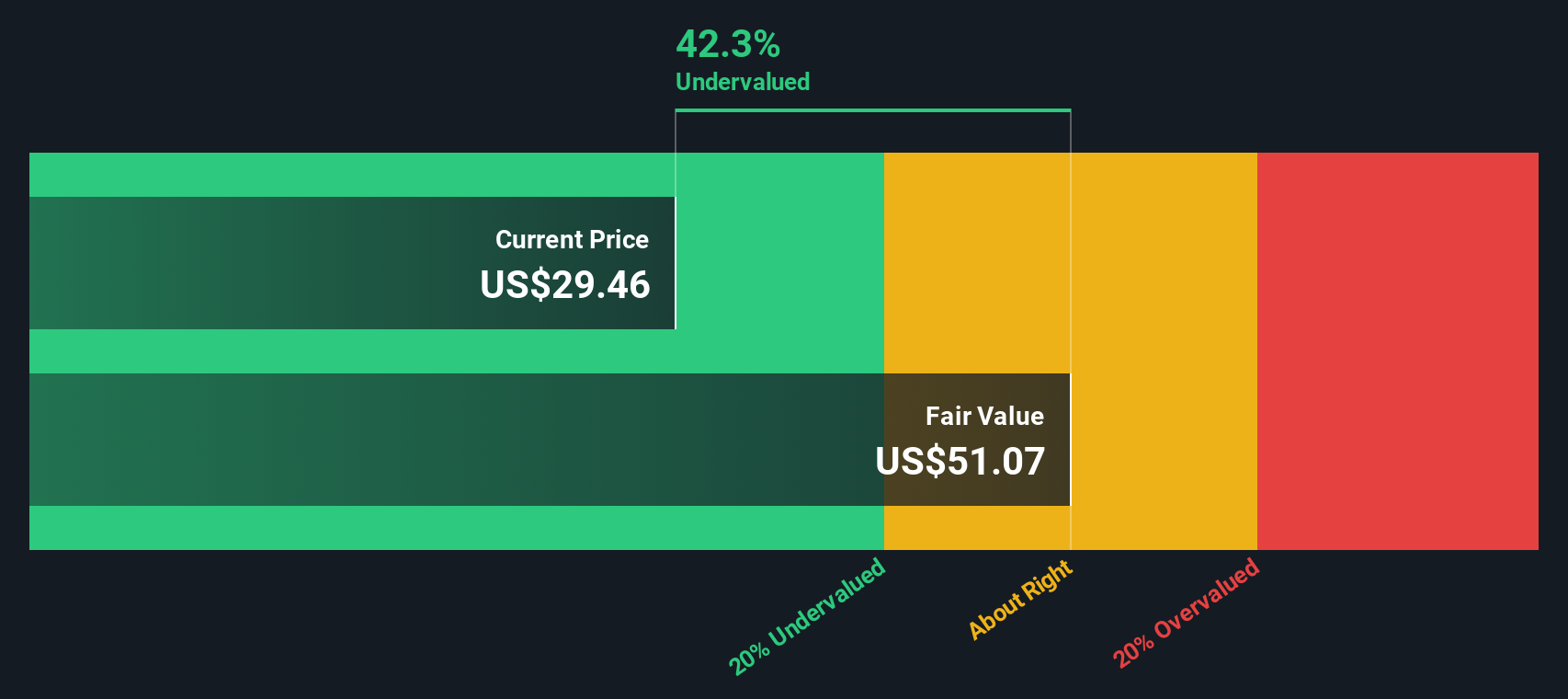

With earnings per share at US$3.13, an intrinsic value estimate implying roughly a 41% discount, and a share price above the latest analyst target, the real question is whether this is a mispriced opportunity or whether the market is already baking in future growth.

Most Popular Narrative: 5.4% Overvalued

With Univest Financial at $35.83 versus a narrative fair value of $34, the current setup hinges on how much faith you put in modeled earnings and margins.

Prudent capital management, including continued share buybacks and disciplined expense growth, positions Univest to return value to shareholders even as loan prepayments and competition temporarily suppress loan balances, helping to support future EPS and margins.

Curious what earnings path, margin profile, and valuation multiple need to line up for that fair value to hold? The narrative leans on specific revenue growth, profitability and buyback assumptions that paint a very particular picture of Univest's next few years.

Result: Fair Value of $34 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, it is worth keeping an eye on loan contraction from early payoffs and deposit competition, which could pressure margins and challenge this fair value story.

Find out about the key risks to this Univest Financial narrative.

Another Angle on Univest's Valuation

The narrative work suggests Univest is 5.4% overvalued at $35.83 versus a $34 fair value, but our DCF model points a different way. On those cash flow assumptions, Univest screens as undervalued, with a fair value estimate of $60.40. So which story do you trust more: the cash flows or the narrative fair value?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Univest Financial Narrative

If the assumptions behind these models do not quite match how you see Univest, you can test the numbers yourself and shape your own view in just a few minutes, starting with Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Univest Financial.

Looking for more investment ideas?

If Univest has sharpened your thinking, do not stop here. Broaden your watchlist with ideas that line up better with your own risk and return preferences.

- Jump on potential value opportunities before the crowd with our list of 53 high quality undervalued stocks that fit strict quality and pricing checks.

- Prioritise resilience by scanning 86 resilient stocks with low risk scores that score well on our risk framework, so you are not surprised when conditions change.

- Hunt for future market favourites hiding in plain sight through our screener containing 24 high quality undiscovered gems, where strong fundamentals have not yet attracted broad attention.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com