3 Stocks Estimated To Be Up To 49.8% Below Intrinsic Value

As the United States stock market begins February on a high note with major indexes like the Dow Jones and S&P 500 showing significant gains, investors are keenly observing opportunities amidst fluctuating economic indicators and geopolitical developments. In this environment, identifying undervalued stocks becomes crucial as they may offer potential for growth when trading below their intrinsic value.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Sprout Social (SPT) | $7.75 | $15.43 | 49.8% |

| Peraso (PRSO) | $0.87 | $1.70 | 48.8% |

| Old National Bancorp (ONB) | $25.67 | $50.00 | 48.7% |

| Northwest Bancshares (NWBI) | $13.31 | $25.63 | 48.1% |

| KORU Medical Systems (KRMD) | $4.78 | $9.48 | 49.6% |

| Horizon Bancorp (HBNC) | $18.68 | $36.93 | 49.4% |

| Datadog (DDOG) | $114.01 | $218.82 | 47.9% |

| Columbia Banking System (COLB) | $32.42 | $64.63 | 49.8% |

| Calix (CALX) | $55.57 | $111.11 | 50% |

| Alphatec Holdings (ATEC) | $13.51 | $26.19 | 48.4% |

Below we spotlight a couple of our favorites from our exclusive screener.

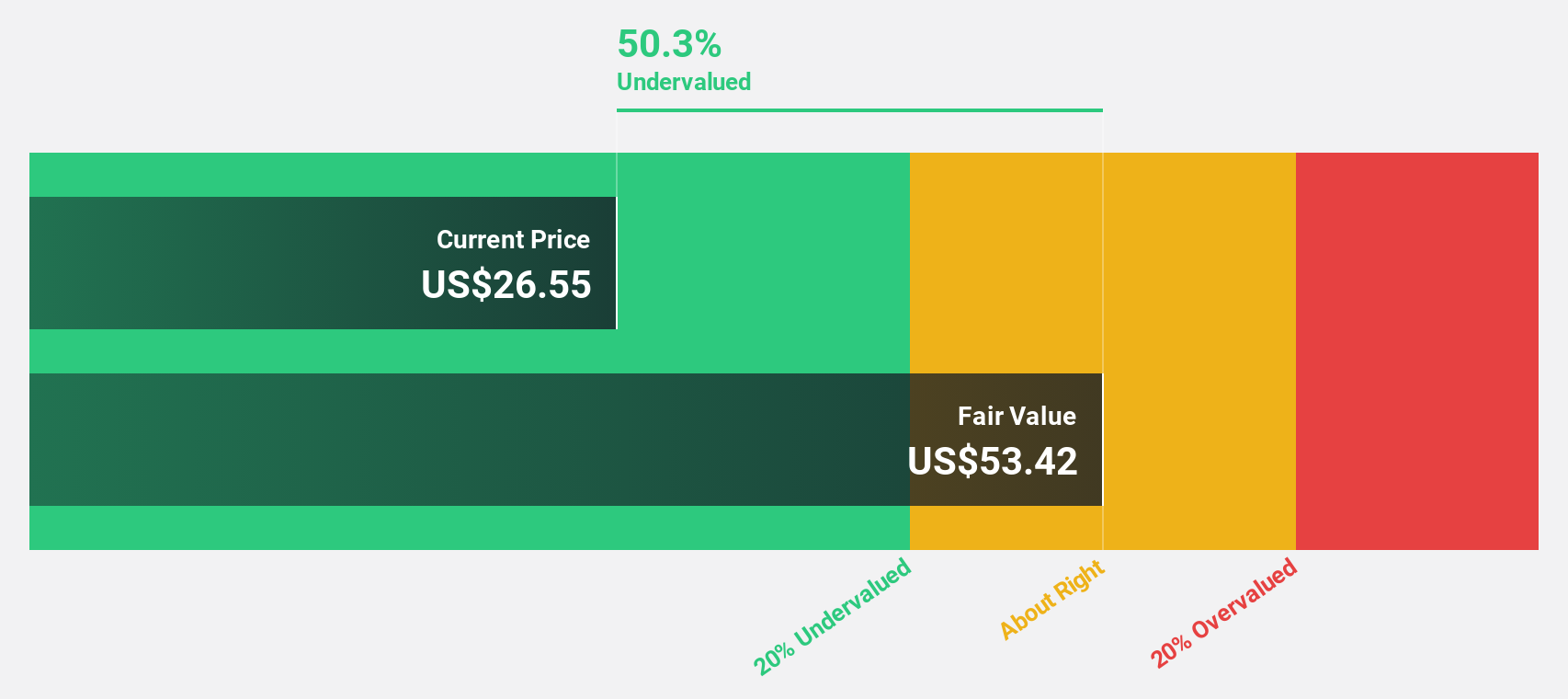

Columbia Banking System (COLB)

Overview: Columbia Banking System, Inc. is a bank holding company for Columbia Bank, offering banking, private banking, mortgage, and other financial services in the United States with a market cap of approximately $9.47 billion.

