3 Promising Penny Stocks With Market Caps Over $100M

As February begins, major U.S. stock indexes have shown strong gains, with the Dow Jones Industrial Average adding 515 points and the S&P 500 nearing a record high. In this context of market optimism, investors often seek out opportunities that balance affordability with potential for growth. Penny stocks, though sometimes seen as a throwback to earlier trading days, continue to offer intriguing possibilities in today's market landscape. These smaller or newer companies can present significant opportunities when they are underpinned by solid financials and strategic positioning.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Dingdong (Cayman) (DDL) | $2.71 | $587.2M | ✅ 4 ⚠️ 1 View Analysis > |

| Waterdrop (WDH) | $1.85 | $669.08M | ✅ 4 ⚠️ 0 View Analysis > |

| WM Technology (MAPS) | $0.7418 | $122.3M | ✅ 4 ⚠️ 1 View Analysis > |

| LexinFintech Holdings (LX) | $3.05 | $513.2M | ✅ 4 ⚠️ 1 View Analysis > |

| Udemy (UDMY) | $4.73 | $677.45M | ✅ 4 ⚠️ 1 View Analysis > |

| Golden Growers Cooperative (GGRO.U) | $5.00 | $77.45M | ✅ 2 ⚠️ 5 View Analysis > |

| Cricut (CRCT) | $4.60 | $974.03M | ✅ 2 ⚠️ 2 View Analysis > |

| Nephros (NEPH) | $4.02 | $42.72M | ✅ 3 ⚠️ 2 View Analysis > |

| BAB (BABB) | $0.985 | $6.98M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (LCUT) | $3.32 | $75.22M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 340 stocks from our US Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

ALX Oncology Holdings (ALXO)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: ALX Oncology Holdings Inc. is a clinical-stage immuno-oncology company developing cancer therapies in the United States, with a market cap of $126.87 million.

Operations: ALX Oncology Holdings Inc. does not report any revenue segments as it is a clinical-stage company focused on developing cancer therapies in the United States.

Market Cap: $126.87M

ALX Oncology Holdings is a pre-revenue clinical-stage immuno-oncology company with a market cap of US$126.87 million. The company recently completed a US$150 million follow-on equity offering, which bolsters its cash reserves, extending its runway to approximately 1.1 years despite historical cash flow reductions. ALX's investigational CD47-inhibitor evorpacept has shown promising results in trials for heavily pretreated HER2-positive metastatic breast cancer and other cancers, indicating potential as a cornerstone therapy in immuno-oncology. However, with high volatility and increasing debt-to-equity ratio over five years, investors should consider the risks alongside these developments.

- Click here and access our complete financial health analysis report to understand the dynamics of ALX Oncology Holdings.

- Examine ALX Oncology Holdings' earnings growth report to understand how analysts expect it to perform.

LexinFintech Holdings (LX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: LexinFintech Holdings Ltd. operates in the People's Republic of China, providing online direct sales and consumer finance services, with a market cap of approximately $513.20 million.

Operations: The company's revenue is primarily derived from its online retail segment, which generated CN¥13.77 billion.

