Assessing Natera (NTRA) Valuation After EDEN Study Launch And Recent Clinical Milestones

Why the EDEN study matters for Natera stock

Natera (NTRA) has drawn fresh attention after launching EDEN, a large multi center study that will test its non invasive prenatal screening approach for early preeclampsia risk and other serious pregnancy complications.

The study plans to enroll up to 7,500 pregnant participants in the US, using cell free DNA, additional analytes and clinical data to generate individualized risk assessments for adverse pregnancy outcomes.

See our latest analysis for Natera.

The EDEN announcement comes after a busy few weeks, including an FDA submission for Signatera CDx in bladder cancer and full enrollment of the Prospera heart transplant trial. This stream of clinical milestones sits alongside a 1-year total shareholder return of 17.49% and a very large 3-year total shareholder return, while the 30-day share price return of 13.35% and year-to-date share price return of 11.27% suggest momentum has cooled recently.

If this kind of healthcare diagnostics news has your attention, it could be a good time to see what else is out there and review 26 healthcare AI stocks for more potential ideas.

With the shares up 17.49% over 1 year and a price of $203.04 still sitting at a 5.6% intrinsic discount and roughly 27% below analyst targets, you have to ask: is there still a buying opportunity here, or is the market already pricing in future growth?

Most Popular Narrative: 21.1% Undervalued

At $203.04, the most followed narrative for Natera lines up with a fair value of about $257, which frames the recent EDEN and MRD news in a much bigger context.

Investment in new product launches (e.g., Fetal Focus NIPT, Signatera Genome, AI based biomarkers) and a robust R&D pipeline positions Natera to capture growth from long term trends in personalized medicine and early detection, underpinning future revenue expansion.

Curious what is baked into that fair value gap? The narrative leans heavily on rising revenue, improving margins, and a rich earnings multiple that assumes real staying power.

Result: Fair Value of $257.20 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this hinges on continued clinical trial success and reimbursement progress, while high R&D and SG&A spending could keep profitability under pressure longer than bullish models assume.

Find out about the key risks to this Natera narrative.

Another Way To Look At The Price Tag

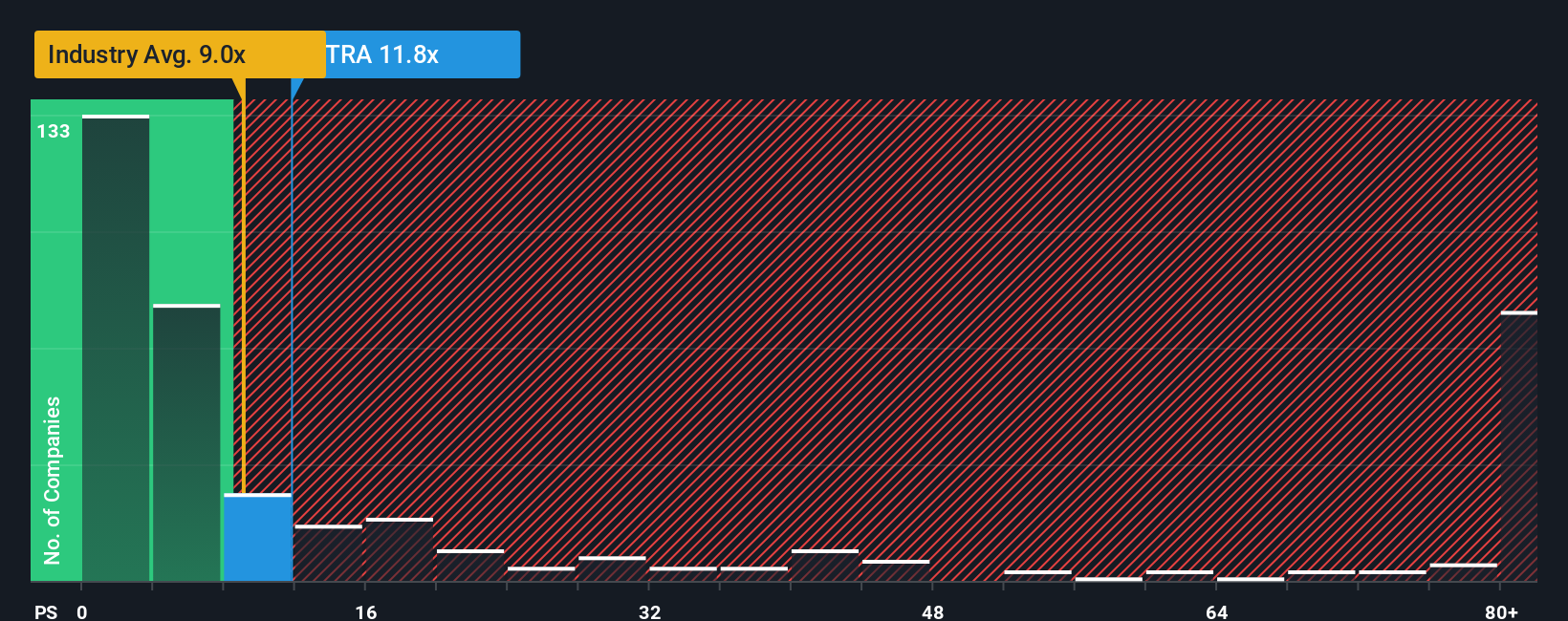

The narrative and intrinsic value models point to Natera being 5.6% below an estimated fair value of $215.08, yet the simple revenue multiple is telling a different story. At a P/S of 13.3x, the shares sit above the US Biotechs industry at 11.2x, the peer average at 8.1x, and the fair ratio of 8.3x. This suggests the market is already paying up for this growth story, and the key consideration is whether that premium is justified or leaves less room for error.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Natera Narrative

If parts of this story do not quite fit your view, or you prefer to lean on your own numbers and judgment, you can review the data, test your assumptions, and build a tailored Natera thesis in just a few minutes by choosing to Do it your way.

A great starting point for your Natera research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If Natera is on your radar, this is the moment to broaden your watchlist, compare a few different angles, and give yourself better context across the market.

- Target value first and see how 52 high quality undervalued stocks could surface companies where the price tag and fundamentals appear out of sync.

- Prioritise resilience by scanning 82 resilient stocks with low risk scores for businesses that our model flags with relatively lower overall risk scores.

- Hunt for potential outliers using our screener containing 24 high quality undiscovered gems to spot smaller names that have not yet attracted wide attention.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com