Operations: The company generates revenue primarily through its banking segment, which accounted for $2.15 billion.

Estimated Discount To Fair Value: 49.8%

Columbia Banking System is trading at US$32.42, significantly below its estimated future cash flow value of US$64.63, suggesting undervaluation based on discounted cash flow analysis. Despite recent shareholder dilution and lower-than-expected earnings per share, the company forecasts robust annual earnings growth of 23%, outpacing the broader U.S. market's 15.7%. Recent strategic moves include a share buyback and executive changes to strengthen leadership, alongside a 3% dividend increase reflecting financial stability.

- Insights from our recent growth report point to a promising forecast for Columbia Banking System's business outlook.

- Take a closer look at Columbia Banking System's balance sheet health here in our report.

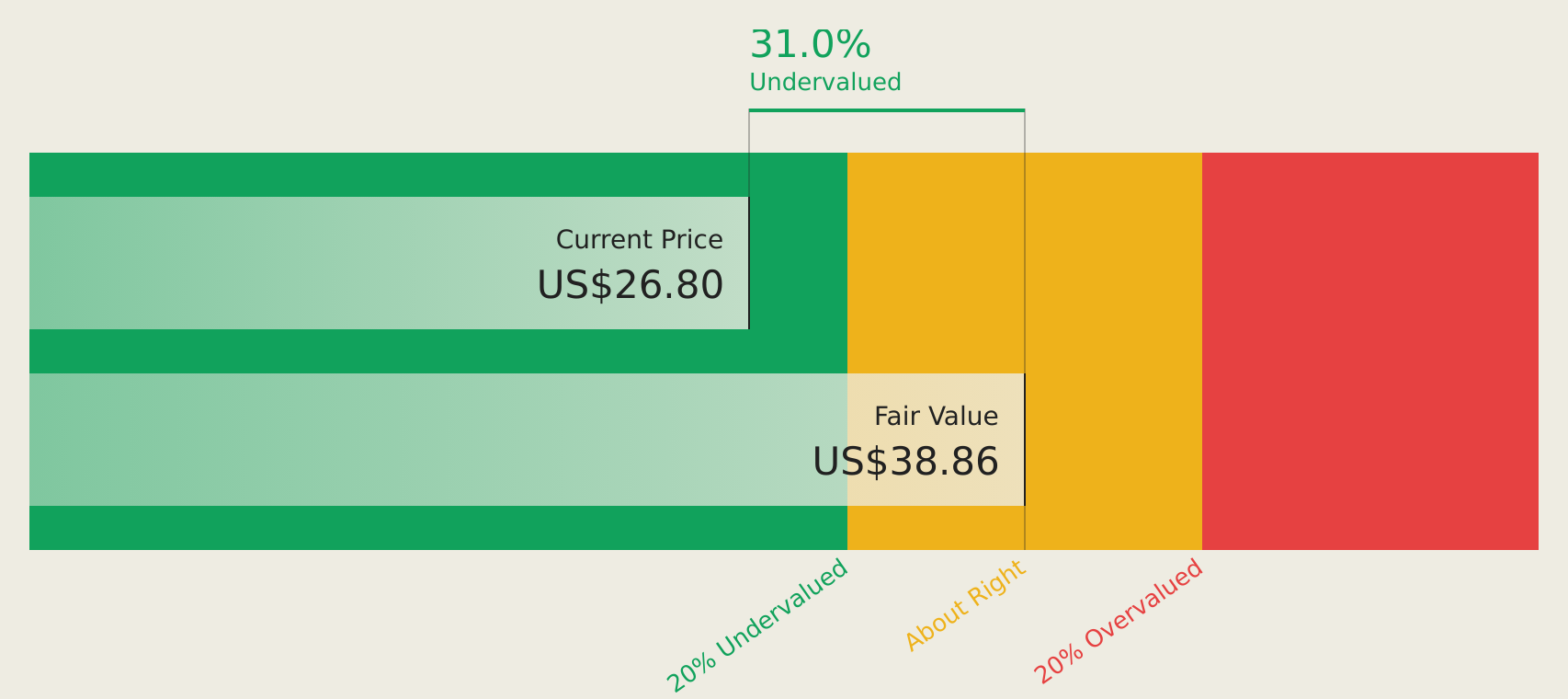

AngloGold Ashanti (AU)

Overview: AngloGold Ashanti plc is a gold mining company with operations in Africa, Australia, and the Americas, and has a market cap of approximately $52.48 billion.

Operations: The company's revenue primarily comes from its Metals & Mining segment, specifically Gold & Other Precious Metals, totaling $8.58 billion.

Estimated Discount To Fair Value: 17.6%

AngloGold Ashanti is trading at US$107.19, below its estimated future cash flow value of US$130.16, indicating potential undervaluation. The company's earnings surged to US$669 million in Q3 2025 from US$223 million a year ago, with gold production rising to 768,000 ounces. Forecasted revenue growth of 18.3% annually surpasses the U.S. market average of 10.3%. However, insider selling has been significant recently and dividend stability remains uncertain despite a recent increase to $0.91 per share.