Market Cap: $513.2M

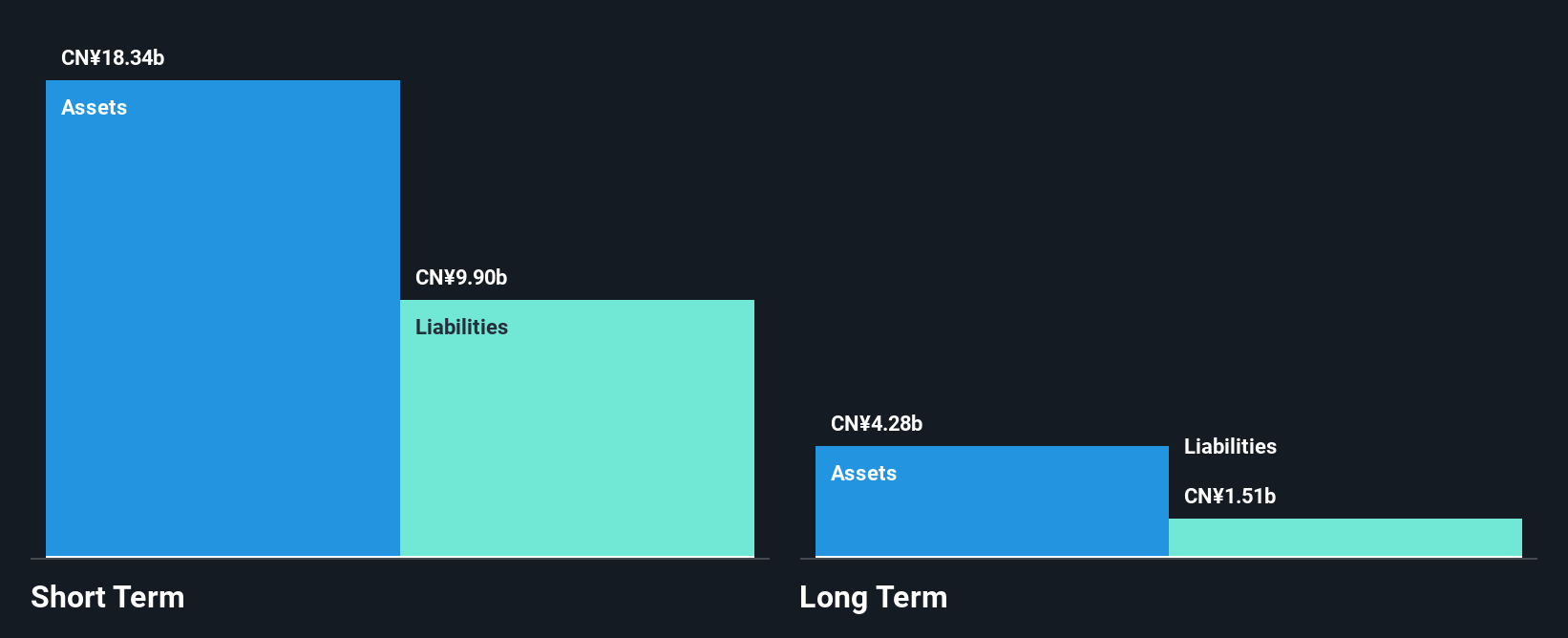

LexinFintech Holdings reported a solid improvement in net income for the third quarter of 2025, reaching CN¥521.27 million from CN¥309.56 million the previous year, despite a slight decline in revenue to CN¥3,417.5 million. The company demonstrates financial stability with short-term assets of CN¥18.4 billion exceeding liabilities and strong interest coverage by EBIT at 113.6 times. Although earnings have declined over five years, recent growth has been robust at 143.5%, outpacing industry averages significantly, while maintaining satisfactory debt levels and avoiding shareholder dilution amidst stable volatility and seasoned management oversight.

- Jump into the full analysis health report here for a deeper understanding of LexinFintech Holdings.

- Assess LexinFintech Holdings' future earnings estimates with our detailed growth reports.

Riskified (RSKD)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Riskified Ltd. develops an e-commerce risk intelligence platform for online merchants worldwide, with a market cap of approximately $690.52 million.

Operations: The company's revenue primarily comes from its Security Software & Services segment, generating $338.84 million.

