Textron (TXT) Is Up 8.4% After Issuing 2026 Guidance and Completing Major Buyback - What's Changed

- Textron Inc. recently reported fourth-quarter 2025 results showing revenue of US$4,175 million and net income of US$235 million, and issued 2026 guidance calling for approximately US$15.5 billion in revenue and GAAP EPS from continuing operations of US$5.39 to US$5.59.

- The company also completed a multi-year share repurchase of 29,998,148 shares for US$2.44 billions and added Otis Worldwide CFO Cristina Méndez to its board, where she will serve on the Audit and Nominating and Corporate Governance Committees.

- We will now examine how Textron’s 2026 earnings guidance shapes its investment narrative, alongside board changes and capital return decisions.

Uncover the next big thing with 24 elite penny stocks that balance risk and reward.

What Is Textron's Investment Narrative?

To own Textron today, you really have to be comfortable with a steady, rather than explosive, story built around its diversified aerospace and defense platforms, incremental earnings growth and disciplined capital returns. The latest quarter delivered higher revenue and net income, yet the stock sold off after 2026 guidance came in below market expectations, reinforcing that near term sentiment is tied closely to Textron’s ability to meet or beat its own outlook. The completion of a US$2.44 billions buyback and continued token dividend signal that excess cash is being funneled primarily into repurchases, which can support per share metrics if earnings hold up. Adding Otis CFO Cristina Méndez, an “audit committee financial expert,” looks incrementally positive for governance, but is unlikely to shift core risks around slower growth than the broader market, execution in key programs and competition inside aerospace and defense.

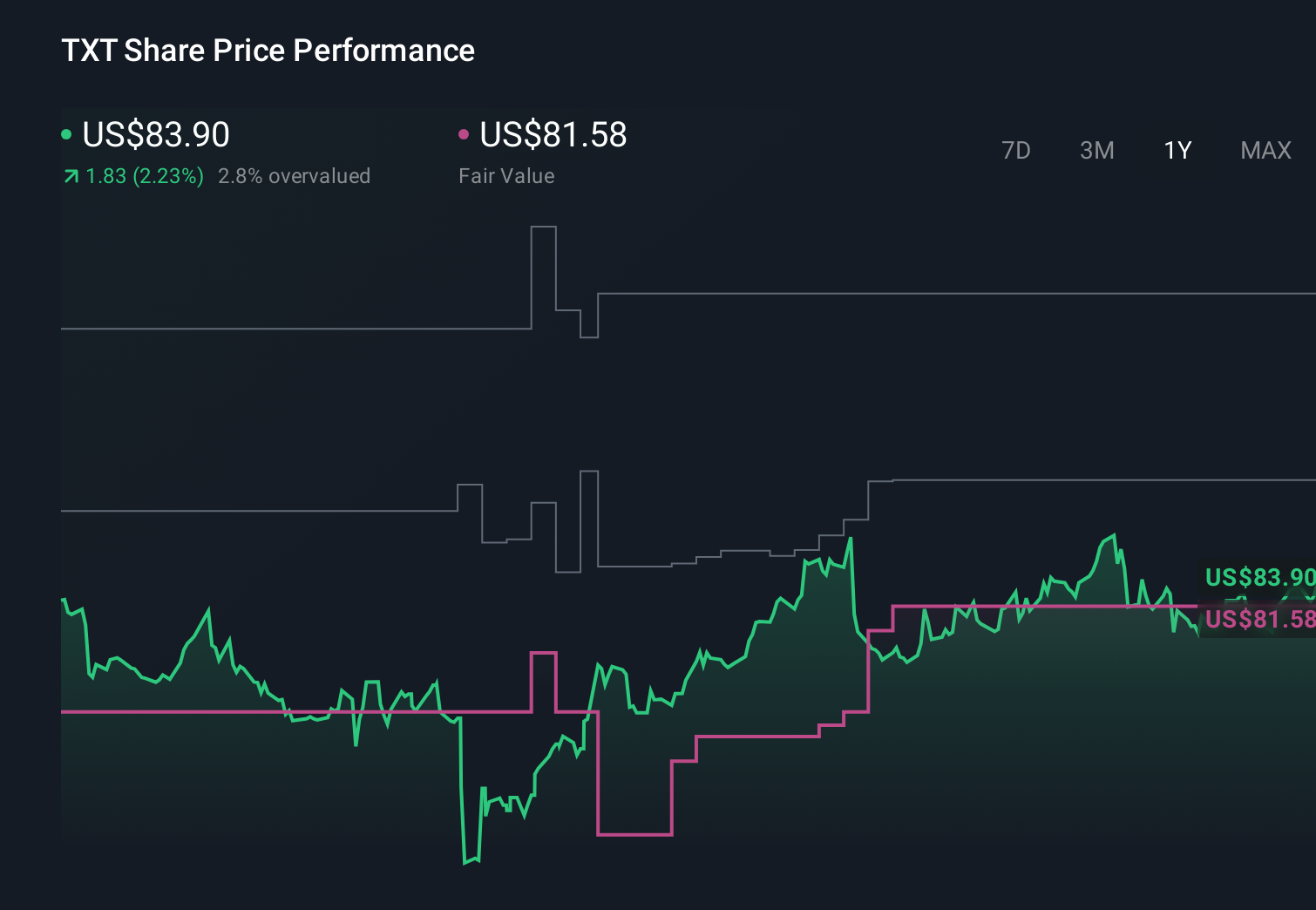

However, investors should be aware that Textron’s growth may lag broader market expectations. Textron's shares are on the way up, but could they be overextended? Uncover how much higher they are than fair value.Exploring Other Perspectives

Explore 5 other fair value estimates on Textron - why the stock might be worth 20% less than the current price!

Build Your Own Textron Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Textron research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Textron research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Textron's overall financial health at a glance.

Searching For A Fresh Perspective?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- The future of work is here. Discover the 28 top robotics and automation stocks leading the charge in AI-driven automation and industrial transformation.

- Invest in the nuclear renaissance through our list of 87 elite nuclear energy infrastructure plays powering the global AI revolution.

- Rare earth metals are the new gold rush. Find out which 29 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com