- In light of our recent growth report, it seems possible that AngloGold Ashanti's financial performance will exceed current levels.

- Unlock comprehensive insights into our analysis of AngloGold Ashanti stock in this financial health report.

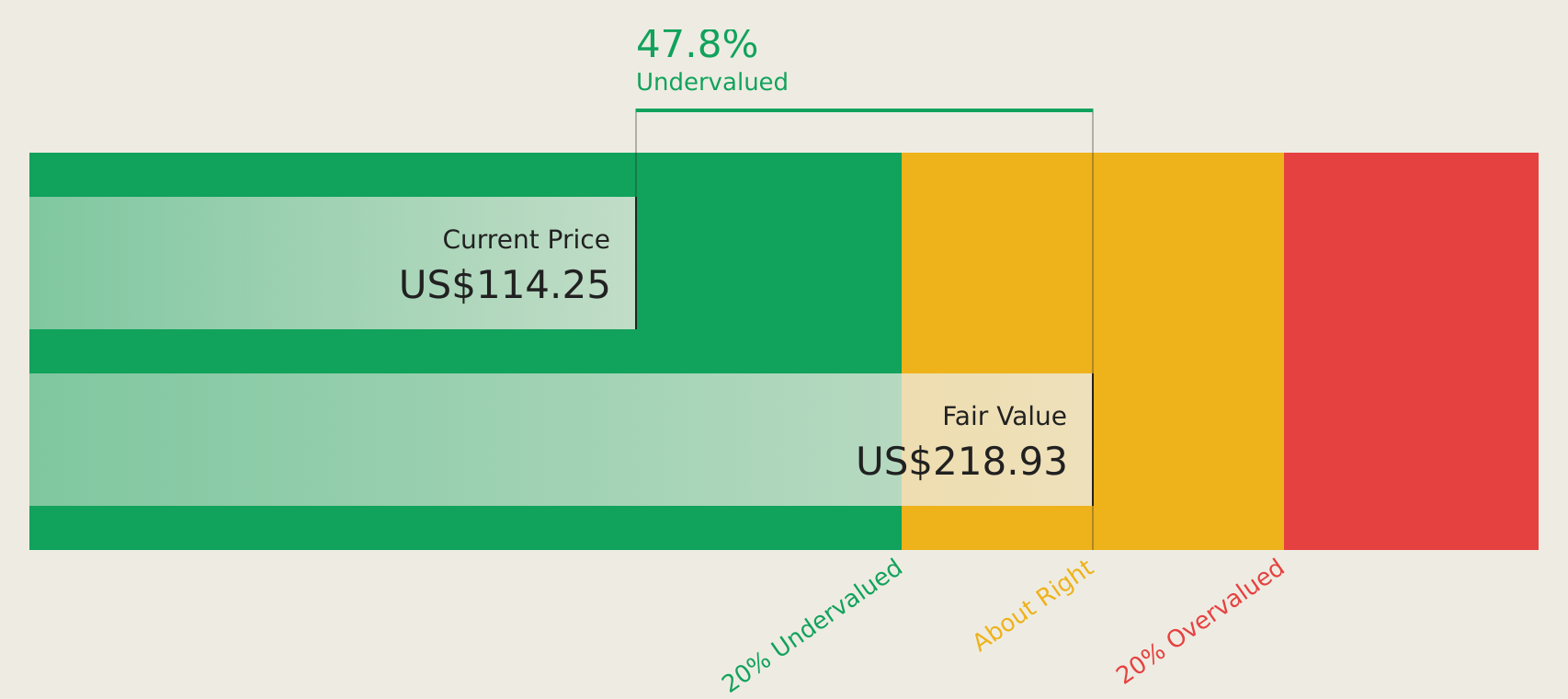

Samsara (IOT)

Overview: Samsara Inc. offers solutions that connect physical operations data to its connected operations platform, serving both the United States and international markets, with a market cap of $15.71 billion.

Operations: The company's revenue primarily stems from its Software & Programming segment, which generated $1.52 billion.

Estimated Discount To Fair Value: 29.6%

Samsara is trading at US$27.23, below its estimated future cash flow value of US$38.67, suggesting it may be undervalued based on cash flows. The company reported Q3 2025 sales of US$415.98 million and a net income turnaround from a loss last year to a profit of US$7.77 million, highlighting operational improvements. Despite significant insider selling recently, Samsara's expansion in Canada and innovative AI-powered products like Samsara Coach bolster its growth prospects in international markets.

- Upon reviewing our latest growth report, Samsara's projected financial performance appears quite optimistic.

- Click here and access our complete balance sheet health report to understand the dynamics of Samsara.

Seize The Opportunity

- Embark on your investment journey to our 155 Undervalued US Stocks Based On Cash Flows selection here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com