Market Cap: $690.52M

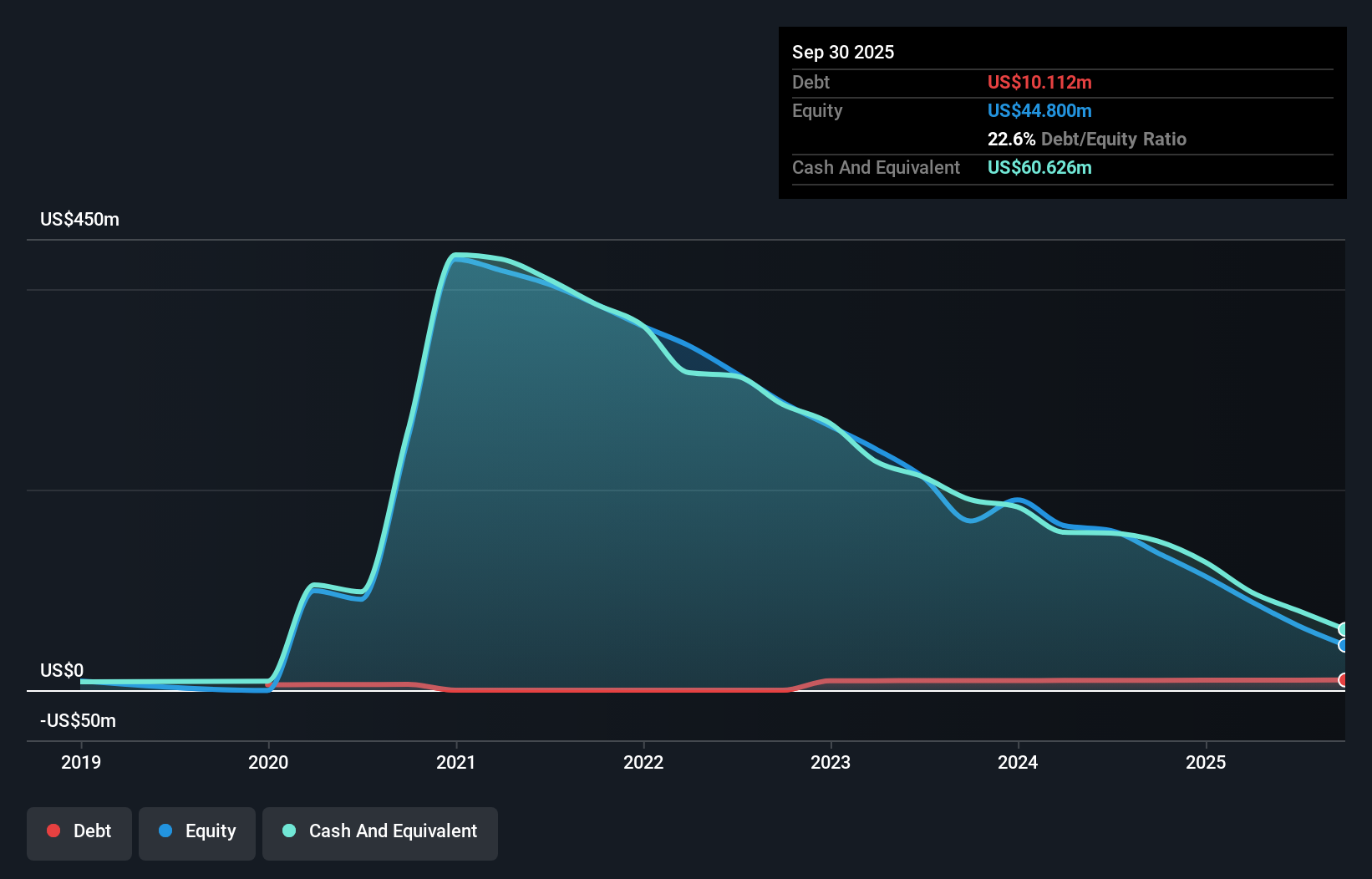

Riskified Ltd., with a market cap of US$690.52 million, has shown a consistent reduction in losses over the past five years, decreasing at an annual rate of 21.7%. Despite being unprofitable, it maintains a strong financial position with short-term assets of US$366.4 million surpassing both short and long-term liabilities. The company is debt-free and has not diluted shareholders recently, while its cash runway extends beyond three years due to positive free cash flow growth. Recent earnings guidance projects revenue between US$338 million and US$346 million for 2025, reflecting steady revenue generation amidst ongoing buyback activities.

- Get an in-depth perspective on Riskified's performance by reading our balance sheet health report here.

- Learn about Riskified's future growth trajectory here.

Turning Ideas Into Actions

- Gain an insight into the universe of 340 US Penny Stocks by clicking here.

- Interested In Other Possibilities? We've found 12 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com