Assessing Fair Isaac (FICO) Valuation As Long Term Gains Contrast With Recent Share Price Volatility

Why Fair Isaac (FICO) Is On Investors’ Radar Today

Fair Isaac (FICO) is drawing attention after recent share price moves, with the stock last closing at US$1,391 and showing weak returns over the past month and past 3 months.

See our latest analysis for Fair Isaac.

That recent 2.48% 1 day share price gain comes after a tougher stretch, with the 30 day share price return of 16.48% and year to date share price return of 15.35% both pointing to fading short term momentum. This is even as the 3 year total shareholder return of 104.64% and 5 year total shareholder return of 193.60% show how strong the longer term story has been.

If FICO’s mixed momentum has you reassessing your watchlist, it could be a good time to broaden your search with our screener of 22 top founder-led companies.

With Fair Isaac trading at US$1,391 and an indicated 7% intrinsic discount, alongside analyst targets above the current price, you have to ask: is there still value on the table, or is the market already pricing in future growth?

Most Popular Narrative: 31.2% Undervalued

With Fair Isaac last closing at $1,391 against a narrative fair value of about $2,023, the current price sits well below that storyline.

The ongoing transition to SaaS and cloud-based delivery, evidenced by double-digit growth in FICO Platform ARR and emphasis on conversion to next-generation AI-driven decisioning solutions, is increasing recurring revenues, supporting margin expansion and greater earnings predictability.

Curious what earnings path and margin profile need to line up for that value gap to close? The narrative leans on steady top line expansion, higher profitability, and a rich future earnings multiple. Want to see which specific growth and margin assumptions support that pricing story and how long the market is expected to wait for it?

Result: Fair Value of $2,023 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, you also need to weigh regulatory changes around mortgage credit scoring and slower recent software growth, either of which could challenge this optimistic earnings path.

Find out about the key risks to this Fair Isaac narrative.

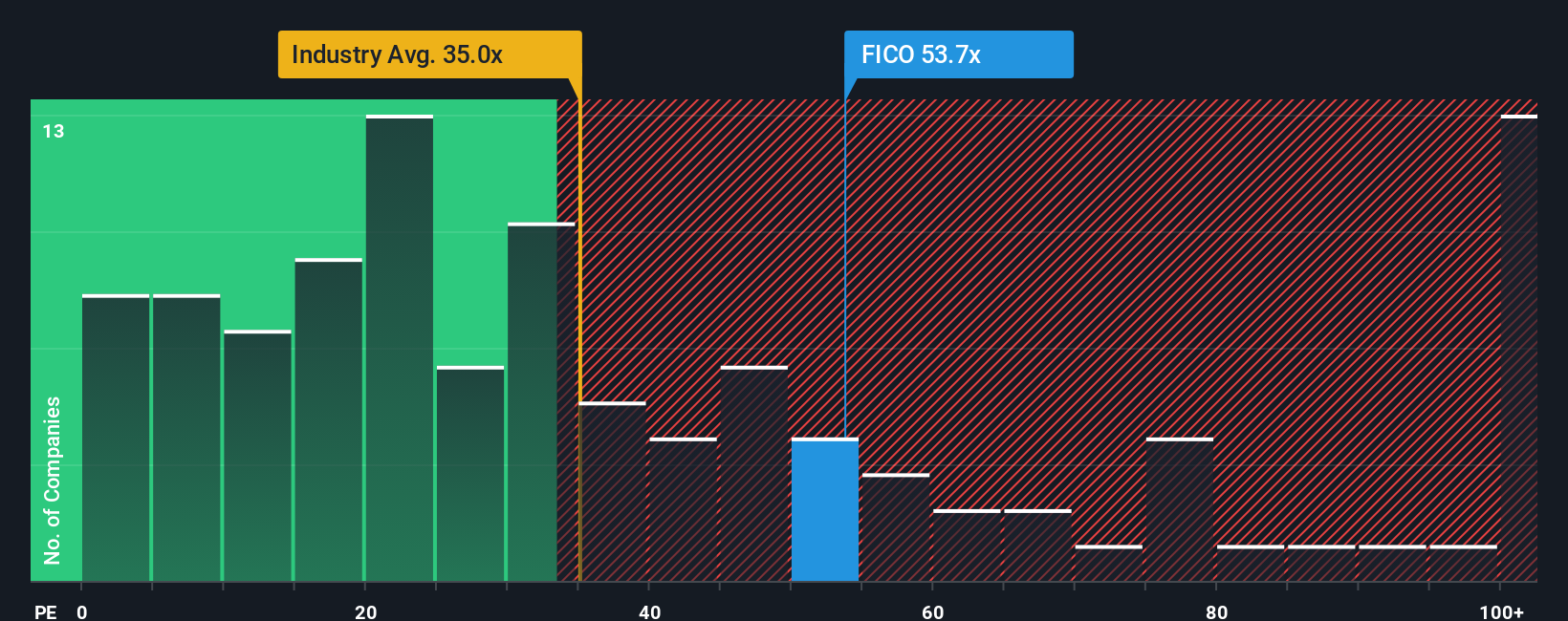

Another Angle: High P/E Puts Pressure On The Story

The first narrative leans on cash flows and long term growth, but the current P/E of about 50x tells a tougher story. That is richer than the US Software industry at 26.9x, the peer average at 38.7x, and even the fair ratio of 36.6x that our model suggests the market could move toward. For you, that gap can mean valuation risk if expectations cool, or an earnings catch up story if the business keeps delivering. Which side do you feel more comfortable backing?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Fair Isaac Narrative

If parts of this story do not quite fit your view, or you simply prefer testing the numbers yourself, you can build a custom Fair Isaac narrative in just a few minutes, Do it your way.

A great starting point for your Fair Isaac research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If you are serious about sharpening your portfolio, do not stop at one company. Use the Simply Wall St screener to spot what others might be missing.

- Zero in on quality at a discount by checking companies our model flags as 52 high quality undervalued stocks relative to their fundamentals and future cash flows.

- Prioritize resilience and support a more comfortable investing experience by focusing on businesses in the 82 resilient stocks with low risk scores that carry lower overall risk scores.

- Explore potential opportunities by searching the screener containing 24 high quality undiscovered gems that combine strong fundamentals with limited current attention from the market.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com