Does CACC’s Earnings Beat and AI Push Reshape the Bull Case For Credit Acceptance (CACC)?

- Credit Acceptance reported past fourth-quarter 2025 results with revenue of US$579.9 million, net income of US$122 million, and diluted earnings per share from continuing operations of US$10.99, alongside meaningful share repurchases under two buyback programs.

- The company coupled this financial update with leadership transitions and highlighted investments in artificial intelligence and a new digital contract origination platform aimed at improving dealer and customer experience.

- Next, we’ll examine how the earnings beat, supported by AI-driven operational improvements, shapes Credit Acceptance’s broader investment narrative.

Invest in the nuclear renaissance through our list of 87 elite nuclear energy infrastructure plays powering the global AI revolution.

What Is Credit Acceptance's Investment Narrative?

To own Credit Acceptance, you need to be comfortable with a leveraged, niche lender that is trying to balance aggressive capital returns with investment in technology and funding flexibility. The latest quarter showed revenue growth but lower earnings, while still beating expectations, which keeps near term catalysts focused on whether AI initiatives and the new digital contract origination platform can sustain operational efficiency and dealer growth. The sizeable buybacks, including completing two programs that retired more than 3% of shares in Q4 alone, reinforce a shareholder friendly posture but also heighten exposure to funding and credit cycle risks if conditions turn. Leadership changes in analytics and sales look manageable given the consulting arrangements, so the key risk narrative still centers on high debt, regulatory exposure and the quality of future loan performance rather than this news itself.

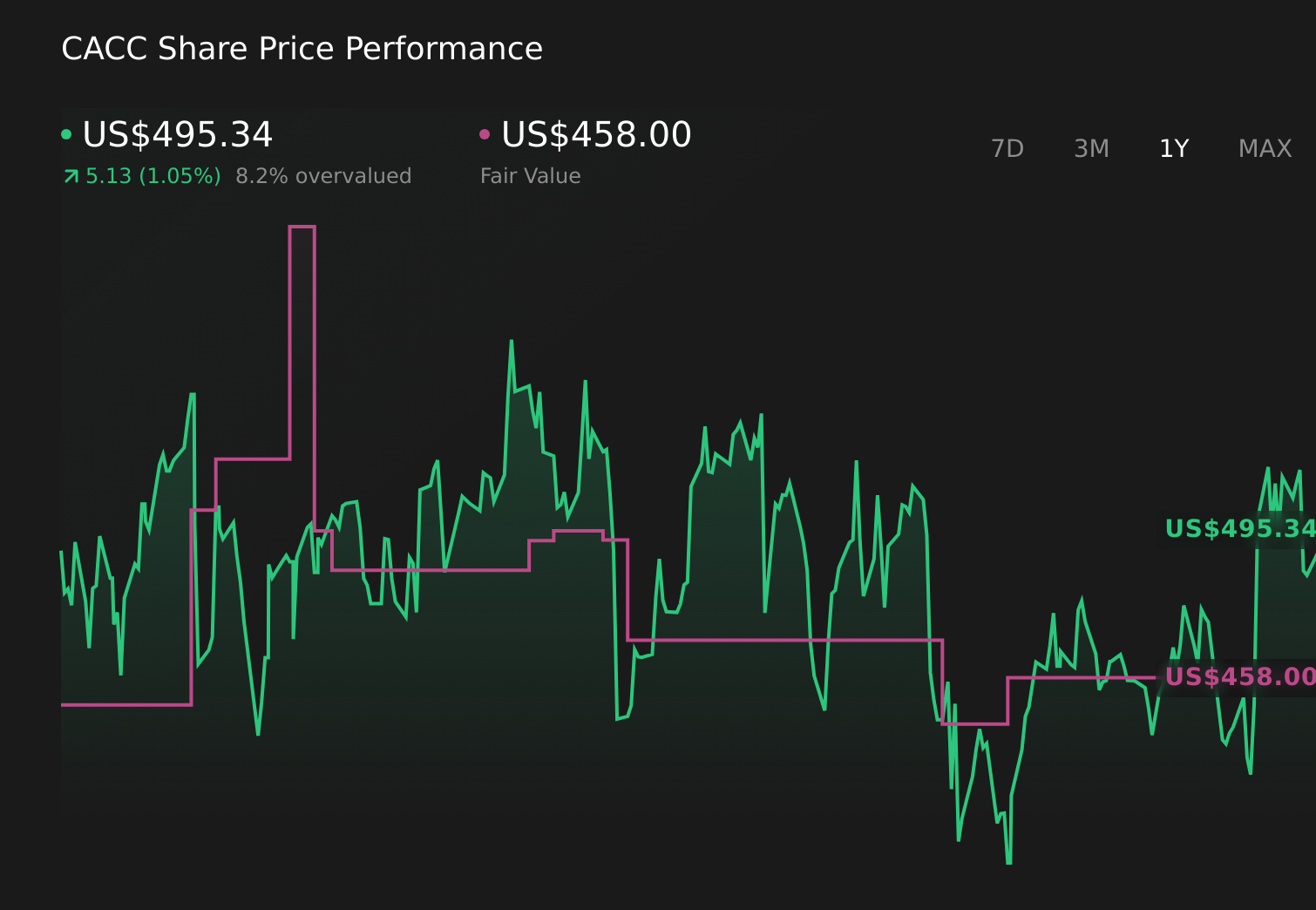

However, one emerging risk around funding and leverage is easy to overlook, and investors should not.Credit Acceptance's share price has been on the slide but might be dropping deeper into value territory. Find out whether it's a bargain at this price.

Exploring Other Perspectives

Explore 2 other fair value estimates on Credit Acceptance - why the stock might be worth 39% less than the current price!

Build Your Own Credit Acceptance Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Credit Acceptance research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Credit Acceptance research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Credit Acceptance's overall financial health at a glance.

Curious About Other Options?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Explore 22 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 29 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com