A Look At Northwest Bancshares (NWBI) Valuation After New 2026 Revenue Guidance

New 2026 revenue guidance puts Northwest Bancshares in focus

Northwest Bancshares (NWBI) has put fresh guidance on the table, telling investors it expects 2026 revenue to fall between US$710 million and US$730 million. This gives the market a clearer view of management’s current outlook.

See our latest analysis for Northwest Bancshares.

Northwest Bancshares’ 2026 revenue guidance lands at a time when the share price has a 30 day share price return of 8.83% and a 90 day share price return of 12.51%, while the 5 year total shareholder return sits at 32.56%. This suggests recent momentum has been stronger than the longer term pace.

If this update has you rethinking where banks fit in your portfolio, it can help to widen the lens and check out 22 top founder-led companies as a fresh source of ideas.

With revenue guidance now on the table, Northwest Bancshares trades around US$13.31, and an intrinsic value estimate suggests a sizeable discount. So is the market overlooking upside here, or already pricing in future growth?

Most Popular Narrative: 50% Undervalued

Compared with the last close at $13.31, the most followed narrative points to a fair value of about $13.38, implying only a small gap between price and that target while a separate intrinsic value estimate suggests a much larger discount.

The successful completion and integration of the Penns Woods acquisition, with cost savings tracking ahead of original expectations and full run rate efficiencies expected by mid 2026, should materially improve expense ratios and net margins going forward. Ongoing expansion into high growth suburban markets (Columbus and Indianapolis) through de novo branch openings positions the bank to capture incremental deposit growth and new lending opportunities, potentially accelerating long term revenue growth as demographics remain favorable for regional and community banks.

Want to see what kind of revenue curve that quote is built on, and how profit margins and future earnings multiples are stitched together to reach that fair value? The most popular narrative lays out a detailed earnings path, revenue assumptions, and a valuation anchored on future profitability rather than today’s headline numbers.

Result: Fair Value of $13.38 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that narrative can be knocked off course if loan growth stays muted or if credit issues in areas like multifamily construction and certain C&I borrowers worsen.

Find out about the key risks to this Northwest Bancshares narrative.

Another way of looking at the price

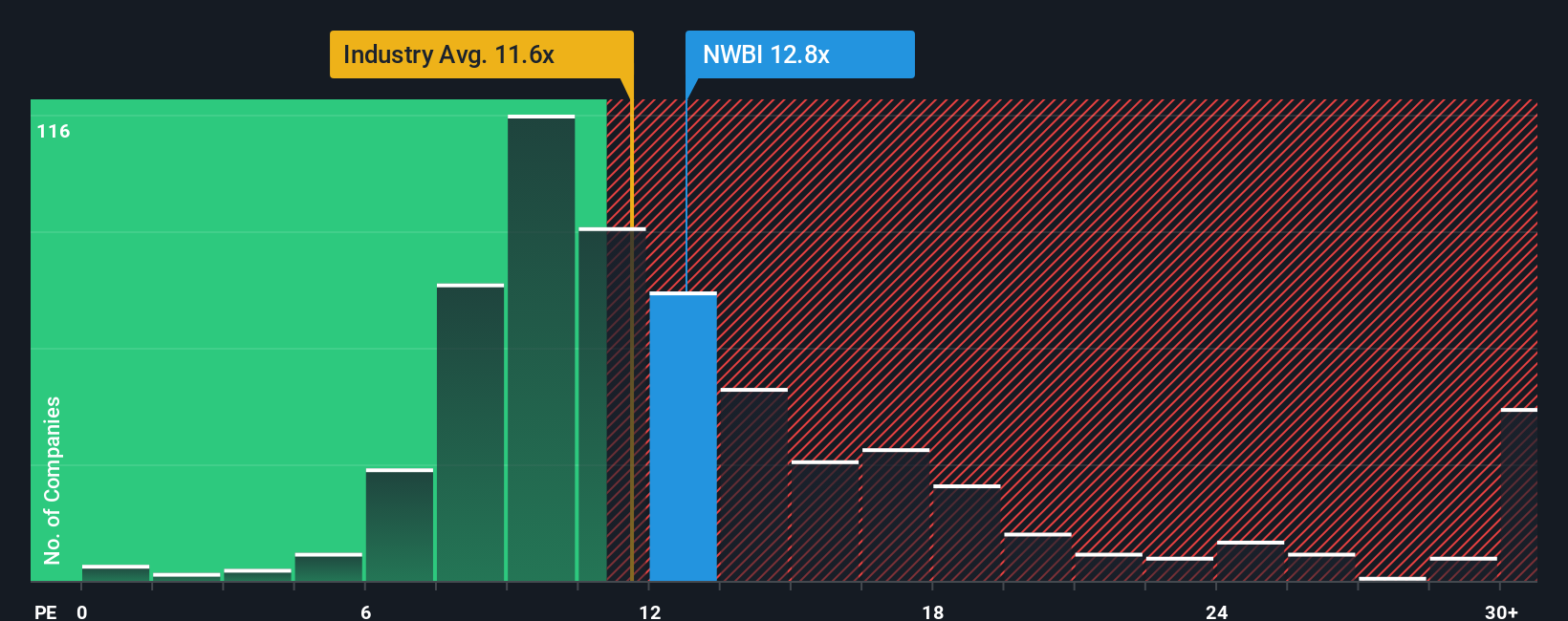

While the most followed narrative leans on future earnings and a fair value of about $13.38, the market today is also putting a P/E of 15.4x on Northwest Bancshares, compared with 12x for the US Banks industry, 14.7x for peers, and a fair ratio of 14.6x.

That gap suggests investors are paying a premium relative to both the sector and where our fair ratio indicates the P/E could drift over time, even though our separate intrinsic value estimate points to the shares trading at a 48.1% discount. This leaves investors with a mixed picture: which signal should carry more weight?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Northwest Bancshares Narrative

If you see the numbers differently or simply prefer to test your own assumptions, you can pull the data together and Do it your way in just a few minutes.

A great starting point for your Northwest Bancshares research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If you are serious about upgrading your watchlist, it is worth casting the net wider and pressure testing your next moves with a few targeted stock lists.

- Target value by scanning companies that screen well on quality and price using our 52 high quality undervalued stocks to see which names pass the toughest filters.

- Prioritise resilience by focusing on businesses with strong finances through the solid balance sheet and fundamentals stocks screener (45 results) and see which names hold up under closer scrutiny.

- Spot potential early movers by running your eye over a 26 elite penny stocks with strong financials that already show stronger financial footing than many assume.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com