Assessing UMB Financial (UMBF) Valuation After Strong Q4 And Full Year 2025 Results

Q4 earnings catalyst and dividend update

UMB Financial (UMBF) has drawn fresh attention after reporting fourth quarter and full year 2025 results, with higher net interest income and net income, alongside an unchanged quarterly common dividend of $0.43 per share.

See our latest analysis for UMB Financial.

UMB Financial shares have been strong around the recent results, with a 7 day share price return of 4.87% and a 90 day share price return of 22.30%, while the 5 year total shareholder return of 86.02% points to sustained momentum beyond the latest quarter. The latest share price of US$134.29 comes after the earnings release, higher net interest income, and an unchanged common dividend. Taken together, these factors may be shaping how investors view both growth prospects and credit risk, particularly given the increase in quarterly net charge offs to US$12.65m from US$8.94m a year earlier.

If UMB Financial’s move has you thinking about what else is working in the market, it could be a good time to broaden your search with 22 top founder-led companies.

With the share price already up strongly and the stock trading at an apparent discount to both analyst targets and intrinsic estimates, the key question now is whether UMB Financial is still mispriced or if the market is already factoring in future growth.

Most Popular Narrative: 7.7% Undervalued

UMB Financial’s most followed valuation narrative puts fair value at about $145.42 per share, compared with the latest close at $134.29, framing the recent move in a wider earnings and cash flow story.

Strong momentum in non-interest income businesses, particularly fund services and asset servicing (with several new institutional clients and assets under administration surpassing $600 billion), positions the company to capitalize on growing demand for fee-based financial solutions, bolstering both revenue diversification and earnings stability.

Curious what justifies that higher fair value? The narrative leans heavily on faster earnings growth, rising margins, and a richer future profit multiple than many regional peers.

The narrative uses a 6.99% discount rate to bring projected revenue and earnings paths back to today, and ties its fair value to assumptions about how much UMB Financial can expand margins and sustain earnings growth over several years. That framework also feeds into the higher future P/E that the narrative expects the market to accept if those earnings arrive as modeled.

Result: Fair Value of $145.42 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, you also need to weigh regional concentration and the Heartland integration, because any stumble on credit quality or cost savings could quickly challenge that undervalued case.

Find out about the key risks to this UMB Financial narrative.

Another angle on valuation

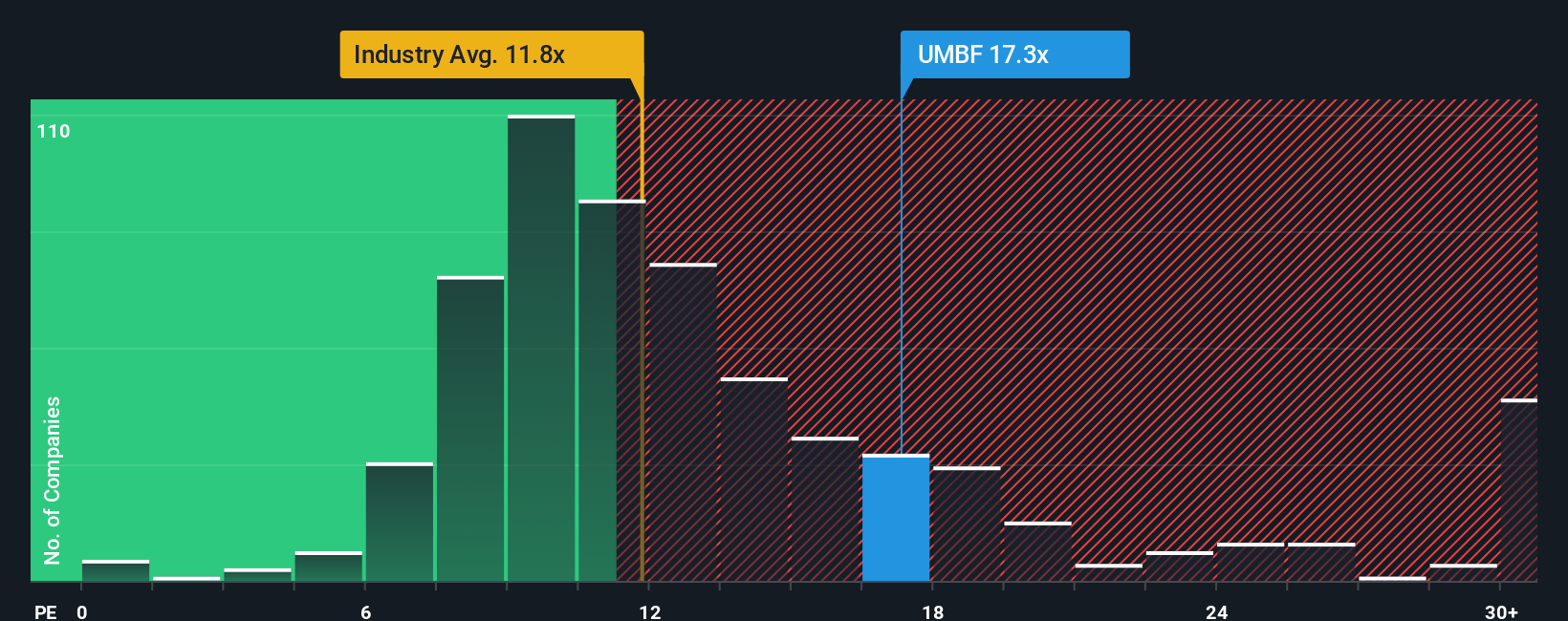

That 7.7% undervalued story clashes a bit with what the P/E is saying. UMB Financial trades on 14.9x earnings, above the US Banks industry at 12x and slightly above its own 15.7x fair ratio. Put simply, you are paying a premium, so is the DCF optimism doing too much of the heavy lifting?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own UMB Financial Narrative

If you are reading this and think the assumptions or focus should be different, you can pull up the same data, test your own view, and build a fresh narrative in just a few minutes: Do it your way.

A great starting point for your UMB Financial research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If UMB Financial has your attention, do not stop here. Use the screener to quickly surface fresh ideas that fit how you like to invest.

- Target potential mispricing with 52 high quality undervalued stocks, which lines up strong fundamentals with a price that may not fully reflect them.

- Consider income-focused ideas by scanning 14 dividend fortresses, which focuses on higher yields for investors who want regular cash returns.

- Prioritise resilience by checking 82 resilient stocks with low risk scores, which scores well on stability and risk controls.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com