A Look At Kirby (KEX) Valuation After Strong Q4 Results And Ongoing Share Buybacks

Kirby (KEX) is back in focus after reporting fourth quarter revenue of US$851.78 million and net income of US$91.81 million, alongside an update on its long running share repurchase program.

See our latest analysis for Kirby.

The latest earnings and ongoing buybacks come after a strong 90 day share price return of 8.98% and a 1 year total shareholder return of 11.90%, with 3 and 5 year total shareholder returns of 64.86% and 97.51%. This suggests longer term momentum has been stronger than the more recent 1 month share price pullback.

If Kirby's update has you looking beyond marine transportation, it could be a good moment to scan our 22 top founder-led companies and see which other businesses are catching investor attention.

With earnings up, cash flow guidance on the table, and a long running buyback now well progressed, the key question is whether Kirby at around US$120 is still mispriced or whether the market is already paying for future growth.

Most Popular Narrative: 13.8% Undervalued

Kirby last closed at $120.46, while the most followed narrative pegs fair value closer to $139.67, built on a detailed long term cash flow view.

Supply constraints and industry-wide aging of the barge fleet are restraining new capacity growth, positioning Kirby to benefit from limited vessel availability, capacity consolidation, and rising charter rates over time, which should support steady revenue growth and expanding net margins.

Curious what kind of revenue path, margin lift, and future earnings multiple are baked into that fair value, and how a single discount rate ties it together?

Result: Fair Value of $139.67 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, softer petrochemical shipping demand or higher labor and maintenance costs could pressure utilization, margins, and the earnings path behind that 13.8% undervaluation story.

Find out about the key risks to this Kirby narrative.

Another Way To Look At Kirby's Price

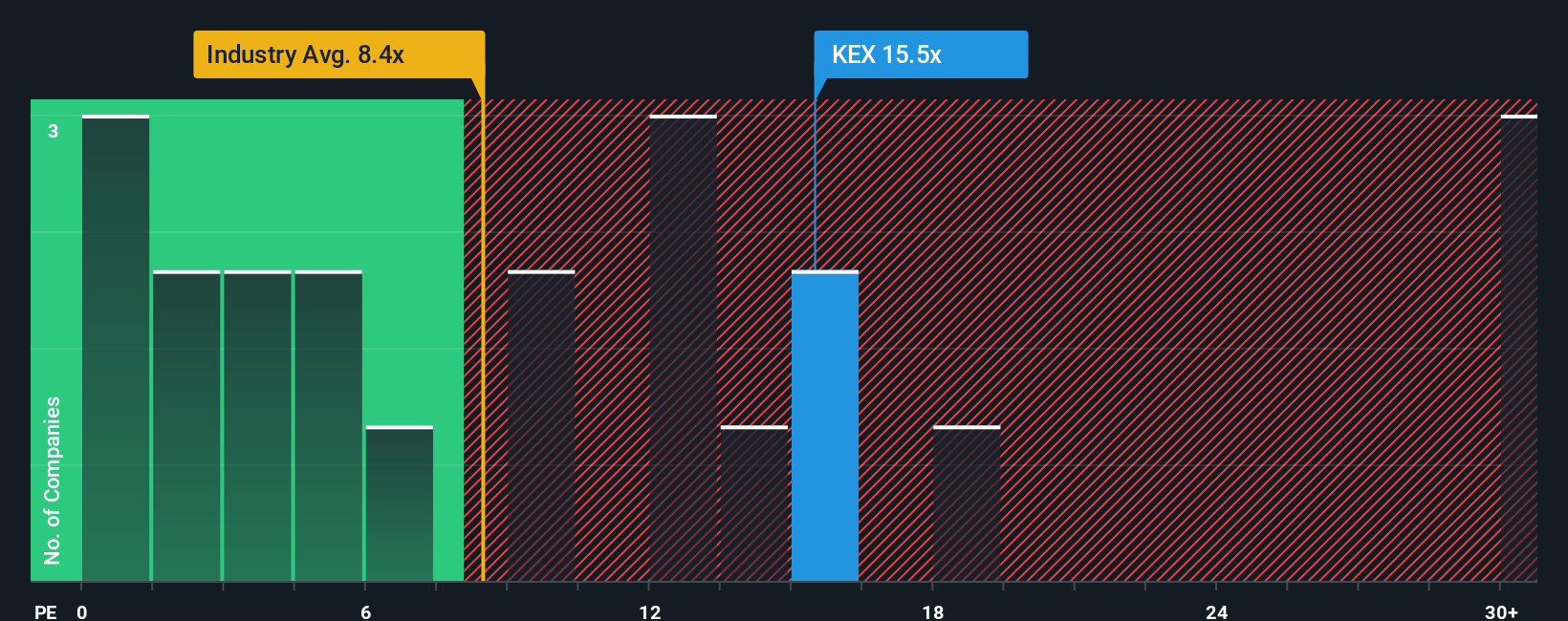

That 13.8% undervalued fair value of $139.67 sits awkwardly next to how the market is actually pricing Kirby today. At a P/E of 18.4x, the shares trade well above North American shipping at 7.4x and peers at 15.4x, and even above a fair ratio of 16.1x. If earnings stumble, that higher multiple could leave less room for error.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Kirby Narrative

If you look at this and think the assumptions do not quite fit your view, you can stress test the numbers yourself in just a few minutes. Do it your way

A great starting point for your Kirby research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If Kirby has sharpened your focus on quality, do not stop here, use the screener to quickly surface other opportunities that might fit your style.

- Zero in on mispriced quality and see what stands out in our 52 high quality undervalued stocks based on robust fundamentals and current market pricing.

- Prioritize resilience by checking companies highlighted in our solid balance sheet and fundamentals stocks screener (45 results) that pair financial strength with consistent business profiles.

- Hunt for future leaders by reviewing our screener containing 24 high quality undiscovered gems that flag lesser known names with strong underlying metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com