A Look At Teledyne Technologies’ Valuation After New Black Hornet 4 Defense Contract Win

Why Teledyne’s latest defense win matters for TDY shareholders

Teledyne Technologies (TDY) is back on investor radar after its Teledyne FLIR Defense division secured a $17.5 million contract from Swiss procurement agency armasuisse for Black Hornet 4 nano-drone systems.

This deal puts a spotlight on demand for Teledyne’s unmanned aerial technology and its ability to integrate the Black Hornet 4 with armored vehicles, a combination that could shape how investors think about the company’s defense exposure.

See our latest analysis for Teledyne Technologies.

The contract news lands at a time when momentum in Teledyne’s stock has been building. A 1 month share price return of 17.95% and a 3 month share price return of 24.49% have helped lift the shares to $647.56, while the 1 year total shareholder return of 26.59% and 5 year total shareholder return of 66.94% point to steady value creation over a longer horizon.

If the Black Hornet win has you thinking about where else defense and autonomy might be gaining traction, it could be worth scanning our list of 28 robotics and automation stocks as a starting point for other potential ideas.

Teledyne now trades at $647.56, with a value score of 1 and only a 4.1% discount to the average analyst price target. The key question is whether there is still an opportunity for investors or if the market is already pricing in future growth.

Most Popular Narrative: 3% Undervalued

Teledyne’s most followed narrative puts fair value at $665.77, slightly above the current $647.56 share price, and ties that gap to earnings power and margins.

Expansion and integration of the FLIR acquisition is leading to higher-margin product offerings (notably in thermal imaging, sensors, and drones), generating significant cross-selling opportunities and driving segment-level margin improvements and elevated net earnings.

Curious how a modest revenue glide path, fatter margins and a richer future earnings multiple combine to support that fair value? The full narrative explains the specific growth, profitability and valuation assumptions behind that $665.77 figure, and compares them with today’s price.

Result: Fair Value of $665.77 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the narrative can be knocked off course if integration drags on margins, or if trade and tariff pressures bite into costs and earnings quality.

Find out about the key risks to this Teledyne Technologies narrative.

Another View on Valuation

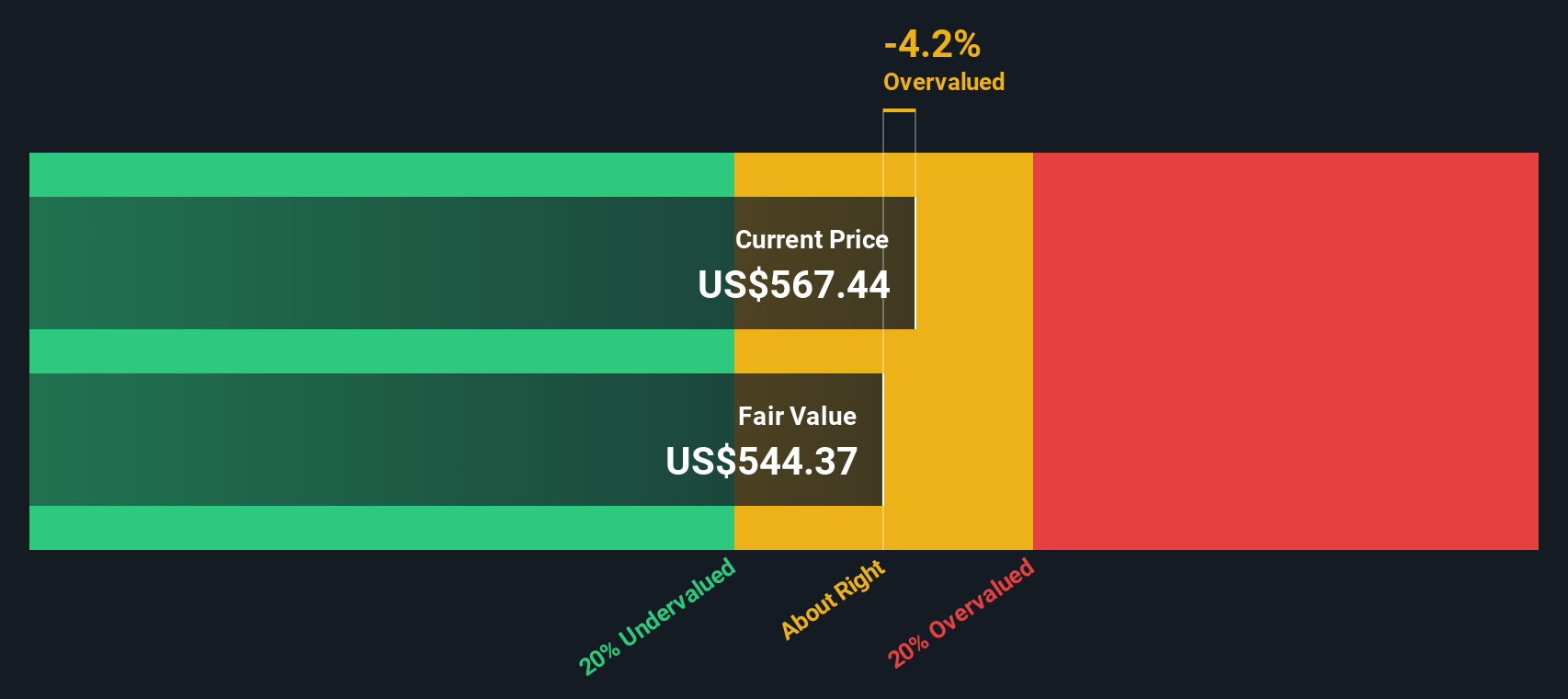

That 3% undervalued fair value of $665.77 contrasts with our DCF model, which puts Teledyne’s value at $571.17 with the current price at $647.56. On this view the shares look expensive, so the key question is which set of assumptions you find more realistic.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Teledyne Technologies for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 52 high quality undervalued stocks. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Teledyne Technologies Narrative

If you see the numbers differently or prefer to rely on your own work, you can build a custom Teledyne view in just a few minutes, starting with Do it your way.

A great starting point for your Teledyne Technologies research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Ready to hunt for your next investment idea?

If Teledyne has sharpened your focus, do not stop here. Use the Simply Wall St screener to uncover fresh ideas that fit your style and goals.

- Target quality at a discount by scanning our list of 52 high quality undervalued stocks that pair strong fundamentals with prices that may sit below their estimated worth.

- Prioritise resilience by checking out 82 resilient stocks with low risk scores, where companies show lower risk scores that could appeal if you want to limit unpleasant surprises.

- Get ahead of the crowd by reviewing our screener containing 24 high quality undiscovered gems, a collection of lesser known names with solid underpinnings that many investors may be overlooking.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com