Arrow Electronics Auto Hub Links Vehicle Electronics Push With Hot Stock Run

- Arrow Electronics (NYSE:ARW) has launched a dedicated research hub focused on next generation vehicle electrical and electronic architectures.

- The new hub is aimed at automotive OEMs and suppliers working on software defined vehicles and advanced E/E systems.

- The initiative builds on Arrow's recent acquisitions of specialist software firms and its existing engineering and supply chain capabilities.

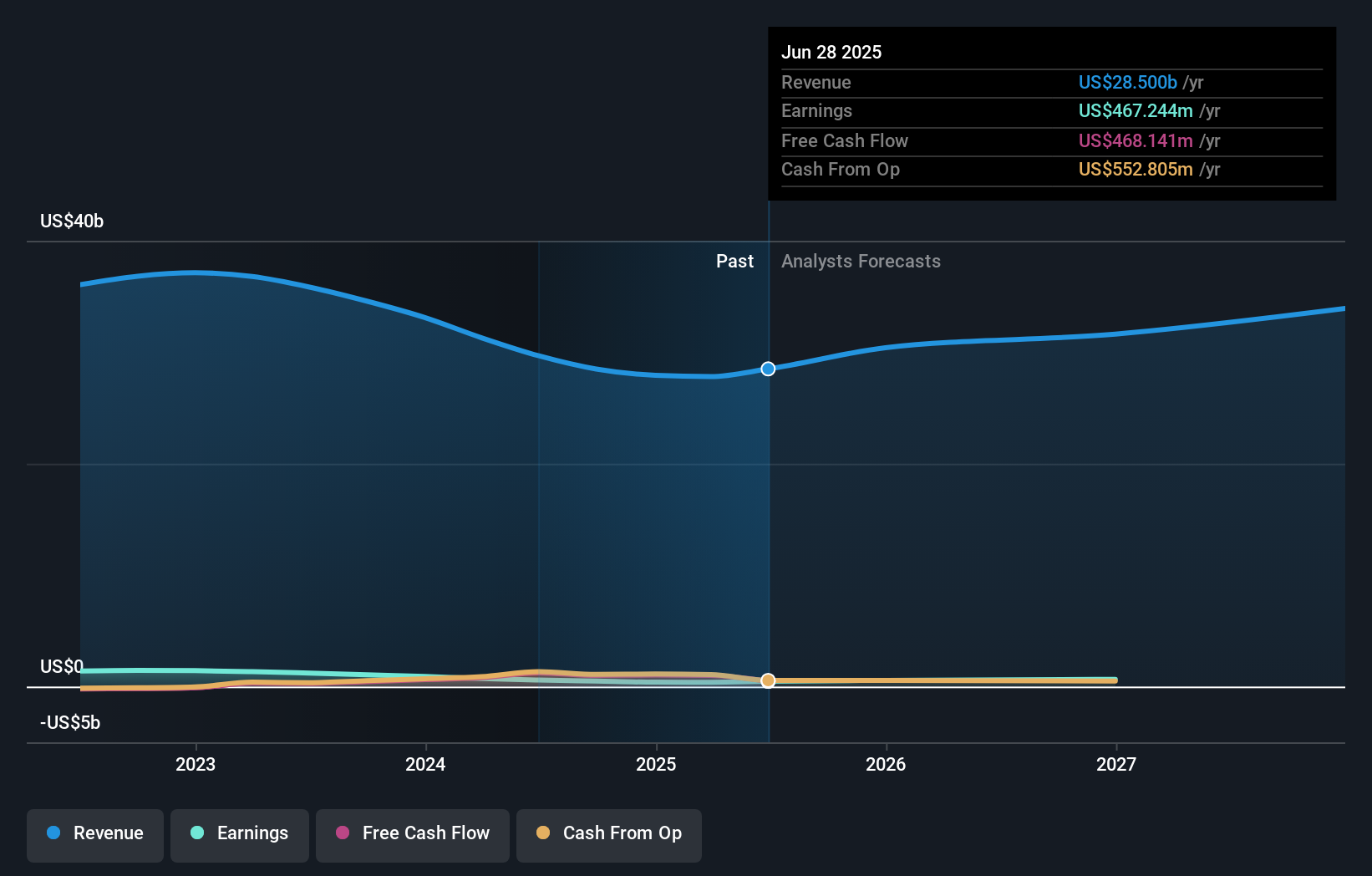

For investors watching NYSE:ARW, this move adds a fresh layer of context to a stock that has seen a 39.9% return year to date and 46.7% over the past year, with shares recently at $158.11. The company is focusing on a defined use case in automotive electronics by bringing together its design support, software assets and component distribution to serve manufacturers that are updating vehicle electronics.

In the period ahead, the new research hub provides Arrow with a focused platform to work directly with automakers and top tier suppliers on next generation vehicle programs. For you as an investor, the key question is how effectively ARW can convert this technical and supply chain role into durable customer relationships and potential new revenue streams as software defined vehicles and new regulatory requirements influence vehicle electronics.

Stay updated on the most important news stories for Arrow Electronics by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on Arrow Electronics.

How Arrow Electronics stacks up against its biggest competitors

Quick Assessment

- ⚖️ Price vs Analyst Target: At $158.11, the share price is about 15% above the US$137.50 analyst target, with the high estimate at $165.00.

- ⚖️ Simply Wall St Valuation: The current valuation status is unknown because DCF data is not available, so this signal is inconclusive.

- ✅ Recent Momentum: The stock has returned about 37.5% over the last 30 days, indicating strong recent momentum.

Check out Simply Wall St's in-depth valuation analysis for Arrow Electronics.

Key Considerations

- 📊 The new research hub more closely aligns ARW with software defined vehicle programs, which could strengthen relationships with automotive OEMs and suppliers.

- 📊 It is worth monitoring how much revenue and earnings contribution eventually comes from automotive electronics compared with the wider US$30.9b business, along with any updates to analyst targets.

- ⚠️ One flagged major risk is that debt is not well covered by operating cash flow, so funding new initiatives and cycles in auto demand are worth tracking together.

Dig Deeper

For the full picture, including more risks and rewards, check out the complete Arrow Electronics analysis.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com